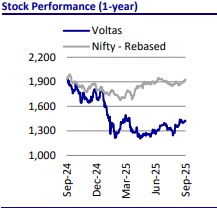

Neutral Voltas Ltd for the Target Rs. 1,350 by Motilal Oswal Financial Services Ltd

Festive tailwinds and GST cut trigger demand recovery in 2H

Industry volume down ~15% in 1HFY26; VOLT to follow similar trend

We interacted with the management of Voltas (VOLT) to understand the current demand trend, the company’s strategy to play festive demand and GST rate cuts, and the segmental performance. VOLT highlighted that it is committed to strengthening its market leadership, unlocking growth potential across business segments, and delivering sustainable value for investors. It expects near-term challenges due to a weak summer season and higher channel inventory. However, VOLT is confident of a pickup in demand momentum in 2HFY26, supported by the festive season, GST rate reduction on RAC, pent-up demand due to the weak summer season, the deferment of purchases by consumers for five weeks between the GST cut announcement and its effective date (22nd Sep’25), and pre-buying ahead of new BEE norms. The commercial AC segment remains its key growth driver for VOLT, while its EMPS business shows resilience with strong domestic execution and selective international orders. We maintain our Neutral rating on the stock with a TP of INR1,350, based on SOTP.

Extended monsoon hits UCP demand; recovery likely in 2HFY26

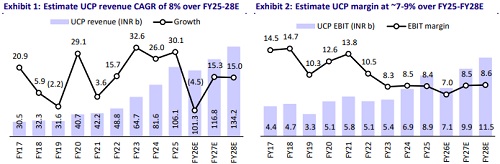

* The UCP business experienced one of the sharpest seasonal reversals in 1QFY26, as the early onset and prolonged spell of monsoon affected demand, along with a high base of last year. Industry volumes fell ~15% YoY in 1HFY26, with VOLT too facing pressure, as channel inventory was high amid delayed purchases by consumers ahead of GST rate cuts. The company maintained its market leadership in the RAC segment with ~18% market share (1QFY26). It is aiming to widen its lead over peers and reinforce the strength of its general trade-led distribution network.

* 2QFY26 is also expected to be under pressure (both revenue and margin) due to the extended monsoon, weak primary sales, and high channel inventory. While the subsequent quarter should benefit from festive demand, the GST rate cut on ACs, a potential second summer in western and southern markets, and pre-buying ahead of new BEE norms. The GST reduction is likely to enhance affordability and release pent-up demand. Management expects a demand recovery in 2HFY26, supported by festive sales, summer spillover, and renewed channel activity, alongside continued RAC premiumization and portfolio expansion to capture broader demand. ? VOLT views the commercial AC segment as a key growth engine over the next 2-3 years, with a stable revenue and margin outlook. It is targeting 15- 20% growth, led by retrofit demand, strategic partnerships, influencer engagement, and an expanded channel network spanning 150 cities.

* Commercial refrigeration, however, is seeing pressure on revenue and margin, though cost and product interventions are underway. The air-cooler business also softened in 1QFY26 due to weather, but should recover as demand normalizes. The company continues to enhance its product portfolio and focus on RAC premiumization to tap wider demand.

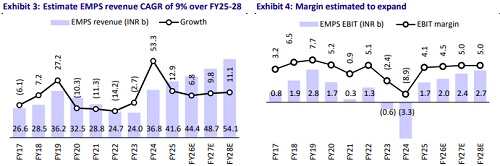

EMPS: Domestic momentum intact; disciplined international orders

* In the domestic business, the order book remains strong, aided by traction in electrical tenders and water projects across several states. Execution has been stable and profitable, with visibility extending over the next 2-3 quarters. The domestic pipeline looks encouraging, with multiple tenders in progress, particularly in the electrical space, which is manpower-intensive but provides predictable growth. The company’s ability to mobilize manpower and execute large-scale tenders remains its competitive strength. The domestic project execution is not only margin-accretive but also provides consistency to overall EMPS revenue flows.

* In the international business, particularly in the Middle East, VOLT has adopted a disciplined approach. Instead of chasing volumes, the company has been highly selective in order intake, focusing on customer quality, payment terms, and margin profile. This has resulted in a moderated international order book but ensures margin protection and reduces working-capital risks. Smaller verticals, such as mining and textiles, also continue to contribute, enhancing diversification. With domestic growth on a strong path and moderate international growth, the EMPS segment provides stability, visibility, and resilience to the overall business.

Voltbek: Market outperformance and premiumization focus

* Voltbek has emerged as one of the fastest-growing appliance brands in India and is positioned to outpace the market across multiple product categories. Growth momentum is being driven by low penetration levels, a rising shift from unorganized to branded appliances, GST cuts-led affordability, and strong demand from the expanding urban and affluent classes. Voltbek’s product offerings include refrigerators, washing machines, microwave ovens, dishwashers, dry iron, and mixer grinders.

* The washing machine category is an area of focus, with the brand investing in premiumization through the launch of fully automatic and front-load models. Refrigerators and dishwashers are also scaling up rapidly, aided by product innovation and distribution expansion. With channel presence strengthened in both traditional trade and e-commerce, Voltbek has been able to capture share across multiple touchpoints. The brand is leveraging GST reductions and consumer financing schemes to expand reach into mass-premium households.

* Deep freezers and water heaters are gaining traction, complementing the larger categories and creating a balanced product basket. Aided by rising incomes, urbanization, and household upgrades, Voltbek is expected to outpace industry growth and strengthen its contribution to the group portfolio.

Valuation and view

* Management sounded confident of a positive demand outlook in ACs, backed by the festive season, GST rate cuts, and pent-up demand. However, near-term headwinds, such as elevated inventory (~2-3 months), intense competition, and weak 1HFY26 performance, continue to pose challenges. We will closely monitor these two events, festive period and GST rate cut, as key catalysts for demand recovery.

* We maintain our earnings estimates as of now. We estimate VOLT’s revenue/EBITDA/PAT to decline ~1%/7%/8% YoY in FY26. We estimate the UCP segment’s revenue to decline by ~5% and margin at 7.0% in FY26 (vs. 8.4% in FY25). The stock is trading at 45x FY27E EPS. We maintain our Neutral rating on the stock with a TP of INR1,350, based on 45x Jun’27E EPS for the UCP segment, 20x Jun’27E EPS for the PES and EMPS segments, and INR22/share for Voltbek.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)