Buy Jubilant FoodWorks Ltd for the Target Rs.666 by PL Capital

Quick Pointers:

* JUBI guided for 15-16% sales CAGR and 5-7% LFL growth in medium term

* Popeye is seeing high double-digit growth with expansion plan on track, aiming for 250 stores and 10bn sales with superior margins in medium term

3Q26 results were largely inline with our estimates with 5% LFL growth led by robust menu innovation and focus on providing value to consumers. Popeyes is witnessing strong traction with high double digit growth and improving economics. Dp eurasia is seeing recovery with business now entirely servicing its acquisition-related debt through internal cash flows to remain impacted by inflation which has now stabalized in Turkey. Management Commentary remained healthy with Poepeye to contribute 1-1.5% towards overall growth in near term & plans to open 1,000 new stores across brands and markets in the next three years. We expect ~150bps expansion over FY26-FY28 led by 1) increase in average ticket size 2) supply chain benefits and 3) gains from tech investments and a healthy LTL outlook.

We estimate 52.1% standalone EPS CAGR over FY26-28 on a low base. We have assigned 33x FY27 EV/EBIDTA to standalone nos and arrive at value of Rs600/share and 22x PAT to dp eurraisa (Rs 66/share) on its CY26 earnings. We assign an SOTP based target price of Rs665 (no change). JUBI seems best placed in QSR space to gain from expected improvement in consumer demand. Retain Buy.

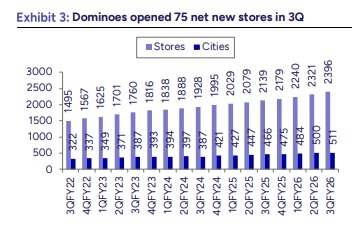

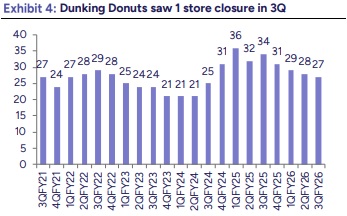

Standalone Revenues up 11.8%, LFL growth at 5.0%: Revenues grew by 11.8% YoY to Rs18bn (PLe: Rs18.012bn). SSG growth at 5%. Gross margins contracted by -16bps YoY to 74.9% (Ple: 75.4%). EBITDA grew by 18.1% YoY to Rs3.7bn (PLe:Rs3.548bn); Margins expanded by 109bps YoY to 20.5% (PLe:13.5%). Adj PAT grew by 20.6% YoY to Rs0.8bn (PLe:Rs0.774bn). Dominos added 75 net stores while Popeye’s added 5 stores. Hong’s kitchen and Dunkin donuts had one store closures each during the quarter.

DP Eurasia (Turkey, Azerbaijan and Georgia) Revenue came in at Rs5,801mn, up 15.0% yoy with PAT margin delivery of 6.2%.

* Domino’s Sri Lanka revenue of Rs353mn was up by 65.9%. Domino’s Bangladesh revenue came in at Rs219mn up by 26.6%

* A total of 36 net stores were added across all brands in the international markets, ending the period with 1,066 stores.

Concall Takeaways: 1) Demand remained robust in Q3, driven by sustained menu innovation. 2) Popeyes delivered strong, high double-digit growth in Q3, led by healthy order growth. 3)JUBI implemented calibrated price hikes in Q3 (notably on Sourdough pizzas). 4) Pre-Ind AS EBITDA margin expanded by 89 bps YoY and 121 bps QoQ, driven by portfolio-wide GM improvement, higher store productivity and operating leverage. 5) GM expected to sustain healthy levels, supported by calibrated price hikes and favorable mix. 6) Mumbai commissary likely to commence operations by end-Q4FY26.7) Menu innovation momentum sustained in Q3 with launch of Cheese Lava Pull Apart Pizza at Domino’s and pan-India rollout of Flavour Burst Burgers at Popeyes.8) Finance costs declined 59% YoY due to refinancing of DPEU debt from Turkish Lira to Euro. 9) New labour code expected to have a 10–15 bps margin impact in the near to medium term. 10)Capex remains elevated, led by aggressive store expansion, but supply chain capex has peaked out. 11) Domino’s mature ADS stood at Rs85,506, up 5% YoY. 12) EBITDA margin expansion guidance maintained at 200bps above FY24 levels. 14) JUBI expects to generate ~1% of online sales as ad revenue over the medium term. 15) The company is investing in AI which will reduce operating costs in long term. 16) Management indicated they are gaining market share within pizza and across relevant segments like chicken.

Above views are of the author and not of the website kindly read disclaimer