Neutral Jubilant FoodWorks Ltd For Target Rs.715 by Motilal Oswal Financial Services Ltd

Robust order-driven delivery growth

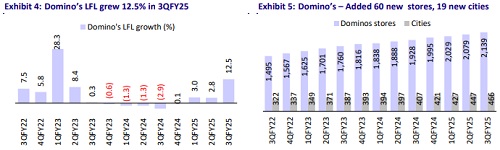

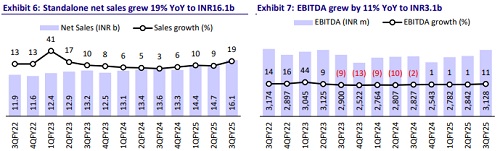

* Jubilant FoodWorks (JUBI) posted 19% YoY growth in standalone revenue to INR16.1b (in line) in 3QFY25. Domino’s orders grew 34%, with LFL growth of 12.5%. Delivery business saw strong 30% YoY revenue growth with 25% LFL growth, contributing 71% of total revenue. Dine-in revenue fell 2% YoY. The waiver of delivery charges continues to shift demand from dine-in to delivery.

* Domino’s India added 60 new stores (+11% YoY) and entered 19 new cities in 3Q. The store expansion spree for Domino’s and other brands will help JUBI broaden its customer reach and gain market share.

* Standalone gross margin was down 160bp YoY and 100bp QoQ at 75.1% (est. 76.2%), affected by higher festive-season discounts, increased cheese offerings and inflation. EBITDA margin contracted 150bp YoY to 19.4% and EBITDA was up by 11%. Pre-Ind-AS EBITDA margin contracted 50bp YoY to 12.4% and EBITDA rose 14%. Higher depreciation (+19%, investments in backend capabilities) and interest costs (+17%) led to a 4% decline in PBT.

* Domino’s Turkey saw 3.2% LFL decline and COFFY’s LFL fell 2.6%, primarily due to currency devaluation. DPEU margins remained under pressure with EBITDA margin at 18.3% (25.5% in 1HFY25) and PAT margin at 2.4% (9.8% in 1HFY25) in 3Q, impacted by negative operating leverage. Revenue growth was strong in Domino’s Sri Lanka (65%) and Bangladesh (37%).

* JUBI has benefited from strong delivery traffic growth, outperforming peers. Delivery is expected to drive superior near-term growth, while operating margin recovery may be slower due to ongoing reinvestments in core capabilities. We reiterate our Neutral rating on stock with a TP of INR715 (implied 33x Dec’26E EV/EBITDA pre-Ind AS).

Delivery LFL up 25%; miss on margin

* Strong LFL growth at 12.5%: JUBI reported sales growth of 19% YoY to INR16.1b (est. INR15.6b), led by Domino’s order growth of 34%. Domino’s LFL grew by 12.5% (delivery LFL up 25%).

* Store expansion continues: In India, JUBI opened 67 net stores, taking the total count to 2,266. Domino’s opened 60 new Domino’s Pizza stores, taking the count to 2,139. Popeyes opened four new stores, taking the count to 58. Hong’s Kitchen opened one store, taking the count to 35. Dunkin’ Donuts opened two stores, taking the count to 34.

* Reinvestment continues to impact EBITDA margin: Gross profit grew 16% YoY to INR12.1b (est. INR11.9b). GM declined 160bp YoY/100bp QoQ to 75.1% (est. 76.2%). EBITDA margins contracted 150bp YoY (flat QoQ) to 19.4% (est. 20.7%). Pre-Ind-AS EBITDA margin contracted 50bp YoY (up 70bp QoQ) to 12.4% (est. 12.7%). PBT margin stood at 4.9% vs. 6.0% in 3QFY24 and 4.8% in 2QFY25.

* Decline in PBT/PAT: EBITDA grew 11% YoY to INR3.1b (est. INR3.2b). PBT (before exceptional) continued to decline by 4% YoY to INR788m (est. INR985m). Adj. PAT fell 2% YoY to INR596m (est. 737m). There was an exceptional item of INR24.8m due to an impairment loss on investments in an associate company.

* In 9MFY25, net sales/EBITDA grew by 13%/4%, while APAT fell 22% YoY.

International business

* Domino’s Sri Lanka revenue rose 65% YoY to INR213m. No store addition in Sri Lanka.

* Domino’s Bangladesh revenue grew 39% YoY to INR173m. Two stores were opened in Bangladesh, taking the total count to 37 stores

DPEU

* Domino’s System Sales stood at INR7,544m. Domino’s Turkey LFL growth was down 3%.

* COFFY’s System Sales came in at INR801m. COFFY LFL growth was down 3%.

* Revenue for DPEU came in at INR5,044m with Op. EBITDA of 18.3% and PAT margin of 2.4%.

* In DP Eurasia, JUBI opened 61 stores in 3QFY25, taking the total count to 907 stores.

Highlights from the management commentary

* The demand environment remained soft during the quarter. However, JUBI is seeing a gradual pickup in demand.

* The shift from dine-in to delivery continues in both India and international markets. Thus, JUBI is recalibrating its store size to ~1,200 sq.ft., with more focus on delivery for its high-street stores.

* Introduced three new flavors in the Cheese Burst range and extended Cheesiken range across all regions.

* Popeyes continues to gain traction and the progress is in line with JUBI’s internal estimates. Management alluded that ADS and margins for Popeyes are improving. JUBI remains cautious with its store locations and thus the store opening pace might seem a little slow.

Valuation and view

* There are no material changes to our EBITDA estimates for FY25 and FY26.

* JUBI has been the key beneficiary of healthy traffic growth for the delivery business. Delivery is expected to outperform in the near term, which will continue to lead to better growth metrics than those of its peers in the near term. Operating margin is likely to see a slower recovery owing to JUBI’s continuous reinvestments in its core capabilities.

* We value India business at 40x EV/EBITDA (pre-IND AS) and international business at 18x EV/EBITDA (pre-IND AS) on Dec’26E to arrive at our TP of INR715 (implied 33x Dec’26E EV/EBITDA). We reiterate our Neutral rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)