Buy L&T Finance Ltd for the Target Rs.250 by Motilal Oswal Financial Services Ltd

Healthy quarter; well-positioned for stronger growth in 2H

Guides a normalization in the MFI business by 3QFY26

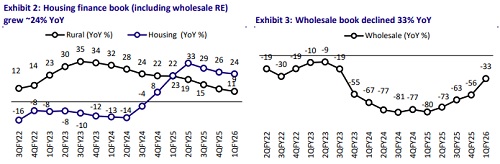

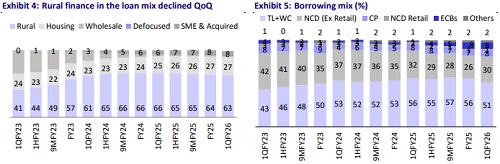

* L&T Finance (LTF)’s 1QFY26 PAT grew 2% YoY to INR7b (in line). NII grew ~8% YoY to INR22.8b (~5% beat). Opex grew ~9% YoY to ~INR10.5b (~6% higher than MOFSLe). The cost-to-income ratio declined to ~40% (PQ: ~41.3%). PPoP grew ~7% YoY to ~INR15.8b (in line) for the quarter.

* Credit costs were INR6.3b (in line), translating into annualized credit costs of ~2.23% (PQ: 2.55%/PY: 2.37%). LTF utilized macroprudential provisions of INR3b in 1QFY26 towards rural business finance (MFI). Before the utilization of the macroprudential provision, credit costs were ~3.43% (PQ: 3.8%) in 1QFY26. LTF now has unutilized macro provisions of ~INR2.75b.

* MFI collection efficiency (0-90dpd) stood at ~97.8% in Jun’25 (vs. 97.6% in Mar’25). Only ~5.2% (PQ: ~8.2%) of LTF customers have loans from 4 or more lenders (including LTF). While the pace of improvement in collection efficiency (CE) in Karnataka has been slower than initially anticipated, the company is witnessing sustained progress. Management expects the situation to stabilize through 2QFY26, with a return to normalcy likely by mid-3Q. Notably, further improvement in CE has been observed in Jul’25, indicating continued positive momentum.

* LTF has been assigned a debut investment grade credit rating of “BBB-/ Positive” by S&P Global Ratings and “BBB-/Stable” by Fitch Ratings.

* Management guided for credit costs to decline to ~2.5% (after taking into account the utilization of macro provisions) by 4QFY26 and ~2.4-2.5% for FY26. We estimate a CAGR of ~22% in total loans and ~25% in PAT over FY25-FY27E, with consolidated RoA/RoE of 2.7%/~14% in FY27E.

* LTF’s FY26 will be a year of transitioning towards the targeted loan mix and implementing Cyclops in Tractors, PL, and SME segments. We expect LTF to deliver a structural improvement in profitability and RoA from FY27 onwards. Reiterate BUY with a TP of INR250 (based on 2x Mar’27E BVPS).

Reported NIM & fees improve ~7bp QoQ; CoB (calc.) dips ~15bp QoQ

* Reported NIM improved ~10bp QoQ to 8.25%. However, consol. NIM & fees expanded ~7bp QoQ to ~10.22%, driven by lower fee income and a decline in MFI in the loan mix.

* Spreads (calc.) rose ~25bp QoQ to ~8.6%. Yields (calc.) rose ~10bp QoQ to ~15.7%, while CoF (calc.) declined ~15bp QoQ to 7.0%.

Asset quality broadly stable; retail GS3 at ~2.9%

* Consol. GS3 was stable QoQ at ~3.3%; NS3 was also stable QoQ at ~1%. PCR declined ~30bp QoQ to ~70.8%. Retail GS3 was broadly stable QoQ at 2.9%.

* Management highlighted that the personal loan portfolio is showing early signs of stabilization, while the 2W will take another one to two quarters before stress fully subsides. The company anticipates realizing the full benefits of Project Cyclops starting in 4QFY26, which should support asset quality improvement going forward.

* We model credit costs (as % of average loans) of ~2.7%/2.6% in FY26/FY27E (compared to ~2.8% in FY25).

Key highlights from the management commentary

* A significant portion of the flow-forwards in the MFI portfolio during the quarter was attributable to the Karnataka portfolio. While recovery is underway, the company anticipates that the KAR performance will take another 3-4 months to fully stabilize, with normalization expected by Oct’25.

* Management shared that the resolutions for several projects under NCLT are in advanced stages, with a substantial portion expected to reach completion and lead to SR recoveries in FY27-28. The proceeds from these resolutions will be strategically utilized to strengthen macro-prudential provisions, thereby enhancing the company’s long-term risk buffers.

* Management indicated that the addition of new gold loan branches will not entail significant costs, as the Paul Merchants team had already established efficient operational processes, enabling a cost-effective branch rollout.

Valuation and view

* LTF’s 1QFY26 earnings were in line with our expectations. Disbursements and loan growth remained modest, reflecting the company’s strategic focus on calibrated risk-based expansion. Notably, asset quality remained largely stable despite 1QFY26 being a seasonally weak quarter, which is a key positive. Additionally, the company benefited from a decline in borrowing costs, driven by policy rate cuts, which supported a modest expansion in NIMs.

* LTF has invested in process automation, security, and customer journeys. This, along with large partnerships in products like PL, should lead to stronger and more sustainable retail loan growth. We expect the broad-based improvement in collection efficiency across product segments to sustain over the next two quarters, which should translate into stronger profitability for the company.

* We estimate a PAT CAGR of 25% over FY25-27E, with consolidated RoA/RoE of 2.7%/~14% in FY27. We reiterate our BUY rating on the stock with a TP of INR250 (based on 2x Mar’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd ( 1 ).jpg)