Neutral TATA Motors Ltd for the Target Rs. 341 by Motilal Oswal Financial Services Ltd

Market share loss across segments remains key concern

CV demand likely to pick up in 2H

* Tata Motors has reported the financials of the demerged entity for the first time. Given the restated financials for prior years, these are strictly not comparable to our estimates.

* 2QFY26 operating margin was in line with our estimate at 12.4%.

* The key concern in TTMT CV business has been its gradual loss of market share across key segments. Particularly worrisome is the market share loss in LCV goods from a high of 40% in FY22 to 27% now, and the gap with the current market leader MM is rising with every passing year. Given the lack of any visible triggers, we rate Tata Motors CV business at Neutral with a TP of INR341 per share – we value the core business at 11x Sep’27E EPS (in line with peers) and add INR12 per share for its stake in Tata Capital.

Margins in line with estimates

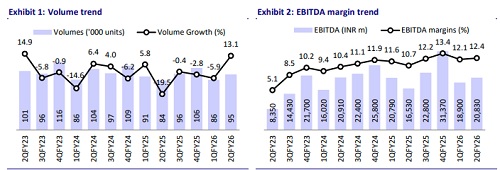

* Standalone revenue grew 9% YoY to INR168b on the back of 12% volume growth. ASP declined 4% YoY to INR1.7m per vehicle.

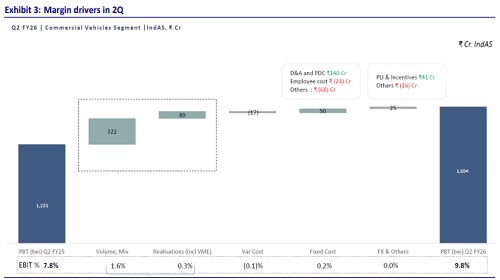

* EBITDA margins expanded 170bp YoY to 12.4%, primarily driven by operating leverage benefits and improved pricing. Pricing has been a function of its ability to pass on costs (or reduce discounts) and an improved mix.

* EBITDA grew 26% YoY to INR 21b.

* Due to MTM loss of INR23b on account of fair valuation of Tata Capital, TTMT CV reported a loss of INR10b. Adjusted for this, PAT almost doubled over a low base to INR13.4b.

* Capex for 1H stood at INR10.8b, while FCF was INR4.2b. Net debt as of 2Q end stood at INR5.8b.

Highlights from the management commentary

* After the GST reforms, demand has picked up in LCVs. Given the pickup in consumption trends, management expects demand to pick up in MHCVs as well in the coming quarters. With increased consumption, fleet utilization has improved and freight rates have also inched up, thereby creating an overall positive sentiment.

* For the Iveco acquisition, regulatory approvals are underway and the company expects to close the transaction by Apr’26. A bridge loan has been arranged to fund this acquisition. The funding source for the repayment of this bridge loan (whether debt or equity raise) would be decided at a later date.

* A key focus area for the CV entity is to sustain robust financial performance by consistently delivering double-digit EBITDA margins, healthy cash flows and strong ROCE.

Valuation and view

The industry’s pricing discipline has certainly been commendable over the last 12 months, with all CV players witnessing improvement in margins. However, the key concern in TTMT CV business has been its gradual loss of market share across key segments. Particularly worrisome is the market share loss in LCV goods from a high of 40% in FY22 to 27% now, and the gap with the current market leader MM is rising with every passing year. Even in MHCV goods, its market share has declined to 49% from 54% in FY22. In the MHCV bus segment, its market share has come down to 30.3% in 1HFY26 from 38% in FY22. Further, its recent acquisition of Iveco would expose it to the ongoing global macro uncertainties, thereby driving a potential derating, if the demand environment does not improve anytime soon. Given the lack of any visible triggers, we rate Tata Motors CV business at Neutral with a TP of INR341 per share – we value the core business at 11x Sep’27E EPS (in line with peers) and add INR12 per share for its stake in Tata Capital.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412