Buy Supreme Industries Ltd for the Target Rs.5,350 by Motilal Oswal Financial Services Ltd

Muted performance; forward-looking guidance remains positive

Earnings below our estimate

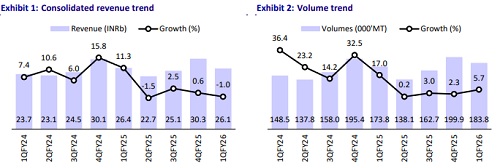

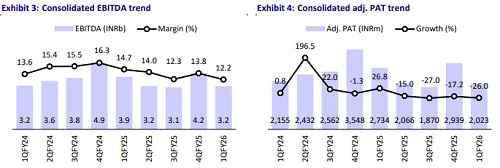

* Supreme Industries (SI) reported a muted quarter amid the ongoing challenges of volatile pricing and the early onset of monsoon, affecting demand. The company reported flat revenue YoY with volume growth of only 6% YoY to 184k MT. EBITDA margin contracted 250bp YoY to 12.2%, mainly affected by inventory losses.

* However, management guided strong volume growth in the plastic piping system for FY26 (15-17%) despite muted growth in 1Q. This was led by a positive demand outlook amid stabilizing prices at affordable levels and the likely addition of Wavin capacity (~75,000MTPA) in 2QFY26. The overall EBITDA margin was guided to be ~14.5-15.5% in FY26, supported by the absence of inventory losses, a higher share of VAP, and an expected improvement in capacity utilization.

* Factoring in its weak 1Q operating performance but strong guidance, we cut our FY26E earnings by only 8% (despite a miss of 24% in 1Q) while maintaining our FY27 estimate. We value the stock at 45x FY27E EPS to arrive at our TP of INR5,350. Reiterate BUY.

Margin contraction due to muted volumes and inventory losses

* Consolidated revenue was largely flat (-1%) YoY at INR26.1b (est. INR28.3b) while the volume grew 6% YoY to 183.8k MT, which was offset by a decline in realization (down 6% YoY, to INR142/Kg).

* Consolidated EBITDA declined -18% YoY to INR3.2b (est. INR3.9b) with an EBITDA margin of 12.2% (est. 14.0%), which contracted -250bp YoY. The EBITDA/Kg for the quarter was INR17.3/kg (-22% YoY). Adj. PAT declined 26% YoY to INR2b (est. INR2.6b).

* Plastic piping products reported a volume of 149k MT (+6% YoY) with revenue at INR17.9b (-4% YoY). EBIT stood at INR1.6b (-32% YoY), resulting in an EBIT margin of 8.8% (-370bp YoY). Realization came in at INR121/kg (-9% YoY), while EBIT per kg stood at INR10.6/kg (-36% YoY).

* For Industrial products, revenue stood at INR3b (-4% YoY), EBIT at INR176m (-10% YoY), and EBIT margin at 5.8% (-50bp YoY); for Packaging products, revenue was INR4b (+9% YoY), EBIT INR457m (+9% YoY), with an EBIT margin of 11.4% (flat YoY); and for Consumer products, revenue came in at INR984m (+1% YoY), EBIT at INR138m (-14% YoY), and EBIT margin at 14.0% (-250bp YoY).

Highlights from the management commentary

* Guidance: Management guided a strong recovery in demand from 2QFY26 onwards, with channel restocking as inventory levels are below normal levels; normalization is expected by Sep’25. The company expects FY26 total volume growth of 14-15%, with plastic piping systems growing at a higher 15-17%. The EBITDA margin is projected to be 14.5–15.5%, and effective capacity utilization is likely to be 65-70% by year-end.

* Capex: The company expects cash outflow of ~INR13.5b in FY26, including INR3.1b for the Wavin acquisition. The balance will be invested for capacity addition across business verticals to drive product diversification. The company aims to expand plastic piping capacity to 1MMTPA by Mar’26. SI is also setting up a 5KMT window profile line in Kanpur.

* Outlook: SI remains optimistic about industry growth of ~9-10%. The overall business environment is improving, with a recovery expected in rural demand and sustained momentum in urban housing, infrastructure, and real estate segments. Moreover, supply-side volatility has reduced, with PVC prices stabilizing, but uncertainties remain around delayed government payments and the outcome of the ADD on PVC imports.

Valuation and view

* Macro headwinds have hit the industry, including SI, over the last few quarters; however, with PVC prices expected to stabilize around this level and demand likely to improve, we anticipate the growth momentum to pick up going forward.

* With strong guidance of a 14-15% volume growth and a healthy EBITDA margin of 14.5-15.5% in FY26 backed by capacity additions, better utilization, higher VAP mix, and no inventory losses, we expect SI to clock 13%/22%/24% CAGR in revenue/EBITDA/PAT over FY25-28E. We value the stock at 45x FY27 EPS to arrive at a TP of INR5,350. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)