Neutral United Spirits Ltd for the Target Rs. 1,575 by Motilal Oswal Financial Services Ltd

Beat on margin; watchful of evolving Maharashtra and AP trends

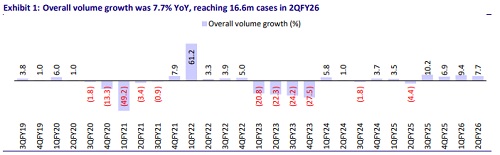

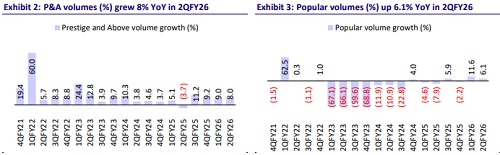

* United Spirits (UNSP) delivered a strong performance in 2QFY26, with revenue rising 12% YoY (beat) and total volumes up 8% (vs. est. 6%). Growth was driven by the company’s re-entry into Andhra Pradesh (from Sep’24), continued innovation and renovation initiatives, and a favorable base, partly offset by the excise duty hike in Maharashtra. The Prestige & Above (P&A) segment posted healthy volume and value growth of 8% and 12%, respectively, while the Popular segment reported 6% volume and 9% revenue growth.

* For 1HFY26, revenue grew 10% YoY, led by an 11% increase in the P&A segment. Excluding Andhra Pradesh, total revenue and P&A segment revenue grew 5% each, while growth ex-Maharashtra and Andhra Pradesh remained in double digits, underscoring the strength of the core portfolio.

* Gross margin surprisingly expanded by 190bp YoY and 300bp QoQ to 47.1% (est. 45.2%), supported by pricing, improved product/state mix, sustained productivity gains, and relatively stable input costs. Lower A&P spends (down 6% YoY) further boosted profitability, resulting in a 340bp YoY expansion in EBITDA margin to an all-time high of 21.2% (beat). Management has reiterated its guidance of maintaining high-teen EBITDA margins, and we model margins of around ~19% in FY27-FY28.

* The re-entry into Andhra Pradesh contributed to UNSP’s volume growth; however, the excise duty hike in Maharashtra (high-teen revenue share) led to a mid-teen decline in volumes in the state. The newly launched Maharashtra made liquor (MML) category, priced at INR160 for 180ml, was introduced in early Oct. Consumer response to this new segment remains uncertain, and we remain watchful over the next few quarters to assess its performance and potential impact.

* The steady double-digit revenue growth (despite Maharashtra), along with sharp beat in margin, certainly increased the possibility of strong growth delivery in the coming quarters. However, evolving trends in Maharashtra (post MML), a high base in 2HFY26 led by AP opening, and ENA prices will remain key monitorables to check the growth momentum. We increased margin assumptions and raised our estimates by 7-8% for FY26-FY27. We value 50x Sep’27E standalone EPS and an additional INR250/share for its RCB and other non-core assets to derive a TP of INR1,575. We maintain Neutral rating.

Beat in performance; all-time high operating margins

* Volume up 8%: Standalone net sales rose 11.5% YoY to INR31.7b (est. INR30.4b) in 2QFY26 on a weak base of 1% decline in 2QFY25. P&A revenue (90% revenue mix) rose 12% YoY and Popular revenue grew 9% YoY. Growth was supported by its re-entry into AP and the strong performance of innovation and renovation launches, partially offset by adverse policy changes in Maharashtra. Total volume rose 8% (est. 6%), with P&A volume up 8% YoY (est. 6% YoY, 9% in 1QFY26) to 13.9m cases. Popular volume rose 6% YoY (est. 5% YoY, 12% in 1QFY26) to 2.7m cases.

* All-time high operating margins: Gross margin saw a sharp expansion of 190bp YoY to 47.1% (est. 45.2%, 44% in 1Q). Employee expenses rose 8%, other expenses rose 13%, and A&P spends declined 6%. EBITDA margin expanded 340bp YoY to 21.2% (est. 18.5%), recording an all-time high.

* Strong double-digit growth: EBITDA rose 32% YoY to INR6.7b (est. INR5.6b). PBT increased 48% YoY to INR6.6b (est. INR5.1b). APAT rose 48% YoY to INR4.9b (est. INR3.8b). There was an exceptional item of INR300m toward severance costs related to a closing unit.

* In 1HFY26, net sales, EBITDA and APAT grew 10%, 13%, and 25%, respectively.

Highlights from the management commentary

* The festive season (Oct-Dec) is expected to sustain healthy category growth and drive premiumization. Pocket pack (180ml) format continues to drive penetration and attract new consumers.

* In Maharashtra, headwinds stemmed from a ~35% price increase post-tax change. Consumer spending grew ~20-25%, implying ~10-15% volume decline for the industry.

* UNSP expects that 2HFY26 is expected to be more challenging than 1HFY26. The company continues to target double-digit growth; however, it remains cautious given the high base in AP and ongoing challenges in Maharashtra.

* Smirnoff recorded double-digit growth, driven by new flavors—Minty Jamun, Mango Mirchi, and Citrón—with strong traction in UP, Haryana, and Odisha.

Valuation and view

* We increased margin assumptions and raised our estimates by 7-8% for FY26- 27.

* The re-entry into AP contributed to UNSP’s volume growth; however, the excise duty hike in Maharashtra led to a mid-teen decline in volumes in the state, which contributes a mid- to high-teen share of the company’s total revenue. The newly launched MML category, priced at INR160 for 180ml, was introduced in early Oct. Consumer response to this new segment remains uncertain, and we remain watchful over the next few quarters to assess its performance and potential impact.

* We value 50x Sep’27E standalone EPS and an additional INR250/share for its RCB and other non-core assets to derive a TP of INR1,575. We maintain Neutral rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)