Neutral Voltas Ltd for the Target Rs. 1,390 by Motilal Oswal Financial Services Ltd

RAC downtrend bottoming out; market share in focus

Structural drivers support RAC; EMP segment resilient

We interacted with management of Voltas (VOLT) to understand the current demand trend, channel inventory, the likely impact of upcoming energy label changes and the overall recovery in home appliances business. VOLT highlighted that RAC volume remained under pressure in 3QFY26 due to higher channel inventory (~45 days) and a strong winter, though the YoY decline has moderated and there are multiple levers (GST rate cut increase affordability, energy label changes) to drive demand going forward. Voltas Beko continues to outperform, gaining market share and nearing the number one position in semi-automatic washing machines. In EPM segment, domestic project business is doing well, with a steady margin given good selection in projects. Currently, we are maintaining our earnings estimates and closely monitoring the pickup in RAC demand and normalization of inventory. We maintain our Neutral rating on the stock with a TP of INR1,390, based on SoTP.

Demand environment, pricing dynamics, and channel inventory

* Severe winter conditions and higher channel inventory continued to impact growth in 3QFY26. Though VOLT believes that the industry decline will be lower than the 1HFY26 level and better than earlier estimates. Channel inventory has come down sequentially to near 45 days currently from ~60 days in Oct-Nov’25. Though this is higher than the historical 3Q level of less than a month.

* VOLT expects inventory levels to normalize gradually from Jan’25 onward with a pick-up in demand. Further, the upcoming energy label changes and the resultant price increase expectations should drive primary sales in the near term. VOLT believes the worst in terms of volume decline is behind.

* The GST reduction benefit has been fully passed on, and this has improved RAC affordability by ~7-8%. While new energy-labelled products will be introduced at revised prices, management is evaluating differentiated pricing strategies for old and new label products. Currently, it is evaluating pricing strategy considering multiple factors such as currency depreciation (as ~20-30% products are imported), higher commodity prices, and energy labelling-related cost escalations. The e-waste costs are not incremental, as they were already included in pricing earlier.

* Improved capacity utilization, scale benefits, and cost optimization initiatives are expected to support better absorption of cost pressure going forward, although the overall impact remains difficult to quantify as of now.

* A comparison of the upcoming summer with previous seasons is difficult due to the GST rate cut and expected price revisions due to energy labelling changes, which are likely to result in selective stocking over the coming months. Hence, VOLT expects channel partner stocking will be at a reasonable level going forward, and aggressive inventory build-up is not expected.

* The company indicated that gaining market share remains a priority even in a competitive environment when some players continue to pursue loss-making strategies to disrupt the market. VOLT reported a steady increase in market share in CY25 (as of Sep’25), with gains of 1.5pp-2.0pp, and expects this to continue.

Channel expansion in Voltbek; EMP business continues to grow

* Despite a weak industry environment, Voltbek has continued to gain market share and has created a niche name for itself for a few products, particularly in semi-automatic washing machines. The overall market share remains in single digits, indicating a long runway for growth. It expanded distribution network to ~19,000-20,000 touchpoints, with a strong focus on regional retailers and northern markets, alongside efforts to strengthen the southern region. While refrigerators and washing machines remained relatively sluggish, market share gains continued, supported by improved price realization and cost optimization initiatives.

* In EMP segment, management indicated the strong momentum continuing, driven by the domestic project business, steady profitability and a robust order book. The company is looking to leverage air cooling opportunities from data centers, battery storage facilities and EVs from the large investment by the group companies.

Valuation and view

* Management is confident of a positive demand outlook, citing strong growth divers (GST reduction increasing affordability, low penetration, robust demand expected from tier II- IV cities and energy label changes). It is also expanding its capabilities in centrifugal chillers. India’s manufacturing expansion, including significant investment by large conglomerates, is creating stable project demand opportunities. We will further monitor the effects of the energy label changes and the upcoming summer season as key catalysts for demand recovery.

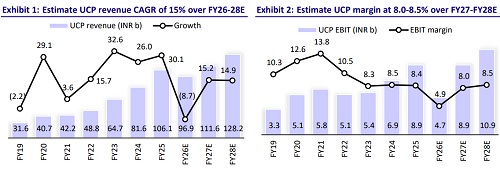

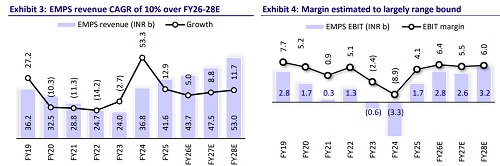

* We estimate VOLT’s revenue/EBITDA/PAT to decline ~5%/22%/27% YoY in FY26 due to weak 1HFY26. We estimate VOLT’s revenue/EBITDA/PAT CAGR at 13%/34%/41% over FY26-28, albeit on a low base. We estimate UCP margin to improve in 2HFY26 and FY27 with a recovery in demand and positive operating leverage. We maintain our Neutral rating on the stock with a TP of INR1,390, based on 45x Dec’27E EPS for the UCP segment, 20x Dec’27E EPS for the PES and EMPS segments (each), and INR20/share for Voltbek.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412