Neutral ALKEM Laboratories Ltd for the Target Rs. 5,560 by Motilal Oswal Financial Services Ltd

Broad-based show drives all-time high quarterly revenue

Opex from CDMO/Med-tech to constrain margin expansion over the near term

* ALKEM Laboratories (ALKEM) delivered better-than-expected revenue/EBITDA/PAT, with a beat of 6%/9%/13% for the quarter. The superior performance was driven by broad-based higher revenue growth and lower-than-expected R&D spend for the quarter.

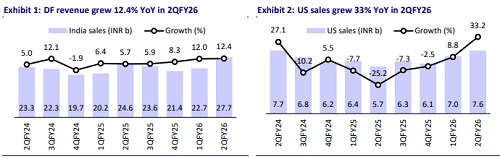

* Despite the GST transition in Sep’25, ALKEM delivered better-thanindustry growth in the domestic formulation (DF) segment. Specifically, it outperformed IPM in respiratory, dermatology, pain management, VMN, and anti-infective therapies.

* Superior execution in certain geographies aided strong YoY growth in nonUS markets, while new product launches supported growth in the US market during the quarter.

* That said, we reduce our earnings estimate by 2%/4% for FY26/FY27, factoring in: a) additional operational costs related to new growth drivers (CDMO and Med-tech segments). We value ALKEM at 28x 12M forward earnings to arrive at a TP of INR5,560.

* ALKEM is working to enhance its growth outlook across the focus markets of DF/US and Non-US exports. Accordingly, we expect a 10%/14% revenue/EBITDA CAGR over FY25-28. However, earnings growth is expected to remain under check due to a sharp surge in ETR following the loss of certain tax benefits. Reiterate Neutral.

Operational efficiency and lower R&D spends drive margins YoY

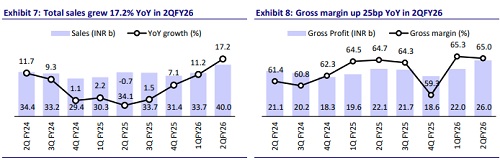

* ALKEM’s 2QFY26 revenue grew 17% YoY to INR40b (our est: INR37.8b).

* The DF business grew 12% YoY to INR27.7b (70% of sales).

* International business grew 30% YoY to INR11.9b for the quarter. Within international business, US sales grew 33% YoY to INR7.7b (19% of sales). Other international sales grew 32% YoY to INR4.2b (11% of sales).

* Gross margin expanded 25bp on a YoY basis to 65%.

* EBITDA margin expanded 100bp YoY to 23% (our est: 22.3%), driven by lower R&D spent/employee expenses (down 100bp/15bp YoY as % of sales, partly offset by higher other expenses (+45bp YoY as % of sales)

* Accordingly, EBITDA grew 22.3% YoY at INR9.2b (vs est. of INR8.4b).

* PAT grew 11% YoY to INR7.6b (our est: INR7.1b).

* For 1HFY26, revenue/EBITDA/PAT grew 15%/22%/15% YoY.

Highlights from the management commentary

* ALKEM remains confident about outperforming the DF segment by 100- 150bp on a consistent basis.

* It expects low double-digit/high-teen YoY growth in the US/Non-US segments in FY26.

* The company has raised its EBITDA margin guidance to 19.5%-20% for FY26.

* Opex related to the Enzene US plant (INR500m-INR600m) will be expensed from 3QFY26 onwards. Overall opex (Ex-R&D) is projected at INR9b per quarter over the next two quarters.

* ETR is expected to be 35-38% for FY27.

* ALKEM expects its US plant to attain an asset turnover of 1-1.2x, reaching the corresponding sales in 12-18M.

* In 2QFY26, ALKEM garnered INR1.2b revenue from the Enzene Pune plant.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412