Neutral Power Grid Corporation of India Ltd for the Target Rs. 300 by Motilal Oswal Financial Services Ltd

Weak capitalization clouds outlook

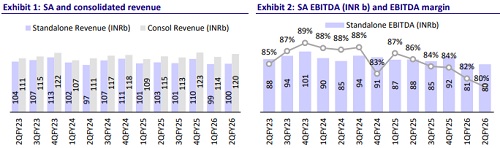

* In 2QFY26, Power Grid Corporation (PWGR) reported a standalone (SA) revenue of INR100b (-3% YoY), 6% below our estimate. EBITDA was 13% below our estimate at INR80.1b (-9% YoY), hit by a 55% YoY surge in other expenses. Reported PAT was INR35.5b, 4% below estimates (-4%YoY), supported by higher other income, lower depreciation (likely due to reduced capitalization), and a positive net regulatory deferral movement of INR 5.2b. Adj. SA PAT was 16% below our est. of INR31.2b, mainly due to a miss at the EBITDA level.

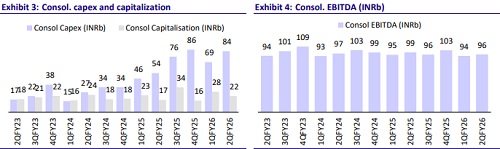

* In the analyst meet, management reiterated its capex guidance of INR280b/INR350b/INR450b for FY26/FY27/FY28, respectively. However, the capitalization target for FY26 might be on the lower side of INR200-220b, owing to persistent issues related to right-of-way (RoW).

* We downgrade PWGR to Neutral as we cut out FY26/27 Adj. PAT by 6%/4%. The cut to our estimate and our more cautious view is attributed to the slower-than-expected pace of capitalization, with PWGR capitalizing INR45b in 1HFY26 vs. the previously guided FY26 target of INR220b. While RoW issues have improved somewhat in recent months, we believe the risk to the company falling short of its FY26 capitalization target of INR200-220b remains elevated. While the medium-to-long term project pipeline continues to improve, we await more clarity on the resolution of near-term execution issues before forming a positive outlook.

* The stock is trading at FY27 P/B of 2.4x vs. the long-term avg. of 1.7x. We derive our TP of INR300 for PWGR based on Dec’27 BVPS and a P/B multiple of 2.5x (earlier 3x).

Earnings miss estimates due to higher other expenses

* Standalone (SA) Performance:

* In 2QFY26, PWGR reported SA revenue of INR100b (-3% YoY,+1% QoQ), missing our estimate by 6%. EBITDA was 13% below our estimate at INR80.1b (-9% YoY, -1% QoQ), hit by a 55% YoY growth in other expenses.

* Reported PAT came in 4% below our estimate at INR35.5b (-4% YoY, -3% QoQ), supported by higher-than-expected other income, lower-thanexpected depreciation (likely due to lower capitalization), and positive net movement in regulatory deferral account balances of INR5.2b.

* Adj. PAT was 16% below our estimate at INR31.2b (-11%YoY,-10% QoQ), mainly due to a miss at the EBITDA level.

* Consolidated Performance:

* Consolidated operating revenue came in at INR114.76b, improving 2% YoY, while reported PAT declined ~6% YoY to INR35.7b.

* The transmission segment remained the primary revenue driver, contributing 92% of total income (INR116.7b).

* In 2QFY26, its JVs reported a loss of INR0.6b (vs. a loss of INR1b/INR0.4b in 2QFY25/1QFY26).

* Other Matters:

* The Board of Directors approved the payment of the first interim dividend of INR4.5/share.

* The Board further approved raising of funds through an unsecured rupee term loan/line of credit up to INR60b from SBI.

Highlights of the 2QFY26 performance:

* In 2QFY26, PWGR added ~205 ckm of transmission lines and 11,185 MVA transformation capacity.

* System availability stood at 99.83% in 1HFY26, with 0.09 trippings per line per year.

* Capex and capitalization in 1HFY26 were INR153.8b and INR45.8b, respectively. FY26 capex target of INR280b (TBCB: INR190.6b, RTM: INR35.5b, others: INR53.8b) has been maintained, with a potential to rise to INR300b.

* Capex targets for FY27/FY28 were reiterated at INR350b/INR450b, and capitalization targets at INR200b/250b/280b for FY26/27/28.

* Work in hand totals INR1.52t, including INR1,030b in TBCB projects.

* In the Brahmaputra Basin, the Ministry of Power has outlined a development plan requiring investments of about INR1.91t by 2035 and INR4.52t thereafter, presenting a total opportunity of INR6.43t. The project, currently under study, is an HVDC project in plain terrain and may follow the TBCB route.

* For the Leh–Ladakh HVDC project, the single bid received was not acceptable. The government is now considering replacing the HVDC system with an AC alternative costing ~INR 300b.

* The company participated in several BESS tenders but did not win any; it remains committed to future opportunities.

Valuation and view

We derive our TP of INR300 for PWGR based on Dec’27 BVPS and a P/B multiple of 2.5x

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412