Buy Zen Technologies Ltd For Target Rs.1,600 by Motilal Oswal Financial Services Ltd

Sharp miss

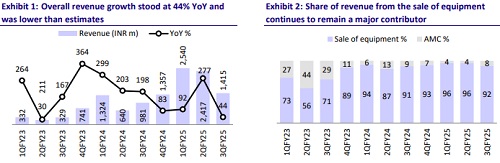

Zen Technologies’ results were sharply below our estimates on revenue/EBITDA/PAT due to delays in booking certain contracts during 3QFY25. The company’s revenue/PAT grew by 44%/22% YoY, while EBITDA declined by 17% YoY due to operating deleverage. Zen has underperformed broader indices on concerns related to growth visibility, order inflows, and acquisition plans. The company: 1) expects inflows worth INR8b to materialize during 4QFY25-FY26, which will provide revenue visibility beyond FY25, 2) maintains revenue guidance of INR9b for FY25, with an EBITDA margin of 35%, despite a miss on revenues for 3QFY25, and 3) is building its portfolio across other simulators with the recent acquisition announcement of ARIPL, which is engaged in naval simulators, and MoUs and tie ups with other firms for air-based simulation solutions. Due to lower-than-expected order inflows in 9MFY25, we cut our estimates by 4%/25%/22% for FY25/26/27. Along with this, our target multiple has also been revised downwards, as the company was earlier getting a higher valuation multiple for growth, which is looking weak till FY26. Beyond FY26, we expect overall ordering to improve from large-sized simulator orders, recent acquisitions, and MoUs, as the company’s overall capabilities are being enhanced across simulators, anti-drone, and other new areas. However, due to delays in the finalization of tenders, execution may remain impacted in the near to medium term. We reiterate BUY with a revised TP of INR1,600 based on 30x Mar’27E earnings.

Weak set of results

Zen Tech’s 3QFY25 revenue, EBITDA, and PAT came in below our estimates. Revenue was up 44.3% YoY at INR1.42b, a 39% miss on our estimate of INR2.31b. The revenue miss was due to delays in shipments and the shift of revenue booking to 4QFY25. Absolute EBITDA was down 17% YoY at INR367m vs. our estimate of INR859m (57% miss). EBITDA margin contracted 1910bp YoY/690bp QoQ to 26.0% vs. our estimate of 37.2% due to the revenue miss. PAT at INR386m came in 39% below our estimate of INR637m. PAT margin contracted 500bp YoY to 27.3%. Order book as of 30th Dec’24 stood at INR8.17b. This includes equipment order book of INR5.4b and AMC order book of INR2.8b. Despite a revenue miss in 3QFY25, the company has maintained its revenue guidance of INR9b for FY25.

Future order inflow visibility

The company’s order book stands at INR8.17b (66% Equipment; 34% AMC). The share of training simulators/anti-drones in the total order book is ~48%/52%, with the training simulators’ order book comprising majority of orders in the domestic market (76%), while the anti-drone systems order book is more inclined towards the export market (55%). The anti-drone market is becoming crowded with an increasing number of players; however Zen has the advantage of full backward integration across seeker, detector, radar, camera, as well as both hard kill and soft kill, which others don’t have as of now. Management mentioned that a few new orders are in the final stage of discussions and will start getting finalized in the next 2-3 months. Further, the company expects a sharp ramp-up in orders beyond FY26 on an overall increase in ordering as well as a wider TAM from the newly acquired companies

Recent tie-ups and acquisitions

Zen Technologies has been catering its products to the Indian Army and, in its 2QFY25 con-call, the company mentioned opportunities to expand its offerings to the Indian Air Force and Indian Navy. The company has announced the acquisition of a 100% stake in Applied Research International Private Limited and ARI Labs Private Limited, marking its strategic entry into the Indian Navy platform. Additionally, the company’s recent MoUs signed with AVT Simulation and TXT Group are in line with its statement to address opportunities across the Indian Air Force.

* Announced Acquisition: The Board of Directors approved the following acquisitions:

* 100% stake in Applied Research International Private Limited (ARIPL) in multiple tranches: ARIPL is engaged in the business of providing simulation and assessment tools for the marine, offshore, naval, ports & terminals, construction, and mining industries. Zen’s management claimed that once it combines its weapon simulation technology with ARIPL’s marine simulation technology, it will be able to create a product that caters to the Indian Navy with a margin profile of 35% vs ARIPL’s current margin of 18-19%.

* 100% stake in ARI Labs Private Limited in multiple tranches.

* 45.33% stake in Bhairav Robotics Private Limited by way of subscription.

* 51% stake in Vector Technics Private Limited by way of subscription: Through this acquisition, the company marked its entry into the drone segment by manufacturing support sub-units for drones, catering to the domestic as well as export markets.

* MoU with TXT Group: This MoU focuses on the development of advanced pilot training solutions, ranging from Part Task Trainers to Full Flight and Full Mission Simulators.

* MoU with AVT Simulation: Under this MoU, AVT Simulation will support Zen's entry into the US defense market, while Zen will help AVT expand internationally. Combining Zen's ground simulation expertise with AVT's air simulation strengths, the company aims to develop next-gen solutions for defense, emergency response, and commercial use. Further, the company also approved an investment of USD10m in multiple tranches over a period of two years in Zen Technologies USA, Inc., a wholly-owned subsidiary of Zen Technologies, to leverage new growth opportunities in the US markets.

Patents granted during the quarter

Since the beginning of the quarter to date, Zen has received Patent Grants for:

* T90 Containerized Crew Gunnery Simulator (T-90 CGS): An advanced, innovative system that provides a highly immersive and interactive training experience to increase the gunnery proficiency of the T-90 tank commander and gunner. The system replicates the battlefield conditions and operational tasks of the T90 tank, providing realistic targets with AI reactions.

* T-72 Containerized Crew Gunnery Simulator System (T-72 CGS): An advanced training platform designed to enhance the gunnery skills of T-72 tank commanders and gunners. By simulating critical operations like target acquisition, ammunition selection, and firing, the T-72 CGS prepares personnel for real-world combat scenarios.

* Basic Gunnery Training Simulator: A state-of-the-art training platform developed to enhance the technical and operational skills of a tank gunner, replicating real-world battlefield conditions with features such as target acquisition, ammunition selection, and firing simulations.

Guidance

The company continued to maintain its FY25 revenue guidance of INR9b on account of expected strong execution in 4Q, revitalizing its topline growth. It expects orders to start coming in from 2QFY25/1HFY26 onwards, and EBITDA/PAT margin to be at 35%/25% for FY25.

Financial outlook

We cut our estimates to factor in lower-than-expected order inflow in 9MFY25. We expect a revenue/EBITDA/PAT CAGR of 54%/53%/56% during FY24-27. This will be led by: 1) order inflow CAGR growth of 37% over FY24-27, due to a strong pipeline across simulators and anti-drones, 2) EBITDA margin of 37% for FY25, FY26, and FY27, and 3) control over working capital due to improved collections.

Valuation and recommendation

The stock currently trades at 29.5x/20.2x P/E on FY26/27E earnings. We revise our estimates downwards to factor in the 3Q performance and lower-than-expected order inflows. Along with this, our target multiple is also revised downwards as the company was earlier getting a higher valuation multiple for growth, which is looking weak till FY26. Beyond FY26, we expect overall ordering to improve from large-sized simulator orders, recent acquisitions, and MoUs as the company’s overall capabilities are getting enhanced across simulators, anti-drone, and other new areas. However, due to delays in the finalization of tenders, execution may remain impacted in the near to medium term. We reiterate BUY with a revised TP of INR1,600 based on 30x Mar’27E earnings.

Key risks and concerns

A slowdown in procurement from the defense industry, especially for simulators, can expose the company to the risk of further reduced order inflows and hinder its growth. The company is also exposed to foreign currency risks for its export revenue. High working capital can also pose risks to cash flows, as historically, the company’s working capital has remained high due to issues related to high debtors and inventory. This is likely to come down due to improved collections and lower inventory, according to the management. However, any delays in the same can affect cash flows for FY25/26.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412