Accumulate Container Corporation of India Ltd for Target Rs.839 by Elara Capitals

EXIM to pick-up; domestic growth capex-led

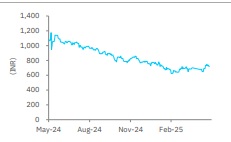

Container Corporation of India’s (CCRI IN) handling volume grew at CAGR of 8% over FY22-25 crossing 5mn TEUs mark for the first time in FY25. The performance continues to be driven by the domestic segment, with growth in high double-digits (led by a rise in bulk cement handling). The EXIM segment continued to grow in high single-digit (on increased double stacking, and collaboration with shipping lines for end-to-end connectivity). CCRI expects the momentum to pick up in the medium term – The Western Dedicated Freight Corridor is expected to be connected to JNPT by Q4FY26, capacity addition is planned across rakes, terminals and containers and long-term agreements have been signed with corporates. CCRI is aiming for EXIM handling to grow 10% and the domestic segment to grow 20%, with overall volume growth at 12% for FY26. Competitive intensity is high, with market share gradually declining across EXIM and domestic segments, and rail coefficients declining at ports. We maintain Accumulate with TP unchanged at INR 839, on FY27E P/E of 32x.

Revenue in line; other income up: Revenue was down 2% YoY to INR 22.8bn, inline with our estimates, led by a 10% drop in revenue from the domestic segment (owing to fall in volume) even as revenue from the EXIM segment was flat at 3%. EBITDA declined 11% YoY to INR 4.3bn with margin at 19%, down 210bps YoY (the lowest since Q2FY22) on higher other expenses. Despite decline in operational performance, PAT was flat YoY at INR 3bn, led by a 53% rise in other income to INR 1.4bn.

EXIM showing initial signs of pick-up: Handling volumes grew 12% in Q4 after eight consecutive quarters of single-digit growth. The performance was led by strategic tie-ups with shipping lines, stable global trade and increase in originating cargo at ports (excluding transshipment cargo, direct port delivery and direct port entry cargo). With Q1FY26 showing similar growth trends, CCRI is targeting 10% handling growth in FY26, in-line with pan-India container handling growth.

Domestic outlook strong, driven by capex push: Domestic handling volumes in Q4 declined a surprising 3% owing to rejection of low-margin cargo, congestion in East India and delay in supply of tank containers. The management has guided for a recovery to 20% growth in handling in FY26, led by capacity expansion through planned capex of INR 8.6bn (INR 8.1bn in FY25) across rakes, containers and terminals. Visible demand is also shaping up in bulk cement, ceramic tiles and food grains and MoUs have been signed with Ultratech Cement and My Home Cement. We believe the runway for growth is longer – FY28 target is to take rake count to 500+ from 388, container count to 70,000 from 53,000 and terminals to 100+.

Maintain Accumulate; TP retained at INR 839: In the long-term, CCRI is focusing on customer centricity and providing end-to-end connectivity services to the customers. We introduce FY28E and expect FY25-28E revenue and earnings CAGRs of 11% and 12%, respectively. Maintain Accumulate with TP retained at INR 839, on unchanged FY27E P/E of 32x. We have not factored in the proposed bonus issue of 1:4 announced in the board meeting.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)