Bank Nifty started the week on a weak note and eventually settling at 58932, marginally lower by 0.1% - ICICI Direct

Nifty : 25942

Technical Outlook

Day that was…

Equity benchmark extended its decline for a third consecutive session, settling at 25,942, down 0.39%, weighed down by continued FII outflows and thin year-end trading volumes. Market breadth remained negative with an A/D ratio of 1:2, while broader markets underperformed, as the Nifty Midcap and Smallcap indices declined 0.52% and 0.72%, respectively. Sectorally, IT, Realty, and Auto stocks emerged as key laggards, whereas PSU Banks and FMCG closed in the green.

Technical Outlook:.

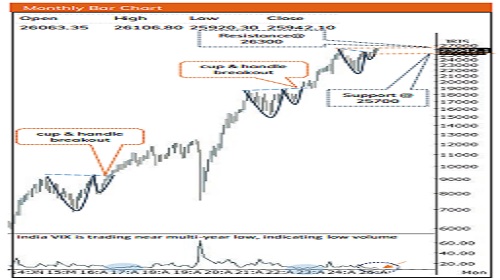

* The index opened on a positive note; however, the lack of follow-through buying led to profit-booking near the 61.8% retracement of the previous session’s move. As a result, the daily price action formed a bearish candle, with the index closing below its 20-day EMA and exhibiting a lower highlow structure, indicating selling pressure at higher levels.

* From a broader perspective, the index has been consolidating within the 25,700-26,300 range for the past seven weeks, highlighting a phase of range-bound activity. To arrest the current downward bias, a decisive close above the previous session’s high is required, which could enable a gradual move towards 26,300 in the coming week. Failure to achieve this may lead to an extended corrective phase.

* Nevertheless, the downside appears cushioned, as the index has consistently defended its 50-day EMA over the past two months, which coincides with last week’s low near 25,700, reinforcing this zone as a key support base

Our constructive bias is outlined on the basis of following observations:

1. The US Dollar Index (DXY) has decisively slipped below 98 after failing to sustain above 100, easing currency-led headwinds. This has fuelled a sharp up-move in base metals, with Copper scaling fresh (all-time highs on MCX), while Aluminum breaks out from a three-year base, signalling the start of a structural uptrend.

2. US equity markets have rebounded strongly to record highs, led by broadbased participation rather than the Magnificent Seven. The Russell 2000 (Small cap index) has consequently surged and is now trading near its alltime high, underscoring improving market breadth.

3. Historically, since 2017 there have been two such instances when VIX slipped below the 9 mark, and on both occasion the Nifty has formed cup & handle formation and witnessed a positive breakout. In the current scenario too India VIX has fell around 9, with a formation of cup & handle pattern in Nifty, mirroring a similar past rhythm.

4. On expected line, USD/INR has retreated from the upper band of rising wedge. Historically, there have been five instances where a retreat in USD/INR from the upper band of this wedge averaging a ~4% decline (with a maximum drawdown of ~7%) over a two-month period was followed by the Nifty delivering average gains of >10% over the subsequent two months.

Key Monitorable for the next week:

* US FOMC meeting minutes

* US and India Tarde Deal

Intraday Rational:

* Trend- consolidating within the 25,700-26,300 range for the past seven weeks, highlighting a phase of range-bound activity

* Levels: Buy near 80% retracement level of its preceding up-move (25800- 26270)

Nifty Bank : 58932

Technical Outlook

Day that was:

Bank Nifty started the week on a weak note and eventually settling at 58932, marginally lower by 0.1%. In contrast, the Nifty PSU Bank index showed relative resilience, ending the day 0.1% higher.

Technical Outlook:

* From a technical standpoint, the daily price action on Bank Nifty formed a high-wave candle with long shadows on both sides, reflecting indecision at current levels after a recent decline.

* Over the past four weeks, the index has undergone a healthy retracement, pulling back towards its 20-day EMA, which also coincides with the earlier gap-up zone. This confluence reinforces the view that the broader uptrend remains intact.

* Going ahead, a sustained move and close above the previous session’s high of 59,140 could trigger a fresh upswing towards 59,500. A decisive breakout above 59,500 would strengthen bullish momentum and open the door for a gradual retest of the all-time high near 60,100.

* Meanwhile, the Nifty PSU Bank index has been consolidating over the last four weeks, retracing nearly 50% of its prior eight-week rally, which signals a healthy consolidation phase rather than trend exhaustion. A decisive close above the two-month identical highs would confirm a resumption of the uptrend, paving the way for a move towards 8,650 in the coming weeks

Intraday Rational:

Trend- Consolidation over past 4 weeks

Levels: After a negative opening, pullback towards 80% of previous day fall (59116-58832)should be used as selling opportunity

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

.jpg)