Buy Aurobindo Pharma Ltd for the Target Rs. 1,370 by Motilal Oswal Financial Services Ltd

US/EU drive steady performance

Guides for stable EBITDA margin despite g-Revlimid headwinds

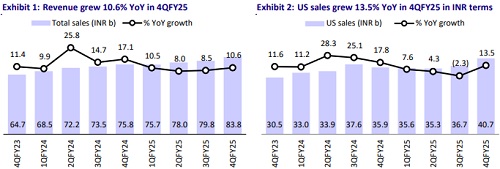

* Aurobindo Pharma (ARBP) exhibited slightly better-than-expected sales/EBITDA (2%/3% beat) for the quarter. Higher depreciation/tax rate led to lower-than-expected earnings (8% miss) for the quarter.

* ARBP delivered the highest-ever quarterly EBITDA in 4QFY25, led by a higher offtake in the US generics segment and steady traction in the EU segment.

* Additionally, US sales achieved the highest-ever quarterly sales run rate of USD470m, driven by niche products (like g-Revlimid) and stable pricing.

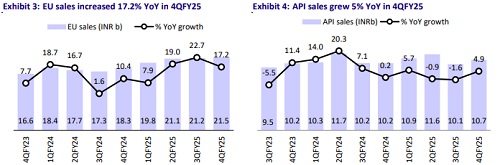

* ARBP’s efforts in the EU market have resulted in a second consecutive year of robust, high-teen YoY sales growth.

* We largely maintain our earnings estimates for FY26/FY27. We value ARBP at 16x 12M forward earnings to arrive at a TP of INR1,370.

* On a formidable base of USD1.8b in US generics sales, ARBP is working to enhance its product offerings in the peptides, oligonucleotides, and respiratory space. The resumption of normalized production at Eugia III is expected to drive better profitability in FY26. With established presence in EU and new launches, ARBP is expected to deliver sustainable growth momentum in the EU market as well.

* Overall, we expect 9%/12%/18% sales/EBITDA/PAT CAGR over FY25-27. The stock is trading at an attractive valuation of 16x FY26E EPS of INR73/14x FY27E EPS of INR83.5. Reiterate BUY.

Broad-based growth with resilient margin profile

* ARBP’s 4QFY25 sales grew 10.6% YoY to INR83.8b (our estimate: INR81.9b). Overall formulation sales grew 12.3% YoY to INR73.1b. US generics sales grew 13.5% YoY to INR40.7b (CC: +8.8% YoY to USD470m; 48% of sales). Europe formulation sales grew 17.2% YoY to INR21.4b (25% of sales). Growth markets’ sales declined 7.8% YoY to INR7.8b (9% of sales).

* ARV revenue grew 29.4% YoY to INR3b (4% of sales).

* API sales grew 5% YoY to INR10.6b (14% of sales).

* Gross Margin (GM) contracted 30bp YoY to 59.3%.

* However, EBITDA margin remained stable YoY at 22.2% (our estimate: 22.1%) as the impact of product mix was offset by lower other expenses.

* EBITDA grew 10.4% YoY to INR18.6b (our est: INR18b).

* Revenue/EBITDA/PAT grew 9%/15.5%/8% YoY to INR317b/INR67.5b/INR35.4b in FY25.

Highlights from the management commentary

* ARBP guided for high single-digit YoY revenue growth and expects to maintain EBITDA margin at FY25 level in FY26.

* The specialty injectables business is expected to be muted in FY26 due to competition in g-Revlimid and limited approval from Eugia III. However, FY27 prospects are expected to remain strong, given the settled product launches and resolution of regulatory issues at Eugia III.

* The China plant is expected to achieve break-even in FY26. In FY25, it had faced an operational loss of INR350m.

* Eugia III is expected to resume normalized production from 1QFY26 onwards.

* Specialty injectable sales stood at USD178m/USD560 in 4QFY25/FY25.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412