Buy Metro Brands Ltd for the Target Rs. 1,400 by Motilal Oswal Financial Services Ltd

Double-digit growth sustains with acceleration in store additions

* Metro Brands (MBL) delivered in-line 11% YoY revenue growth in 2Q, driven by an improvement in in-store sales (+10% YoY vs. 4% YoY in 1Q), acceleration in store additions, and robust 39% YoY online growth.

* MBL’s store additions ramped up with ~38 net store additions in 2Q (significant pick-up from ~20 net store additions over the past 10 quarters), driven by a scale-up of the value format Walkway and addition in recent tie-ups, such as Foot Locker and New Era.

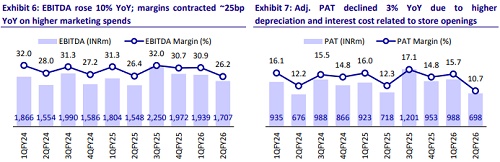

* EBITDA grew 10% YoY (3% miss), as ~20bp gross margin expansion was offset by higher expenses from store openings and elevated A&P spends (up ~100bp YoY).

* MBL’s profitability (PAT -3% YoY) and cash flows were affected by accounting impact and higher capex for the accelerated store additions.

* MBL has delivered double-digit growth on average over the past four quarters. With the government’s recent measures aimed at boosting consumption, management remains upbeat on sustaining the growth trajectory over the medium term.

* Our FY26-28E EBITDA remains broadly unchanged. However, we cut our FY26-28E PAT by 4-6% due to the impact of lease costs from accelerated store additions. Overall, we build in revenue/EBITDA/adj. PAT CAGR of 14%/15%/15% over FY25-28E.

* We reiterate our BUY rating on MBL with a revised TP of INR1,400, premised on 70x Dec’27 EPS.

Revenue growth in line; higher expenses due to store acceleration hurt profitability

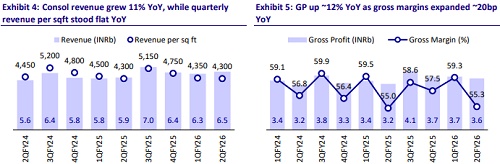

* Consolidated revenue grew ~11% YoY to INR6.5b (in-line) driven largely by ~10% YoY area additions, as revenue/sqft was stable YoY at INR4,300.

* In-store sales grew ~10% YoY (vs. ~4% YoY in 1Q), driven largely by 11% YoY store additions.

* The company added 42 new stores and closed four stores to reach 966 stores. Format-wise, MBL added 10 stores each in Mochi and Walkway, eight stores in Metro, four stores each in Foot Locker and New Era, and one store each in Fitflop and Crocs.

* E-commerce witnessed strong traction with 39% YoY growth to reach INR900m, with share in revenue rising to 14.2% (vs. 11.4% YoY).

* Gross profit grew 12% YoY to INR3.6b (inline) as margins expanded ~20bp YoY to 55.3% (~25bp beat), likely led by lower discounting during EoSS and improvement in the product mix (87% product sales exceeding INR1,500, vs. 85% YoY).

* Employee costs grew 11% YoY (4% ahead) and other expenses jumped 14% YoY (3% ahead).

* As a result, EBITDA at INR1.7b grew 10% YoY and came in ~3% below our estimate.

* EBITDA margin contracted ~25bp YoY to 26.2% (~75bp miss)

* Elevated depreciation (+26% YoY, 13% ahead) and finance cost (+35% YoY, 13% ahead), primarily on account of accelerated store expansions, impacted profitability.

* As a result, adj. PAT at INR698m declined 3% YoY (13% miss).

* For 1HFY26, MBL’s revenue/EBITDA/PAT grew 10%/9%/3%. Based on our estimates, the implied growth run-rate for revenue/EBITDA/PAT stood at 13%/15%/10% for 2HFY26.

Store acceleration leads to higher WC and capex, thereby impacting cash generation

* Working capital days increased to ~83 days (vs. 78 days in 1HFY25), driven by a modest increase in inventory days to 111 (from 108 YoY) and reduction in payable days to 44 (from 47 YoY).

* Cash flow from operations (post leases) declined to a modest INR31m (vs. INR1.7b in 1HFY25), largely driven by adverse working capital changes (build-up of ~INR1.8b vs. a release of INR5m YoY).

* As a result of higher WC intensity and uptick in capex (INR0.6b up 29% YoY, driven by acceleration in store additions), MBL had an FCF outflow of ~INR580m (vs. generation of INR1.2b YoY).

Key takeaways from the management commentary

* Demand: 2Q growth was supported by early festive demand and EOSS, but was partly offset by prolonged monsoons and deferred purchases in anticipation of GST cuts.

* GST impact: MBL has reduced ASPs by ~6%/~11% for products priced below 1k and between 1k and 2.5k, respectively. GST reduction has led to improved affordability, benefiting ~90% of the Walkway and ~40% of the Metro/Mochi portfolio, and is expected to support MBL in sustaining double-digit growth over the medium term.

* Profitability: Gross margin expanded 20bp YoY, driven by disciplined inventory control and discounting despite EOSS during 2Q. However, marketing spends remained elevated (up 100bp YoY) as MBL continues to spend on building greater customer awareness. Further, acceleration in store additions during 2Q impacted reported profitability (~60bp impact on margins) and cash flows.

* Guidance: Management reiterated its long-term guidance of 15-18% growth CAGR, driven by mid-to-high single digit SSSG, new store openings, and rising contribution from newer banners. Further, driven by its robust cost controls and superior store economics, the company aims to deliver 30% EBITDA margins and mid-teen profit margins.

Valuation and view

* Concerns around Fila's liquidation and BIS-related challenges are now well behind the company, and MBL's strategic focus is on ramping up Foot Locker and FILA, as well as scaling up the recent addition, Clarks.

* We remain positive on MBL’s long-term outlook, given a) its superior store economics, with industry-leading store productivity and strong cost controls, and b) a long runway for growth, largely funded through internal accruals.

* Our FY26-28E EBITDA remains broadly unchanged. However, we cut our FY26- 28E PAT by 4-6% due to the impact of lease costs from accelerated store additions.

* Given the strong runway for growth in the Metro, Mochi, and Walkway formats, along with significant growth opportunities in FILA/Foot Locker/Clarks, we build in revenue/EBITDA/PAT CAGR of 14%/15%/14% over FY25-28E.

* We roll forward our valuation base to Dec’27 (from Sep’27) and assign a 70x P/E multiple. We reiterate our BUY rating on MBL with a revised TP of INR1,400 (earlier INR1,435). Consistent double-digit growth and ramp-up of newer formats, such as FILA, Foot Locker, and Clarks, remain the key re-rating triggers for the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)