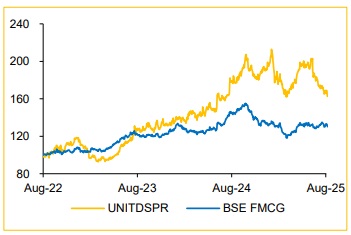

Add United Spirits Ltd for the Target Rs.1,110 by Choice Broking Ltd

AP re-opening Aids Q1FY26 Volume Growth:

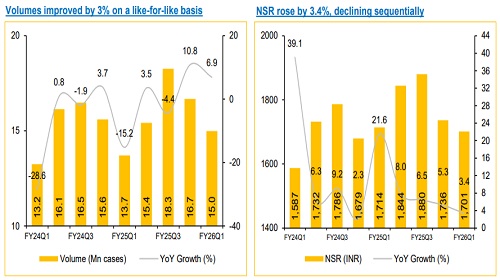

UNITDSPR posted Net Revenues of INR 30.2 Bn for Q1FY26, growing at 9.4% YoY. Of this, ~8% came in from the normalisation of the Andhra Pradesh (AP) market. Receivables started accruing normally as a result of which shipments to the AP market have regularised. Volumes grew by 9% YoY for the P&A segment and 12% for the Popular segment. However, Maharashtra, which commands a mid-to-high teen salience, was slower due to a sharp increase in excise duties. NSR for the quarter stood at 1,701, remaining flat YoY and dropping sequentially. Demand is expected to revive with the upcoming festival seasons starting in H2 FY26E.

Holding in Nao Spirits rises to 100%:

In June 2025, UNITDSPR completed the acquisition of Nao Spirits, the maker of “Greater Than” and “Hapusa Gin”, for ~INR 1,300 Mn. This gives UNITDSPR a firm foothold in India’s Premium Craft Gin segment. Now, with wider distribution and stronger brand visibility, we expect volumes and NSR to post a steady growth over the medium term. For FY25, Nao Spirits had a net revenue of INR 340 Mn, even as the deal is unlikely to materially impact UNITDSPR’s near-term financials

View and Valuation

With EBITDA margin for the quarter remaining muted even with the adjustment for one-offs, we have marginally changed our estimates for FY26E–FY28E. Therefore, we retain our “SELL” rating with a target price of INR 1,110 using the DCF approach, implying an FY27E/FY28E PE of ~37x/32x.

Weak Performance: One-Offs Lead to a 14% Decline in Net Income

* P&A volumes saw a 7.3% decline QoQ while Popular segment volumes were down by 11.6% QoQ.

* UNITDSPR reported a Net Revenue of INR 30.2 Bn, posting a growth of 9.4% YoY (CIE Est. of INR 29.4 Bn).

* EBIDTA came in at INR 6.4 Bn (CIE Est. of INR 6.2 Bn), a decline of 9.7% YoY, mainly due to one-off indirect tax impact of INR 0.43 Bn. ? PAT came in line with CIE estimates at INR 4.1 Bn, versus INR 4.8 Bn in Q1FY25, a decline of 14% YoY.

EBITDA margin drop by 308 bps YoY ex one-off: There was a decline in EBITDA due to one-off impact, totaling INR 430 Mn. EBITDA Margin came in at 22.7%; adding back the one-offs, the margin declined by 308 bps YoY. However, we forecast EBITDA margin to expand by ~200 bps over FY25–FY28E on the strength of management initiatives as part of a multi-year supply agility program, which is underway.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131