Buy TCS Ltd for the Target Rs.3,850 by Motilal Oswal Financial Services Ltd

A disappointing quarter

No growth kicker yet, but margin scope intact

* TCS reported revenue of USD7.4b in 1QFY26, down 0.6% QoQ in USD terms vs. our estimate of 1.2% growth. Growth was led by Hi-Tech/Manufacturing (up 3.1%/3.0% QoQ). BFSI/Energy & Utilities grew ~2.0%/2.9% QoQ in USD terms. India was down 31% QoQ (in USD terms). Ex-India business was also down 0.5% QoQ in CC terms, missing estimates. EBIT margin was 24.5% (up 30bp QoQ), above our estimate of 24.2%. PAT was up 4% QoQ/6% YoY at INR128b (in-line with our est. of INR125b).

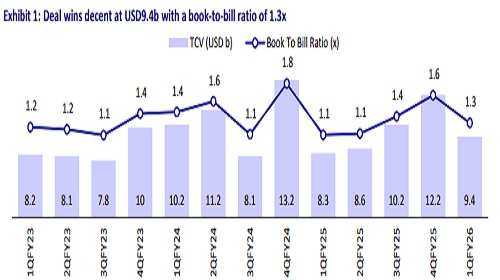

* For 1QFY26, revenue/EBIT/PAT grew 1.3%/0.5%/6.0% YoY in INR terms. We expect revenue/EBIT/PAT to grow by 1.4%/4.1%/7.0% YoY in 2QFY26. TCS reported a deal TCV of USD9.4b, up 13.3% YoY. The book-to-bill ratio was stable at 1.3x.

* Growth for TCS remains elusive. That said, sequentially the headwind from the BSNL ramp-down is now manageable, and there is enough slack in the pyramid to drive margin gains through the year. Valuations are undemanding, and we reiterate our BUY rating on TCS with a TP of INR3,850, implying a 14% potential upside.

Our view: Growth remains elusive

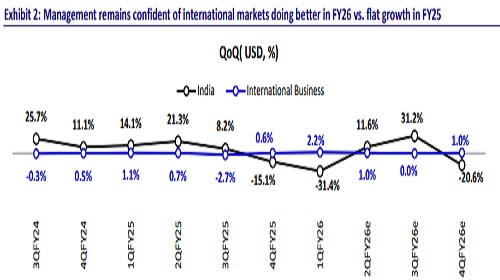

* While a majority of the revenue decline was due to the BSNL ramp-down (2.8% of out of the 3.3% QoQ CC decline was BSNL led); International business also declined by 0.5%, underscoring an uncertain quarter marred by tariffs and other geopolitical uncertainties. The management retained its outlook of international doing better in FY26 (vs. 0% growth in FY25), though we bake in a modest 0.5-1% cc growth in international business in FY26. While bookings remain healthy, revenue conversion remains a challenge.

* Regarding BSNL, there is currently no clarity on when the incremental order worth INR29b will be executed. We model the majority of that revenue coming in 3Q.

* Productivity gains now becoming pervasive, but no signs of offsetting revenue growth: It is now clear that productivity benefits are being promised as a part of most deals, potentially dragging future revenues for the industry. In most tech cycles, however, a declining legacy business is offset by a growing new-age business (see Exhibit 5). This kicker is missing in this cycle, putting further pressure on growth.

* Margins beat estimates, but scope to go higher: EBIT margins improved 30bp QoQ, despite a 340bp QoQ drop in third-party revenue, high employee costs (up 230bp), and limited margin upside. Management indicated that this was largely due to poor utilization: we believe there is significant slack in the TCS pyramid (see exhibit 3), and this could lead to margin gains, but this is dependent on a recovery in the international business.

Valuations and changes to our estimates

* Over FY25-27, we expect a CAGR of ~3.0% in USD revenue and ~6.6% in INR EPS.

* Growth for TCS remains elusive. That said, sequentially, the headwind from the BSNL ramp-down is now manageable, and there is enough slack in the pyramid to drive margin gains through the year.

* We have maintained our estimates for FY26/FY27, as slightly lower growth is offset by one-off interest income due to income tax refunds. Valuations are undemanding, and our TP of INR3,850 implies 25x FY27 EPS (unchanged), with a 14% upside potential. We reiterate our BUY rating.

Miss on revenue (mainly due to BSNL) and beat on margins; TCV deal wins decent at USD9.4b

* USD revenue came in at USD7.4b, down 0.6% QoQ in USD terms vs. our estimate of 1.2% growth. On a YoY CC basis, revenue was down 3.1%.

* This was driven by a decline in India, down 31% QoQ (in USD terms). Ex-India business was also down 0.5% QoQ in CC terms (2.2% QoQ growth in USD terms), missing estimates.

* 1Q growth was led by Hi-Tech/Manufacturing (up 3.1%/3.0% QoQ). BFSI/Energy & Utilities grew ~2.0%/2.9% QoQ in USD terms, while Regional markets declined 13.5% QoQ (BSNL).

* EBIT margin was 24.5% (up 30bp QoQ), above our estimate of 24.2%.

* Deal TCV stood at USD9.4b in 1QFY26, down 23% QoQ but up 13.3% YoY.

* PAT was up 4% QoQ/6% YoY at INR128b (in-line with our est. of INR125b).

* The net headcount rose by 5,090 employees to 613,069 (up 1% QoQ) in 1QFY26. Attrition (LTM) increased by 50bp QoQ to 13.8%.

* The board declared a dividend of INR11/share in 1QFY26.

Key highlights from the management commentary

* Global macroeconomic and geopolitical uncertainty continued to hurt demand.

* Decision-making delays persisted and even intensified during the quarter.

* Confident that international revenue in FY26 will surpass FY25 levels, backed by strong client conversations in AI & data modernization and cost optimization.

* High single-digit growth for FY26 looks challenging.

* Sequential CC decline was 3.3%, driven by a 2.8% impact from BSNL ramp-down and 0.5% from international business.

* Deal pipeline remains healthy and geographically diversified. Key win themes: operating model transformation, vendor consolidation, AI-powered intelligent automation, and SAP S4/HANA transformation.

* New BSNL deal is not included in TCV yet; execution will begin post PO and will be similar to the previous deal.

* No decision yet on wage hikes.

Valuation and view

* Given its size, order book, and exposure to long-duration orders and portfolio, TCS is well positioned to grow over the medium term.

* Owing to its steadfast market leadership position and best-in-class execution, the company has been able to sustain its industry-leading margin and demonstrate superior return ratios.

* Our TP of INR3,850 implies 25x FY27 EPS (unchanged), with a 14% upside potential. We reiterate our BUY rating

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd.jpg)