Weekly Derivatives Insights 25th Aug 2025 Axis Securities

NIFTY Index Highlights:

Nifty futures closed Friday at 24,898.2, up 0.9% (213.5 points), with a 3.8% drop in open interest, indicating Short Covering.

Bank Nifty futures settled at 55,270.6, down 0.4% (233.2 points), with a 3.5% rise in open interest, signaling long Unwinding.

India VIX fell 5.1% to 11.73, down from 12.35, signaling easing market anxiety, with traders factoring in lower short-term volatility.

The FII Long-Short ratio moved up from 0.9 to 0.12 as short positions decreased and fresh longs added, signaling a softer bearish stance.

Total outstanding open interest in Nifty and Bank Nifty futures were 1.77 cr units (prev: 1.82 cr) and 0.31 cr units (prev: 0.31 cr), respectively.

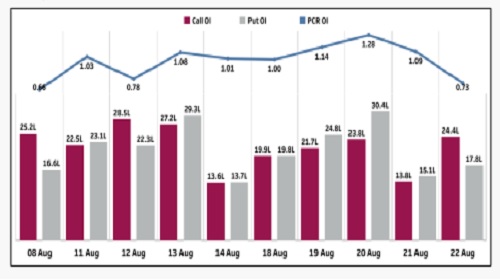

Nifty PCR OI:

The Nifty PCR dropped by 0.28 during the holiday-truncated week, driven by a sharp rise in Call option open interest over Puts, signaling a shift toward a cautiously bearish market sentiment as participants position for limited upside.

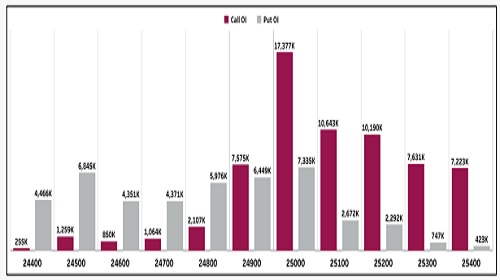

Open Interest Analysis:

The strike-concentration for the upcoming expiry on August 28 shows that the Nifty has strong supports at 24,900, 24,500 and 24,800, while resistance can be seen near 25,100, 25,500 and 25,000.

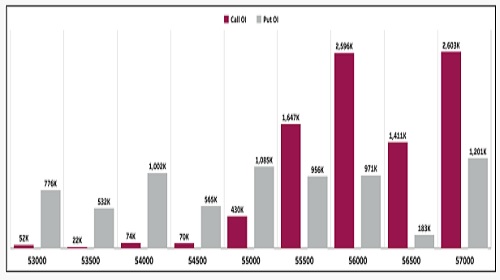

The strike concentration for the August expiration shows that the Bank Nifty has strong supports at 55,000, 54,500, and 54,000, while resistance rests at 55,500, 56,000, and 56,500.

Volatility Analysis:

The implied volatility (IV) curve for the upcoming weekly expiry has shifted upward for both out-of-the-money (OTM) calls and puts, indicating increased demand for option premiums on both sides of the strike spectrum.

This uptick in IV for OTM options, the term structure and relative movement suggest that market participants are anticipating heightened realized volatility for the next week.

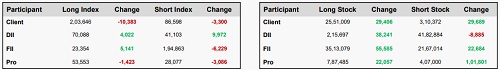

FII's total open interest in Index Futures is at Rs 40,915, which on weekly basis has increased by Rs 128 Crs.

Foreigners had 2,18,217 Index futures contracts open, unwinding 1,088 contracts from the previous week, with Nifty futures witnessed unwinding 2,222 contracts and Bank Nifty futures added 970 contracts.

Trade Ideas:

Buy BLUESTARCO August Futures in 1917 – 1895 range | SL 1875 | Targets 1968 & 1999 (Long Build Up).

Buy DABUR August Futures in 517 – 511 range | SL 505 | Targets 532 & 541 (Long Build Up).

The Week That Was:

* Nifty futures closed Friday at 24,898.2, up 0.9% (213.5 points), with a 3.8% drop in open interest, indicating Short Covering.

* Bank Nifty futures settled at 55,270.6, down 0.4% (233.2 points), with a 3.5% rise in open interest, signaling long Unwinding.

* India VIX fell 5.1% to 11.73, down from 12.35, signaling easing market anxiety, with traders factoring in lower short-term volatility.

* The FII Long-Short ratio moved up from 0.9 to 0.12 as short positions decreased and fresh longs added, signaling a softer bearish stance.

* Total outstanding open interest in Nifty and Bank Nifty futures were 1.77 cr units (prev: 1.82 cr) and 0.31 cr units (prev: 0.31 cr), respectively.

Nifty Open Interest Put-Call Ratio

* The Nifty PCR dropped by 0.28 during the holiday-truncated week, driven by a sharp rise in Call option open interest over Puts, signaling a shift toward a cautiously bearish market sentiment as participants position for limited upside.

Volatility Analysis

* The implied volatility (IV) curve for the upcoming weekly expiry has shifted upward for both out-of-the-money (OTM) calls and puts, indicating increased demand for option premiums on both sides of the strike spectrum.

* This uptick in IV for OTM options, the term structure and relative movement suggest that market participants are anticipating heightened realized volatility for the next week.

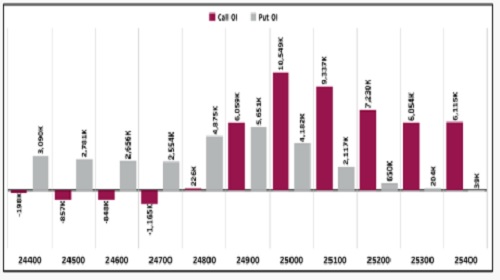

Nifty Open Interest Concentration (Weekly)

* The strike-concentration for the upcoming expiry on August 28 shows that the Nifty has strong supports at 24,900, 24,500 and 24,800, while resistance can be seen near 25,100, 25,500 and 25,000.

* Speaking of open interest changes, the 25,000-strike Call and 24,900 strike Put saw the maximum addition, alongside the 25,100 strike Call and 24,800 strike Put.

* Based on the data, we project the Nifty to trade between 24,500 and 25,200 in the week ahead.

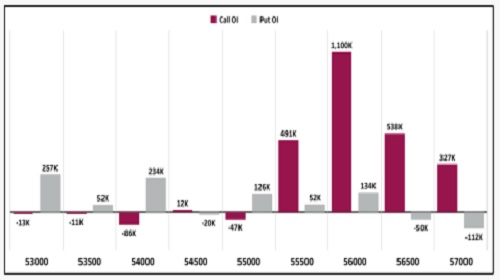

Bank Nifty Open Interest Concentration (Monthly)

* The strike concentration for the August expiration shows that the Bank Nifty has strong supports at 55,000, 54,500, and 54,000, while resistance rests at 55,500, 56,000, and 56,500.

* Speaking of open interest changes, the 56000-strike Call and 54000 strike Put saw the maximum addition, alongside the 56500 strike Call and 55800 strike Put.

* Based on the data, we project the Bank Nifty to trade between 54,000 and 56,500 in the coming week, with 56,000 acting as a pivotal level.

Nifty Change in Open Interest (Weekly)

* Using the monthly expiration cycle, notable addition in calls was seen at the following strikes - 25,000 (105.5 Lc), 25,100 (93.7 Lc), and 25,200 (72.3 Lc), respectively. There was unwinding observed at 24,500 & 24,700 strike.

* Coming to puts, the 24,900 (56.5 Lc), 24,800 (48.7 Lc), and 25,000 strikes (41.8 Lc) saw considerable addition in open interest. Unwinding was witnessed at the 25,500 strike.

Bank Nifty Change in Open Interest (Monthly)

* For the Bank Nifty - based again on the monthly expiration cycle - notable addition in calls was seen at the following strikes - 56,000 (11 Lc), 56,500 (5.4 Lc), and 55,800 (5.4 Lc), respectively. There was unwinding observed at 54,000 & 55,000 strikes.

* Coming to puts, the 54,000 (2.3 Lc), 55,800 (1.5 Lc), and 54,800 strikes (1.4 Lc) saw considerable addition in open interest. There was notable unwinding observed at 55,100 & 56,500 strikes.

Weekly Participant-wise Open Interest (contracts)

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Market Watch: Nifty eyes fresh cues to push higher ahead of derivatives expiry by Geojit Fin...

.jpg)

.jpg)