Neutral IDFC First Bank Ltd For Target Rs. 72 by Motilal Oswal Financial Services Ltd

Earnings in line; credit cost peaks out

Deposit mobilization remains healthy

* IDFC First Bank (IDFCFB) reported 4QFY25 PAT of INR3.04b (58% YoY decline, 6% beat to MOFSLe) amid lower tax expense.

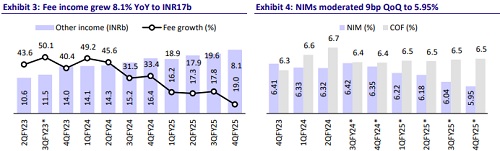

* NII grew 10% YoY/ flat QoQ to INR49.1b (in line). NIMs contracted 9bp QoQ to 5.95% (in line), dragged by a decline in the MFI business.

* Opex grew 12.2% YoY/ 1.4% QoQ to INR49.9b (in line). C/I ratio, thus, continued to stand elevated at ~73.4%.

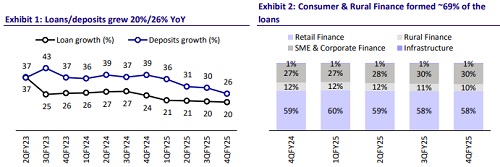

* Net advances grew 19.8% YoY/4.5% QoQ, while deposits continued to grow at a much faster pace at 25.7% YoY/ 6.4% QoQ. The CD ratio, thus, declined to 92.5% vs 94.2% in 4QFY25.

* The GNPA ratio moderated 7bp QoQ to 1.87%, while the NNPA ratio increased slightly by 1bp QoQ to 0.53%. The PCR ratio moderated 133bp QoQ to 72.3%.

* We reduce our earnings by 7% for FY26E amid NIM and credit cost pressures, and estimate FY27 RoA/RoE at 1.1%/10%. Reiterate Neutral with a TP of INR72 (premised on 1.3x FY27E ABV).

Asset quality ratios largely stable; margin moderates 9bp QoQ

* IDFCFB reported 4QFY25 PAT of INR3.04b (58% YoY decline, 6% beat from MOFSLe) amid lower tax expense. In FY25, earnings dipped 48% YoY to INR15.2b.

* NII grew 10% YoY/ flat QoQ to INR49.1b (in line). NIMs contracted 9bp QoQ to 5.95% (in line). Provisions were elevated at INR14.5b (up 8% QoQ, 5% higher than MOFSLe) due to high provisions on the MFI book.

* Other income grew 15% YoY/ 6% QoQ to INR18.9b (5% beat). Opex grew 12.2% YoY/ 1.4% QoQ to INR49.9b (in line). The C/I ratio, thus, continued to stand elevated at ~73.4%. PPoP grew 9% YoY/ 3% QoQ to INR18.1b (in line). Management expects opex growth to remain ~12–13% YoY.

* On the business front, net advances grew 19.8% YoY/4.5% QoQ, led by 5% QoQ growth in retail finance and 8% QoQ growth in SME & Corporate Finance. Within retail, growth was led by LAP (10% QoQ) and credit card (9% QoQ). The share of consumer & rural finance was ~68.6% as of 4QFY25.

* Deposit growth remained robust at 25.7% YoY/6.4% QoQ, with the CASA mix declining 80bp QoQ to 46.9%. CD ratio dipped 170bp QoQ to 92.5%.

* The GNPA ratio moderated 7bp QoQ to 1.87%, while the NNPA ratio increased slightly by 1bp QoQ to 0.53%. The PCR ratio moderated 133bp QoQ to 72.3%. The SMA book stood at 1.07% vs. 1.03% in 3QFY25.

* Excluding MFI and one legacy infrastructure toll account, the credit cost for FY25 was 1.76%, while for 4QFY25, it improved to 1.73% from 1.82% in 3QFY25.

Highlights from the management commentary

* The MFI loan mix is expected to decline to 3-3.5% over the next year, considering ongoing industry adjustments.

* Fee income is projected to grow at 14-15% going forward.

* The loan book composition is 61% fixed rate and 39% floating rate, with about 30% of the floating book linked to the repo rate.

* The bank aims to achieve a 1% RoA by 4QFY26.

Valuation and view: Reiterate Neutral with a TP of INR72

IDFCFB reported muted earnings amid elevated provisions. Opex ratios stood elevated, while NIM moderated 9bp QoQ to 5.95%. Provisions continued to remain elevated amid higher stress in MFI. On the business front, deposit traction remained robust, while the CASA mix moderated slightly to 46.9%. Advances growth also remained healthy, led by steady traction across Retail, SME, and Corporate Finance. We estimate the C/I ratio to remain elevated at 71% by FY26 and at 66% by FY27, primarily as the bank will continue to mobilize deposits at a healthy run rate. We reduce our earnings by 7% for FY26E amid higher credit cost and margin pressures, and estimate FY27E RoA/RoE at 1.1%/10%. Reiterate Neutral with a TP of INR72 (premised on 1.3x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)