Accumulate Praj Industries Ltd For Target Rs. 676 By Elara Capital Ltd

Engineering segment drags performance

Praj Industries (PRJ IN) execution remains muted for the past seven quarters due to several headwinds, such as the ban on sugar feedstock for ethanol production, delay in commissioning of the engineering facility and decline in new order inflows during the year. We believe the stock lacks near-term triggers as engineering customers take longer to inspect the new facility, macro liquidity challenges leading to delay in financial closure of new ethanol projects, policy push needed toward higher ethanol blending target to rebound inflows (EBP-20 already achieved up to 18%). However, international orders could provide respite as enquiries are building up in 2G ethanol in South America and Sustainable Aviation Fuel (SAF) in the US. We remain cautious and factor in delay in inflows & execution, leading to an earnings cut of 18% for FY26E and 16% for FY27E. We reiterate Accumulate and lower TP to INR 676 on 32x FY27E P/E.

Slowdown in the engineering segment drags overall performance:

Q3 revenue grew at a mere 3% YoY to INR 8.5bn, 6% lower than our estimates, as engineering revenue was down 10% YoY, which also negatively affected EBITDA margin, down 478bp YoY, to 6.9%. Post commissioning of the new Mangalore Gen X facility in Q1FY25, incremental opex cost rose to INR 250-300mn per quarter; however, new orders and execution were delayed due to time spend by customers during the inspection process. Depreciation and interest expense also increased on capitalizing of the new facility, leading to a lower PAT at INR 411mn, down 42% YoY.

Opportunities plenty; conversion crucial:

While domestic order inflows remain uneven, management is hopeful of a pickup in international projects, including: 1) SAF opportunity in the US intact even after changes in the government and ethanol production continues with SAF blending mandated from 2027, and 2) healthy inquiry pipeline in Brazil (moving to blending mandate of 30%), and other LATAM countries focusing on 2G ethanol from corn. In India, PRJ expects bio bitumen (for roads) to be an upcoming opportunity (currently India imports 50% of bitumen), which provides synergy to Compressed Biogas (CBG) producers as its byproduct lignin is used as a raw material for bio-bitumen. The company is already in talks with customers in India and abroad. It has signed a JV with BPCL to set up CBG plants across India (earlier signed a JV with IOCL for exploring bioenergy opportunities).

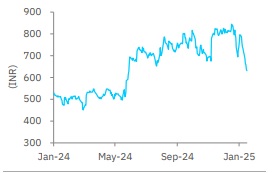

Price chart

Source: Bloomberg

Reiterate Accumulate with a TP of INR 676:

Amid changing business dynamics, management expects similar muted performance to continue in Q4. Engineering orders are likely to pick up from 2HFY26 and bioenergy order finalization may take longer than usual. We await the pickup in business momentum as also the new professional leadership takes charge from June 2025 (Ashish Gaikwad appointed as Managing Director for the next five years). We cut our earnings by 18% for FY26E and 16% for FY27E. We expect a revenue CAGR of 8%, an EBITDA CAGR of 14% and a PAT CAGR of 11% during FY24-27E. We reiterate Accumulate with a lower TP of INR 676 from 802 on 32x (unchanged) FY27E P/E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933