Buy UltraTech Cement Ltd For Target Rs. 13,900 by Motilal Oswal Financial Services Ltd

In-line 4Q; cost efficiency and volume gain key focus areas

FY26 volume growth guidance in double digits vs. ~+7-8% for the industry

* UltraTech Cement (UTCEM)’s 4QFY25 performance was in line with our estimates. EBITDA increased ~12% YoY to INR46.2b, while EBITDA/t declined 4% YoY to INR1,126 (est. INR1,104). OPM was flat YoY at ~20%. Adj. PAT increased ~8% YoY to INR24.9b (in line).

* Management highlighted that there was some demand weakness at the beginning of FY26 due to heatwaves; however, demand is likely to improve going forward. Sustainable volume growth for the industry should be 7-8%, and UTCEM’s FY26 volume growth on a like-to-like basis should be in double digits. It has achieved cost savings of INR86/t in FY25, and it aims to achieve further cost savings of ~INR214/t by FY27. Net debt/EBITDA was 1.2x and debt should start reducing rapidly. UTCEM has a comfortable net debt/EBITDA of 0.5x.

* We maintain our earnings estimates for FY26/FY27. The stock trades at 21x/ 17x FY26E/FY27E EV/EBITDA. We value UTCEM at 20x FY27E EV/EBITDA to arrive at our TP of INR13,900. Reiterate BUY.

Opex/t down 3%/8% YoY/QoQ; EBITDA/t at INR1,126 (est. INR1,104)

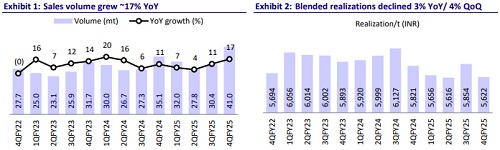

* UTCEM’s consolidated revenue/EBITDA/adj. PAT stood at INR230.6b/ INR46.2b/INR24.9b (+13%/+12%/+8% YoY; in line with our estimates). Volume grew 17% YoY to 41.0mt (in line). RMC revenue was up 17% YoY, while white cement revenue declined ~3%. Other operating income/t stood at INR67 vs. INR100/INR73 in 4QFY24/3QFY25.

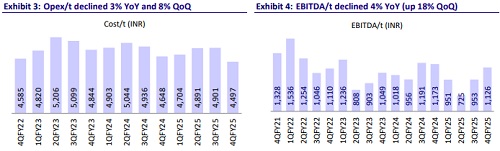

* Blended realization declined ~3% YoY. Grey cement realization also declined ~3% YoY. Opex/t was down 3% YoY (down 8% QoQ), backed by a 5% decline in variable/freight cost (each). However, other expenses/t rose ~3% YoY. EBITDA/t declined 4% YoY to INR1,126. Depreciation/interest expenses rose 38%/82% YoY, and other income declined 25% YoY. ETR stood at ~20% vs. 27.5% in 4QFY25.

* In FY25, UTCEM’s consolidated revenue was up 7% YoY, while EBITDA/adj. PAT declined 3%/13% YoY. Volume grew ~14% YoY, while realization/t was down ~6%. EBITDA/t stood at INR924 (down 15% YoY). OCF stood at INR106.7b vs. INR109.0b in FY24. Capex stood at INR89.5b vs. INR88.8b in FY24. FCF stood at INR17.2b vs. INR20.1b in FY24.

Highlights from the management commentary

* Industry volumes grew ~4% YoY in 4QFY25. UTCEM’s volume growth on a like-to-like basis was ~6% YoY. Grey cement capacity utilization was at ~89% in 4QFY25 and ~78% in FY25.

* Kesoram’s assets delivered an EBITDA/t of INR399 in 4QFY25, and the target is to achieve an EBITDA/t of INR1,000+ by 4QFY26. ICEM achieved an EBITDA break-even in the first quarter after the takeover. Further, it achieved the highest-ever monthly volume of 1mt+ in Mar’25.

* In FY25, cost savings of INR86/t have been achieved by the company, led by higher usage of green power & WHRS (INR31/t), reduction in lead distance (INR44/t), and higher clinker conversion/usage of alternate fuel (INR13/t).

Valuation and view

* UTCEM, on a like-to-like basis, delivered ~6% YoY volume growth, and it anticipates double-digit growth in FY26. The company remains focused on capitalizing the infrastructure-led demand recovery, while recent price increases and cost-saving initiatives drive improvement in profitability. Though Kesoram’s profitability during the quarter was in line with our estimates, ICEM has surprised by achieving an EBITDA break-even vs. an estimated operating loss.

* We estimate a CAGR of 15%/29%/34% in consolidated revenue/EBITDA/PAT over FY25-FY27, aided by inorganic growth. We estimate its consolidated volume CAGR at ~13% and EBITDA/t of INR1120/INR1210 in FY26/FY27 vs. INR924 in FY25. UTCEM is estimated to continue to gain market share with its robust capacity expansion and increasing scale of operations. We estimate its net debt to decline to INR105.3b (vs. INR176.7b as of Mar’25) and net debt to EBITDA ratio at 0.5x by FY27 (vs. 1.2x as of Mar’25). We value the stock at 20x FY27E EV/EBITDA to arrive at our TP of INR13,900. We reiterate our BUY rating

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412