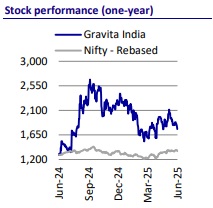

Buy Gravita (India) Ltd for the Target Rs. 2,300 by Motilal Oswal Financial Services Ltd

From scrap to success: Capitalizing on market diversification

Gravita India Ltd (Gravita), a prominent leader in India's recycling industry, is wellplaced to leverage strong industry growth and rising momentum through its global and pan-India operations, supported by a comprehensive procurement network.

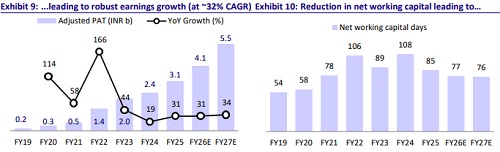

* With the implementation of Environmental Compensation (EC) for EPR noncompliance, the availability of domestic scrap has improved, leading to a 60% increase in domestic scrap sourcing by Gravita in FY25. This shift to domestic sourcing is expected to improve working capital days from 85 in FY25 to 77/76 in FY26/FY27, thereby enhancing cash flow from operations to INR3.6b/INR3.1b from INR2.8b in FY25.

* The increase in domestic scrap availability is expected to sustain as automotive battery manufacturers are now mandated to collect and recycle ~90% of the batteries placed by them three years ago in FY26 (up from ~70% in FY25). This is likely to further increase the market share of organized players.

* Furthermore, with the company's heightened emphasis on the non-lead segment, including its upcoming ventures in rubber and lithium-ion recycling (currently in the prototype phase), both operations are scheduled to commence by 1HFY26. The management is targeting a revenue CAGR of ~70% from the rubber segment over the next 3-4 years.

* This strategic expansion is expected to support the company’s goal of generating 30% of its revenue from the non-lead segment by FY29.

Expanding horizons with Gravita’s strategic shift beyond lead recycling

* In FY25, Gravita’s lead recycling vertical contributed ~88% to the company's revenue and is set for substantial growth in the domestic market, driven by favorable industry dynamics and higher availability of domestic scrap.

* With the increase in domestic scrap procurement (up 60% YoY), led by regulatory tailwinds, we expect the working capital days to decrease from 85 in FY25 to 77/76 in FY26/FY27, resulting in an increase in cash flow from operations to INR3.6b/INR3.1b in FY26/FY27 from INR2.8b in FY25.

* Value-added lead products—tailored to specific customer requirements— will be a key growth driver for the lead segment, enabling Gravita to command a premium. These products offer margins that are 2-3% higher than the base product.

* The company plans to increase the share from value-added products to 50% from 45% in FY25.

* Meanwhile, the company remains committed to diversifying its revenue streams by expanding into new and faster-growing segments, such as lithium and rubber recycling, while also scaling up its aluminum and plastic recycling operations.

* The non-lead business accounted for ~12% of the company's revenue in FY25. However, Gravita aims to expand this segment, targeting a contribution of up to 30% of total revenue by FY29.

* Gravita is set to enter the rubber and lithium recycling segment, with the inaugural plant scheduled to be operational by 1HFY26 in Mundra, India.

* The company does not anticipate significant revenue from lithium-ion recycling in the near term, primarily due to the limited availability of scrap materials, as EV adoption has yet to reach a scale that supports substantial recycling volumes.

* The ongoing pilot project is expected to provide a competitive edge by enhancing the company’s understanding of the technology, with early expertise and advancements being crucial for long-term success in this capital-intensive sector. This approach aligns with the company’s playbook, as seen during its initial expansion in the lead segment.

Expanding global presence and market opportunities in rubber recycling

* As Gravitas intensifies its focus on enhancing the composition of its non-lead portfolio, the company's entry into rubber recycling represents a significant strategic milestone, with the management aiming for a revenue CAGR of ~70% over the next 3-4 years.

* The global rubber recycling market reported a volume of 11MMT in CY23, registering a CAGR of 7.2% over CY18-23. Looking ahead, the market is expected to post a CAGR of ~6.8% over CY24-32, reaching volumes of ~21MMT by CY32.

* The growing awareness of environmental sustainability and the need to reduce carbon footprints among end users are expected to significantly drive the rubber recycling market growth.

* Additionally, global regulations aimed at reducing landfill waste and promoting recycling are likely to boost market expansion. Initiatives like the European Union’s and the US’s push for stricter waste management practices have sparked further interest in scalable rubber recycling solutions, ensuring the market’s continued growth.

* As part of its strategic entry into the European market, Gravita, through its stepdown subsidiary Gravita Netherlands BV (GNBV), has signed an MoU to acquire an 80% stake in a ~18,000 MTPA waste tire recycling facility in Romania for INR320m.

* Alongside its expansion in Europe, Gravita is setting up a plant in Mundra, India, which is expected to commence operations by 1HFY26, with an additional capacity of 30 KMT in Phase 1 and another 30KMT in Phase 2.

* In addition to producing pyrolysis oil, Gravita will focus on manufacturing a wide array of value-added products like sheets, crumb rubber, reclaimed carbon black, and byproducts like steel, which will not only be sold but also hold potential for further recycling.

Seizing market potential by expanding operations and global presence

* As a large-scale recycler with a pan-India presence, Gravita has been a key beneficiary of favorable regulatory changes, which have significantly shifted industry dynamics in favor of organized players.

* Strict government regulations under the Battery Waste Management Rules (BWMR) and Extended Producer Responsibility (EPR) have improved domestic scrap availability, leading to higher local sourcing. In FY25, Gravita witnessed a 60% YoY increase in domestic scrap procurement.

* To capitalize on the increasing availability of domestic scrap, Gravita is steadily expanding its capacity, aiming to exceed 728KTPA (major increase in rubber and lead) by FY27, up from 334KTPA in FY25. In addition to its greenfield expansion, the company is also exploring strategic M&A opportunities to fuel its growth plan.

* Backed by its deeply rooted procurement network—comprising ~33 owned yards and ~1,900+ touch points—Gravita is actively pursuing three overseas projects to expand its global presence.

Valuation and view

* As a leading player in India’s rapidly growing recycling industry, Gravita is wellpositioned to capitalize on evolving market dynamics, driven by regulatory policy changes that are expected to increase the availability of domestic scrap— benefiting organized players such as Gravita.

* Going forward, we expect the company to report robust earnings growth on the back of: 1) strategic capacity expansion across verticals and geographies, 2) an increased focus on value-added products, and 3) higher growth in new segments (rubber).

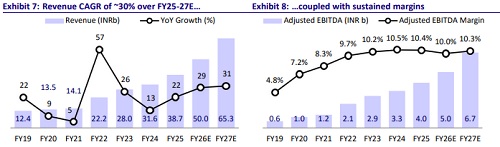

* We expect a revenue/EBITDA/PAT CAGR of 30%/29%/32% over FY25-27. We value the stock at 31x FY27 EPS to arrive at our TP of INR2,300. We reiterate our BUY rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)