Accumulate Voltas Ltd For Target Rs. 1,330 By Elara Capital

Margin push leads to RAC market share loss

Voltas (VOLT IN) saw a subdued Q4FY25, losing market share in the room air conditioners (RAC) segment, likely due to push for higher margin. Q1FY26 also may see lower growth due to delayed Summer, high base in Q1FY25, and rains in some regions. The company is also facing recovery issues in the domestic and international projects segments, and it is selective in order booking. However, we reiterate Accumulate with a lower TP of INR 1,330 on 35x March FY27E P/E, due to price hikes in RAC, likely to offset weak demand scenario for FY26. Rise in RAC exports, faster turnaround in Voltas Beko, and recovery of provision in Electro Mechanical Projects (EMP) are triggers to a re-rating

RAC margin rises but market share declines: VOLT saw the unitary cooling products (UCP) segment margin expand 80bp YoY to 10% in Q4FY25, likely due to price hikes undertaken for some categories, and better performance from other categories except commercial refrigeration. However, VOLT’s market share dipped to 19.0% as on FY25 from 20.5% as on December 2024, with RAC segment growth likely lower than peers. The RAC segment also took a hit in April, due t-=8o delayed Summer and rains in various regions. Due to high base of Q1FY25 due to robust growth last year, we expect Q1FY26 to see muted growth. There are also issues on sourcing of compressors in the RAC industry, which could materialize in FY26.

EMP sees challenges in domestic and international recovery: The EMP segment saw muted growth of 4% in Q4FY25, with a loss of INR 17mn during the quarter, primarily due to provisions of INR 400mn booked due to delay in payments for some international projects. The company also faced challenges in recovery of some domestic projects during the quarters, but it is hopeful of recovery from these projects in subsequent quarters; hence, it has not booked provisions for these recoveries. The company is also selective in order booking hereon. The closing orderbook for this segment stood at INR 65bn as on FY25.

Voltbek sees market share gains across products: Voltas Beko saw market share gains during the quarter, with refrigerator market share rising to 5.3%, and washing machines up to 8.7%. The company rose to the No 2 in semi-automatic washing machines with a share of 15.3% (Source: Company). It is currently looking to localize refrigerator manufacturing in India. However, breakeven for this segment remains uncertain with loss of INR 320mn in Q4

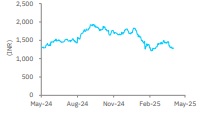

Reiterate Accumulate with a TP of INR 1,330: We cut FY26E and FY27E EPS by 13% and 8%, respectively, on weak year for RAC expected due to delayed Summer, and early rain in various regions. We introduce FY28 estimates. However, we reiterate Accumulate with a lower TP of INR 1,330 from INR 1,385 on 35x (unchanged) March FY27E P/E, due to price hikes in RAC likely to offset weaker volume growth for FY26, and the stock underperforming the Nifty by 26% in the past six months. We expect an earnings CAGR of 17% during FY25-28E and an average ROE & ROCE of 15% and 14%, respectively. The rise in RAC exports, faster turnaround in Voltas Beko, and recovery of provision in EMP are triggers to a re-rating.

Please refer disclaimer at Report

SEBI Registration number is INH000000933