Buy ICICI Lombard Ltd for the Target Rs. 2,300 by Motilal Oswal Financial Services Ltd

Future ready; innovation driven

* ICICI Lombard (ICICIGI), in its annual report, has reiterated its future readiness to capitalize on the fast-growing general insurance industry. Its core business strategy is built on five strategic pillars: 1) delivering market-leading performance; 2) providing next-gen customer service via the use of technology; 3) offering innovative products and capturing newer market opportunities; 4) maintaining robust risk management; and 5) optimizing capital and improving operating performance.

* ICICIGI outpaced industry growth in retail health, reporting a 25% YoY increase (vs. 12.1% for the industry), leading to a market share gain to 3.3% in FY25 from 3% in FY24. This growth was driven by innovative product launches such as the AI-powered Elevate and Activate Booster, a strategic tie-up with Policy Bazaar, expansion of the IL Sahayak support network, and continued investments in scaling up the health agency channels.

* The Motor segment recorded 11.5% YoY growth, outpacing the industry’s growth of 8% and increasing ICICIGI’s market share to 10.8% (vs. 10.5% in FY24), with GDPI reaching INR107.4b. This growth was driven by granular portfolio segmentation, risk-based pricing, efficient claim settlement, and a diversified mix (Private Cars: 53.3%, Two-Wheelers: 25.6%, CVs: 21.2%). The company is actively scaling its presence in the emerging EV insurance space, especially in the private car and two-wheeler segments.

* Technology and digitalization remained central to ICICIGI’s strategy, with 99.9% of policies issued digitally and advanced technologies like AI, ML, analytics, and IoT deployed across key functions. Strategic initiatives like One IL One Digital, Project Orion, and the launch of Elevate supported process modernization, platform synergies, and capability building to drive superior outcomes.

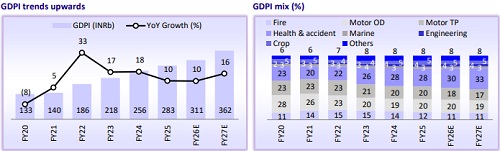

* In FY25, the company recorded a Gross Direct Premium Income (GDPI) of INR268.3b, registering an 8.3% YoY growth (11% excluding the impact of 1/n accounting), ahead of the industry’s growth of 6.2%. The combined ratio improved to 102.8% (vs. 103.3% in FY24), supported by slight improvement in the loss ratio. Solvency ratio strengthened to 2.69x (vs. 2.62x in FY24) and Return on Average Equity (RoAE) improved to 19.1% (vs. 17.2%).

* Valuation: Despite subdued growth in the general insurance industry in FY25, ICICIGI continued to maintain profitable growth, achieving doubledigit expansion in the Motor segment through focused initiatives in older and commercial vehicles and refined portfolio segmentation. The health segment, particularly retail, remained a key growth driver, supported by market share gains, strong traction from new customer acquisitions, and inflation-linked pricing strategies. We have increased our earnings estimates by 3%/5% for FY26/FY27, driven by a decline in expenses. Reiterate a BUY rating on the stock with a TP of INR2,300 (based on 33x Mar’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

ICICI Lombard Q3 Results: Reports premium growth of 13.3% at Rs.70.41 billion