Chemicals Sector Update : Soft quarter anticipated by Prabhudas Lilladher Ltd

Specialty chemical companies within our coverage universe are expected to report modest revenue growth of 2.4% YoY, alongside a 2.6% QoQ decline, with margins contracting by 80bps QoQ. The muted topline performance and margin softness reflect weak end-market demand, lower exports, and subdued realizations across most product segments. Refrigerant gas prices, while still elevated versus last year after reaching all-time highs, moderated slightly toward the end of the quarter. We do not expect a further price uptick, given the slowdown in Chinese AC sales

Based on our channel checks and recent management commentaries, the challenging environment for agrochemical-focused companies is likely to persist, with margins remaining under pressure in the near term. Chinese players continue to pose a significant competitive threat to Indian chemical manufacturers. Chemical production in China grew 7.9% YoY in H1CY25, while India’s production declined by 1%. However, the ongoing anti-dumping investigations by the DGTR could offer meaningful relief once implemented, potentially benefiting several domestic players. Companies with exposure to fluorination chemistry are likely to witness YoY margin expansion, supported by improved realizations for key refrigerants compared to last year. Meanwhile, dyes, pigments, and polymer additives are expected to see steady demand trends.

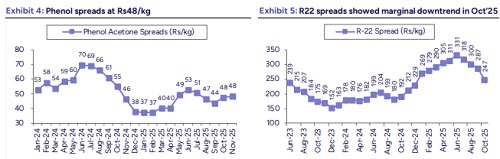

* Key feedstock prices showing mixed trend: Crude oil averaged USD63/bbl, declining 15% YoY and 7% QoQ, with the latest price at USD62/bbl, while key derivatives such as phenol and benzene were down 21% and 25% YoY, respectively. Natural gas prices increased 33% YoY and 30% QoQ, currently at USD3.5/MMBtu. Key raw materials such as acetic acid and ethyl acetate fell 14% and 4% YoY, while PET declined 8% YoY. In contrast, sulfuric acid surged 106% YoY and 15% QoQ, ammonia jumped 22% QoQ, and TDI rose 8% YoY. Meanwhile, caustic soda and soda ash remained stable QoQ but were down 14% and 21% YoY, respectively, and R-22 saw 26% YoY 41% QoQ correction.

* Ongoing Anti-dumping duties could provide potential relief for Indian chemical companies: The potential imposition of anti-dumping duties (ADD) could provide meaningful relief to Indian chemical companies. Within our coverage, NOCIL stands to benefit significantly, with ongoing investigations covering nearly 40% of its product portfolio. Other companies such as Vinati Organics, Laxmi Organics, Jubilant Ingrevia, Gujarat Fluorochemicals, Deepak Nitrite, and SRF are also likely to gain from the implementation of ADD on key products like Para-Tertiary Butyl Phenol, Antioxidants, Methyl Acetoacetate, PTFE, HALS and HFC blends.

* Marginal pickup in volumes: Most of the companies under our coverage are likely to witness a pickup in volumes in Q3FY26, based on commentaries from the management. However, margins are expected to remain under pressure particularly for agrochemical-focused companies due to subdued demand and weak realizations.

Our top picks for the sector include:

* Fine Organics: Fine Organics holds a significant competitive advantage with its unique product portfolio, the global demand for the company’s product portfolio remains robust. The company is undertaking Rs7.5bn green field capex at SEZ land allotted to the company at Jawaharlal Nehru Port Authority. This facility will manufacture products like the company’s current portfolio and is expected to start commercial production by FY27. Additionally, the company has set up new subsidiaries in the USA to set up a manufacturing facility in the USA and in UAE, Dubai to enhance supply chain efficiency respectively. We believe the new facility in SEZ will be a key driver of future growth for the company and is expected to have a peak revenue of Rs26bn at 3.5x asset turnover and will start contributing to the topline majorly from FY28. We expect revenue and EBITDA to decline by 10.7% QoQ but increase by 21.8% YoY. Revenue is expected to remain flat sequentially, while it increase by modest 4.4%.

* Navin Fluorine International Limited: Navin Fluorine’s HFO plant continues to operate stably with healthy capacity utilization. The recently expanded R-32 facility is already running at optimal levels, and the company has announced an additional 15,000mtpa R-32-equivalent plant to capitalize on strong demand. In specialty chemicals, the outlook for H2FY26 and CY26 remain robust, supported by new product ramp up, while the Chemours project is scheduled to commence in Q1FY27. The CDMO business is backed by a solid order book through FY27, and the company continues to reiterate its USD100mn revenue ambition for this segment by FY27. Meanwhile, cGMP-4 Phase 1 plant got recently commissioned post successful validation of batches by the company’s European partner. The AHF plant is progressing well, further strengthening vertical integration once operational. We expect revenue and EBITDA to decline by 0.2% and 8.5% QoQ, while on a YoY basis, both revenue and EBITDA are expected to sharply increase by 25% and 53% respectively.

Change in Target Prices and Estimates:

We continue to maintain our ratings for all the stocks under our coverage, and value them now based on FY27/FY28E average EPS. We cut estimates sharply for Laxmi Organics due to continued weakness in spreads across both ethyl acetate and diketene segment. For PI Industries we have reduced our topline estimates by 9% due to expected decline in Pyroxa sales and realization which is key product for the company

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271