Neutral TCI Express Ltd for the Target Rs. 710 by Motilal Oswal Financial Services Ltd

Weak volumes, especially from SME customers, continue to hurt margin and profitability

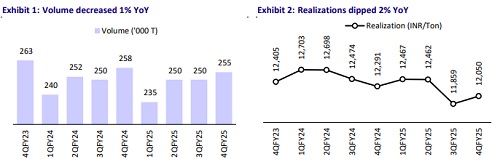

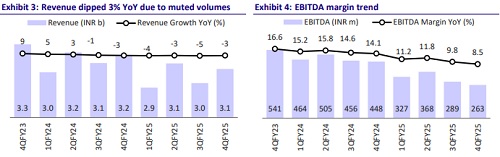

* TCI Express (TCIE)’s 4QFY25 revenue decreased 3% YoY to INR3.1b (+4% QoQ), in line with our estimate. Volumes declined 1% YoY in 4QFY25. Volumes were hit by slower growth in the SME segment.

* EBITDA stood at INR263m (-41% YoY/-9% QoQ), 16% below our estimate. EBITDA margin came in at 8.5% in 4QFY25 vs. our estimate of 10.1%. Rising toll fees and labor costs continued to weigh on operational efficiency.

* The impact of lower margins was offset by higher other income, which resulted in an APAT of INR194m (-39% YoY) vs. our estimate of INR206m.

* During FY25, revenue stood at INR9b (-4% YoY), EBITDA at INR984m (-31% YoY), EBITDA margin came in at 10.9%, and APAT was INR667m (-33% YoY).

* While management expects a 7–8% tonnage and 10–12% revenue growth in FY26, the margin improvement target may face headwinds from persistent cost inflation, subdued SME demand, and continued pressure on air express margins. Heavy capex plans of INR3b over FY26–27 and dependence on higher-margin segments for profitability could pose risks if volume recovery remains soft.

* Weak volume growth, particularly from MSME customers, coupled with higher costs, contributed to a weak performance in 4Q. We cut our EBITDA estimates for FY26 by ~4% to incorporate the weak FY25 performance while marginally reducing EBITDA estimates for FY27 by 1%. We expect TCIE to clock an 8%/ 10%/23% volume/revenue/EBITDA CAGR over FY25-27. We reiterate our Neutral rating with a revised TP of INR710 (based on 20x FY27 EPS).

Highlights from the management commentary

* The SME segment continues to face challenges amid high inflation, interest rates, and tight liquidity. Management indicated no material loss in market share, and volumes were weaker across the industry.

* TCIE continues to steer clear of e-commerce/quick commerce due to poor unit economics — delivery charges have plummeted from INR45–50 to INR4–5.

* Contribution from multimodal express (rail and air) is increasing, with a target to reach 20–22% of total revenue over the next 2–3 years, supporting longterm competitiveness.

* Tonnage growth in FY26 is expected at 7–8%. Revenue growth is projected at 10–12%, driven by higher yields and increased network reach.

* Margin improvement of 150–200bp is expected, led by ~3% price hikes, cost rationalization, and a growing share of high-margin rail and air express

Valuation and view

* TCIE faces headwinds as SME demand remains weak amid high inflation and interest rates. While multimodal express shows some promise, tonnage and revenue growth projections by the management remain modest and dependent on price hikes.

* Weak volume growth, particularly from MSME customers, coupled with higher costs, contributed to a weak performance in 4Q. We cut our EBITDA estimates for FY26 by ~4% each to incorporate the weak FY25 performance while marginally reducing EBITDA estimates for FY27 by 1%. We expect TCIE to clock an 8%/ 10%/23% volume/revenue/EBITDA CAGR over FY25-27. We reiterate our Neutral rating on the stock with a revised TP of INR710 (based on 20x FY27 EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412