Accumulate LT Foods Ltd For Target Rs. 393 By Geojit Financial Services Ltd

Expansion & diversification aids re-rating.

LT Foods Ltd. (LTF) is a global consumer specialty company with an explicit focus on basmati rice, organic foods and ready to eat/ready to cook (RTE/RTC) products. LTF is having a presence in more than 80 countries with significant regional exposure in the US, Europe, Middle East etc.

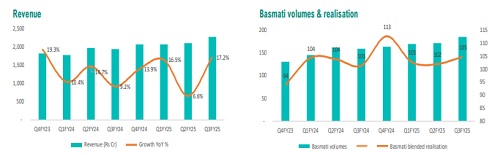

* Consolidated revenue grew by 17%YoY, mainly aided by growth in the basmati segment (87% revenue mix). International basmati volumes grew by 21% YoY, while India basmati volume grew by 12%YoY. Organic segment (11% mix) revenue grew by 27%, YoY driven by expanded distribution in Europe and the US.

* Gross margin improved by 120bps YoY to 33.5%, while EBITDA margin dropped by 130bps YoY to 11.0% due to higher freight costs owing to disruption in the Red Sea. LTF expects the freight costs to normalise in early FY26 and the expected decline in input costs with healthy growth in new crops will support margins.

* LTF has recently set up a new manufacturing facility in the UK and has also appointed a distributor for Saudi Arabia (largest basmati rice market in the world). LTF targets ~Rs. 1,000cr revenue each from UK and Saudi over 5 years.

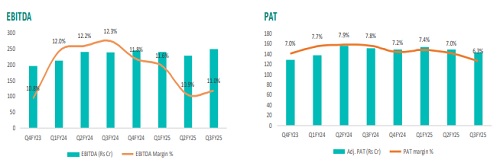

* The organic segment revenue is expected to cross Rs.1,000cr next year and LTF targets ~14% EBITDA margin in this segment (currently at 11.8%). LTF expects the ready to heat/eat (RTC/RTE) segment to grow at 33-35% over next 5years and to breakeven at a revenue of Rs. 400cr by FY27 (Rs. 200cr in FY24). This will improve the consolidated margin in the future.

Outlook & Valuation

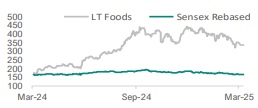

We expect both raw material costs and realisation to decline with expected healthy growth in new crops. LTF’s recent initiatives towards expansion & diversification strategy support a strong long-term positive outlook and re-rating. The additional initiatives in the UK and Saudi Arabia will support long-term volume outlook. We expect Revenue/PAT to grow at a 12%/21% CAGR over FY25-27E. LTF currently trades at 16x 1Yr Fwd PE (3yr avg=15x). We revised our target to Rs. 393 (earlier Rs. 322) by valuing at 15x FY27E EPS, upgrade to BUY due to healthy volume outlook and recent correction in stock price.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345