Buy Nuvama Wealth Ltd For Target Rs.7,200 by Motilal Oswal Financial Services Ltd

A diversified play in the wealth management space

Strong presence across customer segments

* Nuvama Wealth is a diversified play on multiple emerging themes in the capital market ecosystem, with a robust presence in UHNI Wealth Management, Midsegment Wealth Management, Custody & Clearing business, and IE&IB business. Its AMC business is primed for strong growth going forward, with a strong foundation already laid.

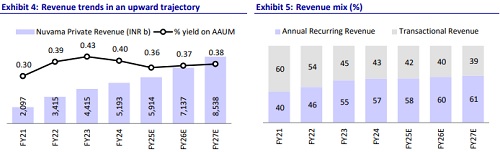

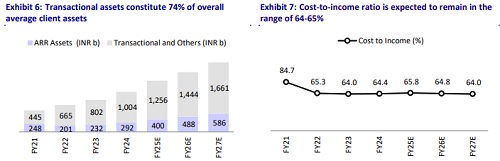

* The Private segment has a strong focus on ARR AUM and expects its share to increase from the current level of 20%. This growth will stem from: 1) a 20% increase in the RM count from the current level of ~130+ and 2) a deepening geographical presence. With new product additions and improved efficiency of the RM base acquired in the past two years, we expect a strong AUM CAGR of 20% over FY25-27 and a significant improvement in the cost-to-income ratio for the segment to 64% in FY27E from 65.8% in FY25E.

* In the wealth segment, there has been an astute focus on increasing the share of managed products. Additionally, the company is adding significant RM force (900 as of Aug’23 to 1,200+ as of Dec’24), leading to a higher cost-to-income ratio. Over the next couple of years, as volumes increase, we anticipate significant scale benefits that will drive margins up by 100bp during FY25-27.

* The custody and clearing business is expected to continue to prosper as FPIs/AIFs continue to increase their trading activities in India. On the other hand, the IE & IB business will see steady growth as new IPOs and overall equity market sentiment remain buoyant.

* Its AMC business, primarily focused on AIFs, has three schemes currently and has garnered an AUM of INR113b. As it scales up through existing schemes and new launches, we anticipate significant improvement in profitability for the segment.

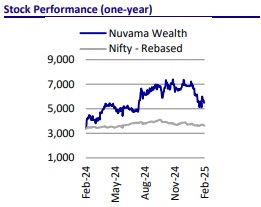

* Overall, we expect Nuvama’s ex-capital market revenues/PBT to post a growth of 20%/12% over FY25-27. Additionally, we expect the cost-to-income ratio to improve from 62% in FY24 to 57% in FY27. With RoEs of 30%+, the stock is attractively trading at FY27 P/E of 17x. We reiterate our BUY rating on the stock with a one-year TP of INR7,200 (based on 22x Sept’26E EPS).

Key industry trends driving significant growth in the Wealth industry

* The integration of digital platforms, AI, and machine learning is reshaping wealth management in India, enhancing client engagement and service efficiency.

* The rising market participation from younger investors, supported by accessible platforms and financial education, is driving equity market growth.

* Wealth management services are expanding into tier 2 and 3 cities, driven by economic growth and increasing wealth accumulation.

* Growing demand for comprehensive financial solutions is prompting wealth managers to offer personalized investment, tax, estate, and retirement planning services.

* Regulatory measures, including small-sized investment plans, are fostering financial inclusion and broadening market participation.

Nuvama Private: Growth fueled by RM additions and geographical expansions; continues to focus on ARR

* The Nuvama Private segment has posted a robust CAGR of 26% (9MFY23- 9MFY25) over the last two years, reaching INR2.1t. This is attributed to new client additions, strong market performance, and increased wallet share from existing clients. An increased focus on ARR has led to strong growth in ARR flows to INR73b in 9MFY25 vs INR77b in FY24.

* The firm has aggressively expanded its RM base, adding 30+ RMs in the last 12 months, bringing the total to 130+ with a guidance of adding 20% capacity every year.

* In terms of geographic expansions, domestically, the firm has improved penetration by expanding beyond tier-1 cities. Internationally, it recently commenced operations in Dubai with 3 RMs and expects to break even within six to nine months. The firm has also received approval to start operations in Singapore.

* The yields have dropped to 77bp in 3QFY25 from 102bp in FY24 due to MTM. Management guides for yields to remain in the range of 80-83 bp on a steady state basis.

* The C/I ratio has largely remained in the range of 64-66% over the past two years due to an increase in RM capacity and tech investments. However, as the vintage and productivity of the RMs increase, we expect it to taper down.

* Several experiments with AI are underway in Nuvama Private, focusing on prospecting, client portfolio analysis, and advisory. These initiatives are expected to significantly impact productivity going forward.

* With a focus on increasing ARR, adding RMs, increasing their vintage, expanding geographically, and converting more IB clients into UHNI clients via various distribution modes, it is poised for strong growth in AUM. We expect the segment to register a CAGR of 16%/20% in ARR AUM/Revenue during FY25-27.

Nuvama Wealth: Leading player with consistent focus on MPIS

* Nuvama is a leading player in the mid-market segment (HNIs) among the few non-bank players with meaningful scale, holding an AUM size of INR1.02t (35% CAGR over 9MFY23-9MFY25) and ~1.2+m clients ( of which ~20% are serviced by RMs and external wealth managers.

* Net new money grew 43% over the last two years to INR58.8b (9MFY25), with the share of Managed Products and Investment Solutions (MPIS) increasing to 87% as the focus shifts toward managed products.

* RM capacity has increased by 40% YoY to 1,200+, leading to an increase in CIR to ~66%. Management expects the CIR to improve as the vintage of those RMs increases and the operating leverage kicks in.

* Yields in 3QFY25 have moved down to 83bp from 98bp, mainly due to a fall in NII. Management guides for yields to remain in the range of 85-95bp on a steady state basis.

* The CIR for 9MFY25 stood at 66% (300bp improvement if costs and revenue generated by these new hirings were not included), the same as last year despite aggressive capacity additions, reflecting improved productivity among existing RMs.

* Nuvama is continuously investing in tech and has recently introduced an AI tool called Nuva AI. This training-based solution provides one-on-one training sessions for RMs, focusing on improving productivity.

* Nuvama aims to grow this segment exponentially over the next three years as it expands its RM base at a ~25% CAGR and deepens its geographic presence. We expect the segment to post a CAGR of 20%/18% in ARR AUM/Revenue during FY25-27.

Capital Markets: Robust C&C business drives stickiness and reduces volatility

* Nuvama is among the leading players in the IE (market share of ~6.2%+ despite a 10% decline in the markets) and IB business (capturing 11 of 57 deals in 3QFY25 and a strong deal pipeline ahead).

* On the AIF and PMS side, in the domestic market, market share has increased to 22% (vs 18% last year). Internationally, the company maintains a dominant position, with new clients contributing ~30%-35% of the new flows in the business.

* The IE&IB business is relatively volatile, and to arrest the impact of cyclicality, Nuvama has built a robust clearing business with institutional funds, which have an average client assets size of INR1.3t (72% CAGR over 9MFY23- 9MFY25). This business is relatively sticky as the sources of income are float income and fund accounting. ~90-95% of the income in C&C is recurring in nature.

* Yields have improved to 170bp in 3QFY35 from 137bp in FY23.

* Given the sustainable long-term potential of the derivatives segment and robust growth in the custody business, we expect this segment to witness strong sustainable growth in revenues.

* The IB business has witnessed strong growth, with a consistent increase in deals (IPO, QIPs, and others). In 9MFY25, Nuvama Investment Banking increased its market share across equity and debt offerings. Its equity IPO market share doubled from 9.1% (CY23) to 18.4% (CY24), while securing the #1 rank in public debt issues. With a high share of debt in the IB transactions, cyclicality is lower vs other IB houses.

Strong net flows lead to faster growth in the AMC business

* Currently, the company has three active strategies: 1) private markets; 2) public markets where AUM has grown 3x in the last 12 months to ~INR50b, with products across the spectrum, including Flexi, Mid, and Small Cap fund; and 3) commercial real estate, with AUM standing at INR17b and a pipeline expected to reach INR20-25b. The company also plans to add corporate credit to its range of offerings soon.

* Nuvama currently has 20+ investment professionals with long and successful track records and has increased capacity on both the investment and distribution sides. In terms of distribution, it has added external capacity, including banks and independent wealth managers.

* During the quarter, the company achieved its first close in the commercial real estate fund, raising INR17b within nine months of launch. Management has guided that after one or two deployments, it will raise funds again, with a target of ~INR30b. The company also recently launched the Flexi Cap Fund.

* Nuvama is in the process of filing an application with SEBI for a mutual fund license, which will enable it to launch schemes with a minimum ticket size of INR1m under the specialized investment fund category.

* Given the smaller AUM, the C/I ratio stood at 126% in 9MFY25. However, management guides for the AMC Business to break even within 12-15 months as it crosses the AUM size of INR200b, backed by strong flows and new launches.

Valuation and view

* Nuvama has been delivering consistent growth across its core business segments. Through digital innovation, diversified product offerings, and enhanced client engagement strategies, the company remains well-positioned to capitalize on emerging opportunities

* Overall, we expect Nuvama’s ex-capital market revenues/PBT to post a CAGR of 20%/12% over FY25-27. Additionally, we expect the C/I to improve from 62% in FY24 to 57% in FY27. With RoEs of 30%+, the stock is attractively trading at FY27 P/E of 17x. We reiterate our BUY rating on the stock with a one-year TP of INR7,200 (based on 22x Sept’26E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)