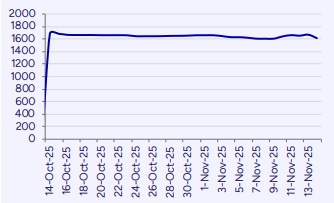

Buy LG Electronics India Ltd For Target Rs.1,920 by Prabhudas Liladhar Capital Ltd

Muted quarter due to demand deferment

Quick Pointers:

* Home Appliances & Air Sol reported flat growth while margin contracted by 390bps

* RM localization stood at 55.8% and aims to improve it by 2-3% annually

Home Appliances & Air Solutions reported flat revenue as purchases were temporarily deferred due to GST rate-cut announcement while margins were impacted by rising commodity costs and incremental festive go-to-market investments to support distributors and retailers, while the company continued to gain market share across major categories. Working capital increased sequentially due to higher inventory in compressor-led products and additional channel support. GST impact has eased, leading to normal channel inventory and an improving demand outlook. A strong push on premiumization, B2B expansion, and the new Essential series is expected to support medium-term growth. Sri City plant to begin RAC production by Oct’26, followed by compressors in Q4FY27 and other lines thereafter. LGEL’s RM localization stood at 55.8% in Q2FY26 and company expects to improve this by 2–3% annually and will support margin improvement over the next few years. We estimate FY25-28E revenue/EBITDA/PAT CAGR of 9.6%/10.0%/9.2%. Maintain ‘BUY’ rating with revised TP of Rs1,920 (earlier Rs1,780) based on 45x (Earlier 42x) FY28 EPS.

Q2FY26: Revenue grew 1.0% and PAT decline 27.3%: Revenues grew by 1.0% YoY to Rs61.7bn. Gross margins contracted by 230bps YoY to 29.4%. EBITDA decline by 27.7% YoY to Rs5.5bn. EBITDA margin contracted by 350bps YoY to 8.9%. Home Appliance and Air Sol revenue was flat YoY to Rs39.5bn and EBIT margin came in at 8.2% (contracted by 390bps YoY). Home Ent revenue grew by 3.0% YoY to Rs22.3bn. EBIT margin contracted by 180bps YoY to 12.6%. PBT decline by 27.1% YoY to Rs5.3bn. PAT decline by 27.3% YoY to Rs 3.9bn.

H1FY26: Revenue decline 0.7% and PAT decline 25.7%: Revenues decline by 0.7% YoY to Rs124.4bn. Gross margins contracted by 600bps YoY to 30.5%. EBITDA decline by 26.3% YoY to Rs12.6bn. EBITDA margin contracted by 350bps YoY to 10.2%. Home Appliance and Air Sol revenues decline by 1.8% YoY to Rs88.6bn and EBIT margin came in at 10.0% (-370bps YoY). Home Ent revenues increased by 2.1% YoY to Rs35.8bn. EBIT margin contracted by 180bps YoY to 13.8% . PBT decline by 25.5% YoY to Rs12.2bn. PAT decline by 25.7% YoY to Rs 9.0bn.

ConCall Takeaways: 1) First line at Sri City will be of RACs, operational by Oct’26, followed by AC compressor line in Q4FY27, with WM and Refs added in phases. 2) YTD market share as on Sep’25: TV 25.5%, Ref 29.9%, RAC 17.3%, WM 33.4%, OLED TV 62.6% and Side by Side Refs 43.3%. 3) B2B segment contributes ~6% of revenue and is currently under pressure due to US tariff changes. 4) Exports contributed ~7% to total revenue in H1FY26, compared with ~6% in H1FY25. 5) RM localization stood at 55.8% in Q2FY26. Company expects to improve this by 2–3% annually over the coming years and aims to reach 70%. 6) Company has implemented price hike of ~1.5-2% in Refs & WM in Oct’25. 7) LGEL has planned capex of ~Rs50bn for next 4-5 years for its Sri City plant. 8) Working capital stood at Rs2.2bn as on Sep’25 vs Rs2.0bn as-on Mar’25 due to incremental inventory in compressor-led products & temporary credit support to trade partners. 9) South contributes ~38–40% to the LGEL’s topline.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271