From Global Headwinds to Domestic Tailwinds: Bajaj Finserv Asset Management Limited on The Indian Markets in 2025

A study by Bajaj Finserv Asset Management Limited notes that the year 2025 was marked by heightened volatility in Indian equity markets, driven by global headwinds such as shifting trade tariffs, geopolitical tensions, and persistent foreign institutional investor (FII) outflows. Despite these challenges, the markets demonstrated notable resilience, underpinned by strong domestic fundamentals and a decisive shift in investor dynamics.

Market Performance and the Broader Landscape

At the headline level, benchmark indices held firm through the year. The Nifty 50 delivered a return of around 9% in 2025, despite early pressure from elevated valuations, tariff-related uncertainty, FII outflows and rupee depreciation. While equity markets remained volatile, returns across other asset classes fared better, with gold and silver registering impressive gains during the year.

Market Capitalisation Trends and Investor Positioning

Performance across market capitalisation segments highlighted a clear shift in investor behaviour. Large-cap stocks provided relative stability, while broader markets faced pressure. Mid-cap indices delivered a modest return of around 5%, while small-cap indices declined by approximately 8% for the year. This divergence reflected a pronounced flight to quality, as investors favoured balance sheet strength and earnings visibility.

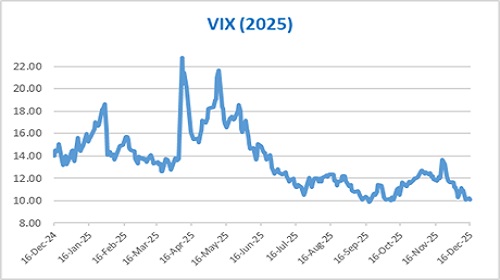

The Volatility Paradox: Decoding India’s Volatility Curve

Volatility played a central role in shaping market sentiment during 2025. According to Bajaj Finserv Asset Management, the India VIX crossed the 20-mark six times between January and May, signalling heightened nervousness in the first half of the year. April saw the India VIX peaking at 22.79, with President Trump’s retaliatory tariff announcements. The second half of the year was relatively calm, with the VIX remaining below 15 and averaging around 13.5, despite markets factored in rupee weakness and stalled progress on the Indo–US trade agreement.

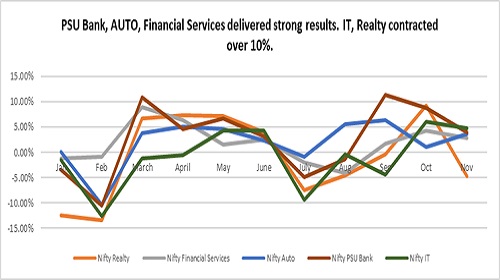

From Capex to Consumption: How Sectoral Shifts Redefined Indian Markets

Sectoral rotation emerged as a defining feature of the Indian markets in 2025. Unlike previous years, when certain sectors delivered sustained performance, no single sector performed decisively over the year. Bajaj Finserv Asset Management highlights that the leadership among sectors shifted every 2–3 months post the September 2024 correction, with auto sector (21.7%) and consumption sector taking turns at the forefront. Supported by government tax and duty cuts, consumption-led sectors picked up. Festive season and GST recalibration during the second half of the year further aided consumption-led sectors.

Sectoral Laggards and Areas of Stress

Export-oriented and interest-rate-sensitive sectors faced notable pressure during the year leaving investors to wonder with the unusual divergence. Export sectors lagged due to tariff related uncertainties despite rupee depreciation. Tariff uncertainties weighed down on IT Services which declined 13.7%.

Rate-sensitive sectors, particularly real estate, confounded expectations. Despite a cumulative 125 bps rate cut, Realty retreated 14.2%. Bajaj Finserv Asset Management emphasizes that this could be due to varying reasons including job related uncertainties, perception of slowdown, people holding back spendings. While the real estate sector as a whole showed underlying strength, individual stocks did not reflect this performance.

Pharma, FMCG, and Utilities also remained marginally negative, hovering around the 2% mark, adding to the list of sectors that underperformed despite apparent tailwinds.

Outlook

Bajaj Finserv Asset Management believes that Indian equity markets appear to be on a firmer footing, as we step into 2026 On the macro front, lower inflation, healthy post-monsoon harvests, and the wealth effect of gold provide strong support for domestic demand. Corporate earnings are expected to improve, aided by government tax measures and RBI’s monetary easing, pointing to a broad-based cyclical recovery in the economy. Clear sectoral leadership is likely to be driven by domestic cyclicals and consumption, while exports could gain momentum as tariff-related uncertainties ease and the rupee stabilises.

Entering the new year, one thing stands true: For investors, the story of the Indian markets remains one of discipline, resilience and opportunity, rewarding for the patient investor.

.jpg)