Weekly Derivatives Insights 29th December 2025 by Axis Securities

Nifty Futures closed at 26,060.2 on Friday with a gain of 0.1% (30.2 points) as open interest fell 4.8%, shedding 8.46 lakh contracts to 166.50 lakh, indicating short covering and a mildly positive trading sentiment.

Bank Nifty futures settled at 59,065.8 with a decline of 0.3% (-165.6 points), while open interest dropped sharply by 15.9%, shedding 3.17 lakh contracts to 16.92 lakh, indicating long unwinding and reflecting a weak trading sentiment.

India VIX declined 3.9% to 9.15%, down from 9.52%, marking a yearly low and signaling subdued market volatility with a stable sentiment backdrop.

FII Long - Short ratio inched up to 0.12 from 0.10, with long additions slightly exceeding marginal levels but still modest compared to the more pronounced unwinding of shorts, reflecting a cautiously bullish tilt in indices though the broader sentiment remains optimistic.

Nifty PCR OI:

Nifty Put - Call Ratio (PCR) fell by 0.37 over the week, driven by a notable rise in Call option open interest alongside an increase in Put option open interest, this positioning suggests a tilt toward bearish sentiment, as traders appear more inclined to hedge or bet against further upside.

The decrease in implied volatility for both out-of-the-money call and put options compared with the previous week suggests that market participants are expecting stable price behavior and assign a lower likelihood to sharp, abrupt moves.

In the current monthly expiry, Nifty strike - concentration shows significant Call open?interest buildup at 26,200 and 26,100, with Put positioning at 26,000 and 25,800, compared to the previous week, indicating a shift in resistance levels toward 26,200 while support remains anchored at 26,000 and 25,800.

Based on the data, we project the Nifty to trade between 25,800 and 26,200 in the week ahead.

Bank Nifty strike - concentration for the current monthly expiry shows Calls clustered at 59,500 and 60,000, with Puts at 59,000 and 58,500, while compared to the previous week's option positioning, highlights unchanged resistance yet a shift in support lower toward 58,500.

Based on the data, we project the Bank Nifty to trade between 58,500 and 59,500 in the coming week.

FII's total open interest in Index Futures is atRs 33,305 ,which on a weekly basis has decreased by Rs 4,044 Crs.

Foreigners had 1,78,665 Index futures contracts open, unwinding 14,122 contracts from the previous week, with Nifty futures witnessed unwinding 10264 contracts and Bank Nifty futures unwinding 5742 contracts.

Trade Ideas:

Buy APOLLOHOSP January Futures in 7205 – 7130 range | SL 7075 | Targets 7465 & 7595 (Short Covering).

Buy TITAN January Futures in 4020 – 3980 range | SL 3950 | Targets 4160 & 4230 (Long Build Up).

The Week That Was:

* Nifty futures closed at 26,060.2 on Friday with a gain of 0.1% (30.2 points) as open interest fell 4.8%, shedding 8.46 lakh contracts to 166.50 lakh, indicating short covering and a mildly positive trading sentiment.

* Bank Nifty futures settled at 59,065.8 with a decline of 0.3% (-165.6 points), while open interest dropped sharply by 15.9%, shedding 3.17 lakh contracts to 16.92 lakh, indicating long unwinding and reflecting a weak trading sentiment.

* India VIX declined 3.9% to 9.15%, down from 9.52%, marking a yearly low and signaling subdued market volatility with a stable sentiment backdrop.

* FII Long-Short ratio inched up to 0.12 from 0.10, with long additions slightly exceeding marginal levels but still modest compared to the more pronounced unwinding of shorts, reflecting a cautiously bullish tilt in indices though the broader sentiment remains optimistic.

Nifty Open Interest Put-Call Ratio

* Nifty Put-Call Ratio (PCR) fell by 0.37 over the week, driven by a notable rise in Call option open interest alongside an increase in Put option open interest, this positioning suggests a tilt toward bearish sentiment, as traders appear more inclined to hedge or bet against further upside.

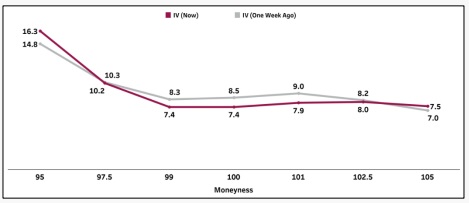

Volatility Analysis

* The decrease in implied volatility for both out-of-the-money call and put options compared with the previous week suggests that market participants are expecting stable price behavior and assign a lower likelihood to sharp, abrupt moves.

* In addition, the flattening of the volatility term structure signals a reduced perception of tail risk going forward, which has led to weaker demand for protective hedges as well as leveraged directional trades

Nifty Open Interest Concentration (Monthly)

* In the current monthly expiry, Nifty strike-concentration shows significant Call open-interest buildup at 26,200 and 26,100, with Put positioning at 26,000 and 25,800, compared to the previous week, indicating a shift in resistance levels toward 26,200 while support remains anchored at 26,000 and 25,800.

* Speaking of open interest changes, the 26,200-strike Call and 26,000 strike Put saw the maximum addition.

* Based on the data, we project the Nifty to trade between 25,800 and 26,200 in the week ahead.

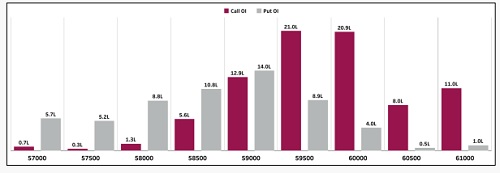

Bank Nifty Open Interest Concentration (Monthly)

* Bank Nifty strike-concentration for the current monthly expiry shows Calls clustered at 59,500 and 60,000, with Puts at 59,000 and 58,500, while in the previous week Calls were also at 59,500 and 60,000 but Puts concentrated at 59,000 and 59,500, highlighting unchanged resistance yet a shift in support lower toward 58,500.

* Speaking of open interest changes, the 59,300-strike Call and 58,900 strike Put saw the maximum addition, alongside the 59,200 strike Call and 59,100 strike Put.

* Based on the data, we project the Bank Nifty to trade between 58,500 and 59,500 in the coming week.

Nifty Change in Open Interest (Monthly)

* For Nifty in the current monthly expiration cycle, notable addition in calls was seen at the following strikes - 26,100 (123.8 Lc), 26,200 (156.5 Lc), and 26,300 (86.8 Lc), respectively. There was notable unwinding observed at 25,700 & 25,600 strike.

* Coming to puts, the 26,100 (44.9 Lc), 26,000 (65 Lc), and 25,900 strikes (39.1 Lc) saw considerable addition in open interest. There was notable Unwinding witnessed at 26,500 strike.

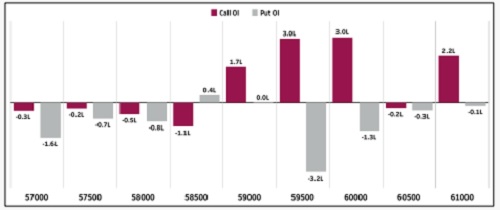

Bank Nifty Change in Open Interest (Monthly)

* For the Bank Nifty based on the current monthly expiration cycle - notable addition in calls was seen at the following strikes - 59,200 (4.5 Lc), 59,300 (4.8 Lc), and 59,400 (4.1 Lc), respectively. There was significant unwinding observed at 60,200 & 58,500 strike.

* Coming to puts, the 59,100 (1.5 Lc), 58,900 (2.8 Lc), and 58,700 strikes (1.3 Lc) saw considerable addition in open interest. There was significant unwinding observed at 59,500 & 60,000 strike.

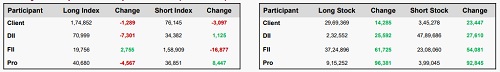

Weekly Participant-wise Open Interest (contracts)

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Tag News

Sensex, Nifty end flat after 2-day rally

More News

Market Watch: Fed minutes raises expectations of more cuts by Geojit Investments Ltd

.jpg)