Buy Titan Company Ltd for Target Rs.5,000 by Motilal Oswal Financial Services

? Titan (TTAN) delivered a strong 3QFY26, with 43% YoY growth in consolidated revenue. Standalone jewelry sales (ex-bullion) rose 40% YoY, driven by festive demand, attractive collections, strong brand campaigns, and effective exchange offers.

? Studded jewelry sales grew 26% YoY, although its mix moderated to 26% (28% in 3QFY25, 34% in 2QFY26). Domestic jewelry (Tanishq, Mia and Zoya) posted 32% LFL growth, and CaratLane reported 23% LFL growth. Buyer growth remained flat (new buyers at 45%), as noted in our management meet note, where the company indicated that customer addition was affected by high gold prices. However, initiatives such as the gold exchange program (launched in Sep’25) and increased availability of <22-carat jewelry are driving affordability and footfalls. Demand was resilient in January despite gold price volatility.

? Standalone jewelry EBIT margin (excl. bullion, adjusted to custom duty in base) contracted 60bp YoY to 10.6% (est. 10.4%), due to lower studded growth, higher gold coins mix and step-up marketing spend. Standalone EBIT grew 32% YoY (34% for domestic brands) vs. our est. of 30%. CaratLane’s EBIT margin expanded 130bp to 13%

? Watch division reported revenue growth of 14% YoY (in line) and EBIT growth of 44% (12% margin). Eye care revenue rose 18% YoY (11% in 1HFY26) and EBIT increased by 20% (10% margin).

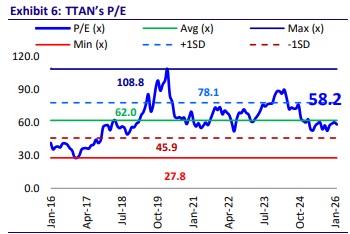

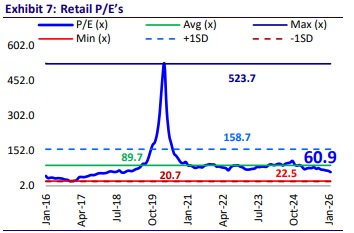

? We remain constructive on jewelry industry growth for top players, and we believe TTAN, with its exchange program and other initiatives, remains competitive. Considering strong revenue and margin delivery, we raise our EPS estimates by 3-5% for FY27 and FY28. We model a CAGR of 23% in sales, 25% in EBITDA, and 27% in APAT over FY25-28E. We reiterate our BUY rating on the stock with a TP of INR5,000, based on 60x Dec’27E EPS

Stellar growth; beat on profitability

? Growth metrics improving: TTAN’s consolidated revenue grew by a strong 43% YoY to INR254.2b (est. INR250.2b). Consolidated jewelry sales rose 46% YoY to INR234.9b (est. 231.6b); excl. Bullion, sales grew 44% to INR230.2b. Watch business reported revenue growth of 14% YoY (in line), while Eye Care revenue was up 18% YoY (11% in 1HFY26)

? Robust LFL of +30%+: Standalone sales (ex-bullion) grew 40% to INR205.5b (est. INR205.8). Domestic jewelry (Tanishq, Mia and Zoya) posted 32% LFL growth, and CaratLane reported 23% LFL growth. Growth was led by festive collections, impactful brand campaigns and powerful exchange initiatives. CaratLane’s revenue jumped 38%. Total jewelry store addition was 49 (139 last 12 months), totaling 1,194 stores. In 3Q, Tanishq saw 12 store addition, Caratlane 24, Mia 11, and Zoya 1. TTAN also added 1 store of beYon (LGD showroom) during the quarter.

? Mix impact on GM: Adjusted to customs duty in base, gross margins contracted 230bp YoY to 19.8%, impacted by increased gold coin sales, lower studded jewelry margins (due to higher gold content value), and jewelry's increased dominance in the overall portfolio mix. Ad spends increased by 9% YoY, other expense rose 20% YoY, and employee costs were up 16% YoY. Consolidated EBITDA margin declined 20bp YoY to 10.7% (est. 10.4%).

? Standalone jewelry EBIT (ex-bullion) growth at 32%: Standalone EBIT (excl. bullion) was up 32% YoY (est. 30%) at INR21.9b and EBIT margin contracted 60bp YoY to 10.6% (est. 10.4%, 10.8% in 2QFY26). CaratLane’s EBIT margin expanded 130bp YoY to 13%. Watches’ margin expanded 250bp to 12% (est. 10.5%). Eye Care’s margin was up 20bp YoY at 10.4% (est. 10%).

? Strong growth in profitability: Consolidated EBITDA grew 41% YoY to INR27.1b (INR 26.1b). PBT was up 44% YoY at INR23.8b (est. INR22.7b). Adj. PAT rose 44% YoY to INR18.0b (est. INR16.9b). There was an exceptional cost of INR1.5b related to the implementation of the new labor code

? In 9MFY26, net sales, EBITDA and APAT grew by 33%, 37% and 39%., respectively.

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH0000004