Buy JK Cement Ltd for the Target Rs.7,300 by Motilal Oswal Financial Services Ltd

Built for the long haul

Delivering on expectations; expansions boost volume growth

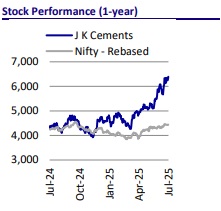

* JK Cement’s (JKCE) stock performance has played out broadly in line with our expectations, reflecting its strong track record of consistent operational delivery and disciplined execution. Over the past several years, JKCE has evolved into a structurally stronger business, outperforming peers.

* The company has a robust pipeline and aims to expand its capacity to 50mtpa by FY30. This target will be achieved through a mix of greenfield and brownfield expansions, with strategic opportunities in Jaisalmer, Muddapur, Panna.

* In order to drive operation efficiency, the company plans to reduce costs, continue to increase the share of blended cement, use more green energy, and leverage digitalization and automation. In FY25, JKCE realized cost savings of INR40-50/t, and it anticipate further cost savings of INR75/t over the next few quarters. The company aspires to be among the top quartile of sustainable, low-cost cement producers in the industry.

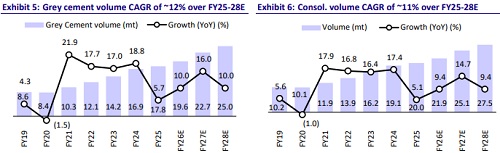

* We introduce our FY28 estimates in this note. We estimate a CAGR of 13%/20%/31% in consol. revenue/EBITDA/PAT over FY25-28, led by strong volume growth (12% CAGR) and profitability improvement. We estimate its EBITDA/t at INR1,210/INR1,230/INR1,280 in FY26/FY27/FY28 vs. INR1,010 in FY25 (avg. INR1,090 over FY20-24). Given the company’s increasing scale of operations, strong execution strategy, and cost-reduction initiatives, we value it at 18x Jun’27E EV/EBITDA (premium to its long-term average) to arrive at our TP of INR7,250. We reiterate our BUY rating on the stock.

Expansions reinforce its pan-India aspirations

* JKCE continues to demonstrate strategic foresight in securing key resources and expanding its geographic footprint. It has signed a 40-year limestone supply agreement with Gujarat Mineral Development Corporation (GMDC), ensuring access to 250mt of reserves. Additionally, the recent allocation of two coal blocks, Mahan (Madhya Pradesh) and west of Shahdol (South), will help to achieve fuel security and reduce input cost volatility.

* The company has entered the Eastern India markets with the launch of grey cement in Bihar and Odisha, supported by its upcoming Buxar plant, which will act as a strategic hub. The plant will also enhance JKCE’s presence in this high-growth region, strengthening its transition toward becoming a pan-India player.

* JKCE is on track to achieve its targeted 30mtpa capacity by FY26. In FY25, it incurred a capex of INR11.6b across key projects (including INR1.6b for its greenfield GU in Buxar). The balance capex for ongoing 6.0mtpa capacity expansion is estimated at INR15.0b in FY26. An additional capex of INR5.0b has been allocated for efficiency projects and maintenance.

Profitability intact despite tepid near-term outlook

* Cement demand was sluggish in 1QFY26, partly due to unfavorable weather conditions, as heatwaves in initial days and early rains in the later part of the quarter adversely affected construction activities. Near-term cement demand is estimated to remain weak due to the seasonal impact, though we believe it is likely to rebound over the medium to long term, led by strong underlying demand drivers. Cement pricing during the quarter was range-bound in the company’s key markets, North and Central, which account for ~80% of its total grinding capacity. We believe pricing will remain resilient in the near term, and estimate upward trends in the medium to long term, given strong demandsupply equilibrium in those regions.

* Despite a tepid near-term outlook, we estimate JKCE to deliver volume growth of ~8% YoY in 1QFY26, led by market share gains. Further, we estimate QoQ improvement in realization, supported by the contribution from the south India plant (Muddapur, Karnataka) and a higher share of premium cement in overall mix. We estimate the company’s EBITDA/t to increase ~26% YoY (flat QoQ) to INR1,266 in 1QFY26E.

* We estimate a CAGR of 13%/20%/31% in JKCE’s consol. revenue/EBITDA/PAT over FY25-28, driven by robust volume growth and profitability improvement. We estimate ~11% CAGR in consol. volume over FY25-28, aided by capacity expansions and access to a new region (east). OPM is estimated to improve to 20-21% by FY27/FY28. We estimate the company’s EBITDA/t at INR1,210/INR1,230/INR1,280 in FY26/FY27/FY28 vs. INR1,010 in FY25 (avg. INR1,090 over FY20-24).

View and valuation

* We estimate JKCE to generate a cumulative OCF of INR81.0b during FY26-28, and its cumulative capex would be INR48.0b over the same period. Given the strong cash flow generation and low-cost expansions (capex cost stood at USD60-70/t), we believe its net debt will peak out in FY26E at INR42b. Further, its net debt-to-EBITDA ratio would decline to <1.0x in FY28E from 2.0x in FY25. We estimate its RoE/RoCE (post-tax) to improve to ~19%/13% in FY27 from ~13%/10% in FY25.

* JKCE saw re-rating in FY22, and started trading at average EV/EBITDA (one-year forward) of 17x. Re-rating in the stock is attributable to its expanded operations, strong execution capabilities, and cost-reduction initiatives. We believe JKCE is best-placed among mid-size cement companies with a pan-India presence.

* Our EBITDA estimates for FY26/FY27/FY28 are higher by ~4%/1%/5% than the consensus estimates for JKCE. It is currently trading at 19x/16x FY26/FY27E EV/EBITDA and EV/T of USD185/USD180. We value JKCE at 18x Jun’27E EV/EBITDA (premium to its long-term average) to arrive at a TP of INR7,250. We reiterate our BUY rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412