Neutral SAIL Ltd for the Target Rs. 150 by Motilal Oswal Financial Services Ltd

Beat on estimates driven by better-than-expected volume and NSR; outlook strong

* SAIL reported revenue of INR267b (+16% YoY and +4% QoQ) in 2QFY26 against our estimate of INR244b. The beat was driven by healthy volume growth and a lower-than-expected decline in NSR.

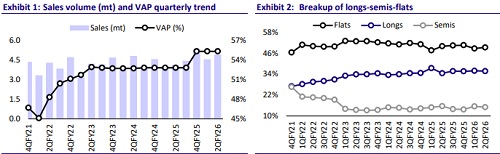

* During the quarter, crude steel production stood at 4.9mt (+6% YoY and +3% QoQ), while sales volume was also 4.9mt (+20% YoY and +8% QoQ vs our est. 4.6mt). Strong offtake during 2QFY26 led to an inventory reduction to 1.9mt (vs opening stock of 2.7mt).

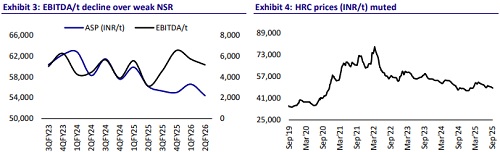

* ASP stood at INR54,387/t (-3% YoY and -4% QoQ) vs. our est. of INR52,590/t in 2QFY26. The decline in steel prices during 2Q was largely offset by higher sales of scrap (incl. defects) and by-product inventories (contributed INR11.4b in 2QFY26 vs INR8.69b in 1QFY26), leading to a better-thanexpected NSR.

* EBITDA stood at INR25.3b (+98% YoY and -3% QoQ) against our est. of INR16.5b. EBITDA/t stood at INR5,149/t (vs. our est. of INR3,553/t), rising 66% YoY but declining 10% QoQ, driven by a decent NSR and lower operating cost. Adj. PAT came in at INR6.7b (vs. our est. INR1b), up 18% QoQ, compared to a net loss of INR3.8b in 2QFY25.

* In 1HFY26, sales volume stood at 9.5mt (+17% YoY) and revenue at INR525b (+12% YoY). EBITDA stood at INR51b (+47% YoY; INR5,416/t), driven by strong revenue and muted cost during 1HFY26. Adj. PAT stood at INR12.4b in 1HFY26, compared to the net loss of INR548m in 1HFY25.

Highlights from the management commentary

* Steel prices are expected to recover from late Nov’25 onwards, driven by a seasonal pickup in domestic demand, infra spending, and restocking activity.

* The company expects coking coal costs to rise USD6-8/t in 3QFY26.

* It has guided for 2HFY26 margins to expand over higher volumes, improved realizations, and lower input costs.

* The company has maintained its full-year capex guidance of over INR75b for FY26. For FY27, it has guided for higher capex of INR100b, mainly directed toward major expansion projects.

* The deleveraging measure will be supported by inventory liquidation, higher by-product monetization, and disciplined capex execution.

Valuation and view.

* Despite muted NSR over weak seasonal prices, SAIL reported a strong 2QFY26 earnings, driven by healthy volumes and muted costs. The earnings outperformance during the quarter was primarily attributed to better-thanexpected NSR.

* The company expects improved operational performance in 2HFY26, supported by higher volumes, efficiency gains, inventory liquidation, and stable raw material costs. We have increased our FY26 Revenue/EBITDA and APAT estimates by 3%/18% and 13% to incorporate the 2Q performance beat, while we largely maintain our FY27 estimates.

* SAIL plans to increase its capacity to 35mtpa. It is currently in the initial tendering phase, with any notable development likely to be visible only after FY27. Considering the limited room for production, we estimate a modest volume CAGR of 6% over FY26-28E. Therefore, any incremental earnings will be driven by healthy pricing and lower costs. We reiterate our Neutral rating on the stock with a TP of INR150 (premised on 6.5x EV/EBITDA on Sep’27 estimate).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)