Buy Syrma SGS Ltd for the Target Rs. 630 by Motilal Oswal Financial Services Ltd

Increased focus on automotive and industrials to fuel growth

Syrma SGS Technology (SYRMA) has recently seen its business mix shift away from the lower-margin consumer segment (~36% share in the sales mix as of FY25 vs 40% in FY24). However, to further strengthen its margins, the company is actively working to diversify its sales mix toward the automotive (22%) and industrial segments (28%).

* SYRMA posted a revenue CAGR of 83% in the automotive segment over FY20-25, driven by increasing EV demand in the country. To complement the rising EV demand, the company is developing its charging infra portfolio, which could become a major growth driver for the EV space.

* The industrial segment posted a revenue CAGR of ~48% over FY20-25, led by increasing tailwinds from the government’s initiatives in smart meters (~INR580b opportunity) and renewable energy (smart meter and solar businesses form a substantial part of the industrial segment).

* The company’s order book size has increased to ~INR53b, with ~25-30% orders in the automotive sector and ~28-30% orders in the industrial sector as of Mar’25 (vs. INR45b as of FY24). Additionally, in response to its lack of presence in the western region, the company has initiated a new manufacturing facility in Pune, which will largely focus on the automotive and industrial sectors.

Riding the EV wave with a focus on charging infra and automotive

* The automotive segment, which contributed ~22% of total sales in FY25, has seen a revenue CAGR of 83% over FY20-25. The EV business, which includes Battery Management System (BMS) and Motor Control Unit (MCU), constitutes a significant part of the automotive segment and has experienced higher growth. Additionally, this business accrues higher margins compared to the Internal Combustion Engine (ICE) segment.

* Another segment in the EV business is the EV charging infrastructure, which currently contributes less to revenue and is still in its nascent stage. However, it is expected to grow rapidly and become a significant driver of future growth. The company is actively onboarding new customers in the charging infra space to capitalize on this emerging opportunity.

* As of Mar’25, the company’s order book stood at ~INR53b, with ~25-30% of orders coming from the automotive segment, reflecting the company’s growing focus on the segment.

* SYRMA’s increased focus is also driven by the growing adoption of EVs, with the number of EVs sold in the country rising to 1.67m in FY24 from 1.17m in FY23 (up 43%). The sale of electric four wheelers (4W) rose to 90,432 units from 47,499 units (up 90%).

* According to industry reports, India's EV market is expected to reach USD48.6b by 2030, driven by surging demand, particularly in the twowheeler (2W) and three-wheeler (3W) segments.

* However, EV charging infrastructure in India is still in its nascent stage. As of the beginning of CY23, India had ~5.3k public EV charging stations. With ~2.2m EVs on the road, the ratio of EVs to public chargers in India was about 1:400.

* According to CII, India needs to achieve a 1:40 ratio of charging infra to EVs, which means installing more than 0.4m chargers annually to reach a total of 1.3m chargers by CY30 across the country. This reflects a significant opportunity for SYRMA in this space.

Capitalizing on India’s smart metering and clean energy push

* The company’s industrial segment posted a revenue CAGR of ~48% over FY20- 25, led by increasing tailwinds from the government’s initiatives in smart meters and renewable energy (smart meter and solar businesses form a substantial part of the industrial segment).

* India is pushing forward with an ambitious plan to install 250m smart meters, presenting an INR750b opportunity for the energy sector.

* As of 15thMay’25, the government has sanctioned ~222m smart meters, of which only ~142m (~64%) have been awarded to companies. This leaves an opportunity of ~80m (~36%) smart meters yet to be awarded. Of the awarded smart meters, ~29m meters (20% of awarded) have been installed, leaving a significant business opportunity of ~INR580b, i.e. ~193.3m meters at a price of ~INR3,000 per meter (refer to Exhibit 11).

* As of Mar’25, the industrial segment makes up ~28-30% of the company’s order book (~INR53b), which sees significant traction in the smart metering business.

* In addition to smart meters in the industrial segment, SYRMA is also actively working to develop the solar and renewable business, which includes solar inverters, solar trackers, and solar controllers.

* In Aug’22, India submitted an NDC to the UN Framework Convention, committing to reduce the emissions intensity by 45% by CY30 (compared to CY05 levels) and achieve 50% of cumulative electricity power from non-fossil fuel sources by CY30. In addition, the country has increased its target for installed non-fossil energy capacity to 500GW by CY30 and 1,800GW by CY47.

* We expect the industrial segment to post a revenue CAGR of ~34% over FY25- 27, led by increasing tailwinds for the smart meters and solar segments.

* With increasing traction in the automotive and industrial segments, the company is also onboarding new clients in these areas. The company anticipates that these clients will yield revenue of ~INR2b in FY26, with further growth expected by FY27.

Increasing capex fueled by rising order book size and industry demand

* As the company continues to prioritize growth in the automotive and industrial segments, it has operationalized a new manufacturing facility in Pune (Oct’24), which will largely focus on these segments. This will help the company establish its presence in the western region as well as strengthen its Printed Circuit Board Assembly (PCBA) capabilities. The new campus spans 26.5 acres of land and will feature a manufacturing area of 1.2m sq. ft. at its peak capacity.

* With rising demand in the automotive and industrial sectors and Pune being a key hub for the automotive and industrial segments, the facility is strategically located to help the company gain healthy traction in terms of client addition and order flows.

* Although SYRMA’s asset turnover was ~5.5x in FY25, the company is confident that it will increase to the range of 6x-7x as the Pune facility ramps up, resulting in improved operating margins and revenue mix.

* SYRMA has installed two lines at the facility so far and may proceed with brownfield expansion as needed. The company has already spent INR1.8b in capex during FY25, primarily focused on building the new facility in Pune.

Valuation and view

* SYRMA is expected to significantly benefit from the gradual shift in business to the automotive and industrial segments, led by increasing demand in the EV space (automotive) as well as smart meters and solar products (industrial), aided by healthy margins across these segments.

* Moving forward, we expect SYRMA to report robust earnings growth on the back of: 1) ample revenue visibility led by healthy order book and strong order inflows; 2) faster execution capabilities due to the expansion of manufacturing capabilities; and 3) high growth in end-user industries.

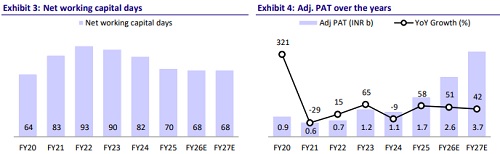

* We estimate SYRMA to post a CAGR of 32%/34%/46% in revenue/EBITDA/Adj. PAT over FY25-27.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)