Nifty Open Interest Put Call ratio fell to 0.66 levels from 0.76 levels. PCR is near oversold territory - HDFC Sescurities Ltd

Nifty : Falls For Third Straight Session; Support Seen at 50 DEMA(25832)

Nifty Smallcap100 Index : Finds Strong Resistance at 50 & 200 DEMA

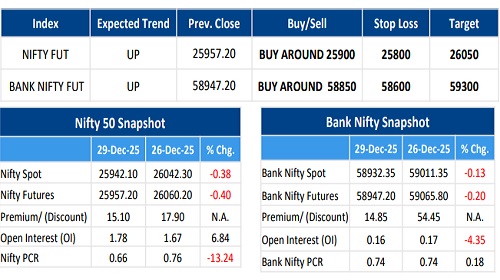

F&O Highlights

PCR IS AT OVERSOLD TERRITORY

Create longs on decline with the SL of 25800 levels.

* After opening higher on strong global cues, Nifty soon faced profit booking at higher levels, which persisted throughout the session. The index eventually closed with a loss of 100 points at 26,042.

* Short Build-Up was seen in the Nifty Futures where Open Interest rose by 6.84% with Nifty falling by 0.38%.

* Long Unwinding was seen in the Bank Nifty Futures where Open Interest fell by 4.35% with Bank Nifty falling by 0.13%.

* Nifty Open Interest Put Call ratio fell to 0.66 levels from 0.76 levels. PCR is near oversold territory.

* One day before the expiry, We have seen lower rollover of 59.43% in the Nifty to the Jan series as against last three series average rollover of 61.08%. Lower rollover is seen in the Bank Nifty futures also where we have seen rollover of 58.38% as against last thee series average rollover of 60.47%.

* Amongst the Nifty options (30-Dec Expiry), Call writing is seen at 26000-26100 levels, indicating Nifty is likely to find strong resistance in the vicinity of 26000-26100 levels. On the lower side, an immediate support is placed in the vicinity of 25800-25900 levels where we have seen Put writing.

* Short build-up was seen by FII's in the Index Futures segment where they net sold worth 1,708 cr with their Open Interest going up by 34469 contracts.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133

.jpg)

_Securities_(600x400).jpg)