IT Sector Update : Seasonality intensifies underlying weakness by Prabhudas Lilladher Ltd

Quick Pointers:

* Muted growth expected for most names due to furloughs

* Margins to remain steady due to rupee depreciation and wage hike deferral

3QFY26 is expected to be soft due to seasonality on top of the underlying weakness. The furloughs and holidays impact is expected to be similar compared to last year’s Q3. Even the demand beyond necessary areas or certain pockets does not seem to have changed notably during the same period. Q3 will have more bearing on topline growth due to BFS having usual impact of furloughs vs other verticals, which also happens to be the only silver lining during tough macros. The weakness in demand also tends to defer compensation revision for most of the names (except HCLT, PSYS, TataTech, TLXI, KPIT) in Q3, the margin improvement would be flat to marginally positive, partly aided by INR depreciation. We expect median revenue growth of 1.0% QoQ in CC terms & 0.8% QoQ in USD terms. The currency volatility is limited in Q3, major currencies like EUR and GBP have weekend against USD by 1.6% and 0.1% QoQ, respectively, countering INR depreciation of 2.4% against USD.

Vertical-wise, BFSI usually tends to have higher furlough and is likely to be soft in Q3. Hi-Tech, Healthcare and Manufacturing (beyond Automotive) should relatively perform better, while challenges should continue to persist within Communications and Retail/CPG. Deal signing activities should remain positive for renewals, partly aided by year-end budget flushes, while new deals are likely to be weak. New tech budgets from enterprise clients are likely to be kicked in early CY26, which should reset clients’ sentiment and prioritize spending. Structurally H2 tends to be weaker for IT Services, and with no incremental signs of recovery, we expect revenue guidance for Infosys and HCL Tech to largely remain unchanged, at least at the top-end.

Tier I & II operating performance: We expect Tier II and small-cap companies to outperform Tier I in a seasonally weak quarter. Tier II firms are likely to deliver 2.6% QoQ CC revenue growth, led by PSYS. Within Tier I, HCLT and LTIM are expected to post relatively stronger growth of 3.0% and 2.0% QoQ CC, respectively, though the Tier I median growth is likely to remain modest at ~1.0% QoQ CC. Among small caps, LATENTVI is expected to stand out with robust 7.1% QoQ CC growth, supported by sustained momentum in the BFSI and Retail & CPG segments.

On margins, we expect pressure across both Tier I and Tier II companies, driven by furloughs, with Tier II likely to see a sharper contraction due to wage hikes in select players. Median EBIT margins are expected to decline by ~40 bps for Tier I companies, while Tier II companies could see a steeper ~70 bps compression.

Deal wins: Deal wins are expected to remain steady, with a higher share of renewals. We do not expect any material change in deal activity related to cost optimization and vendor consolidation programs.

Valuation and View

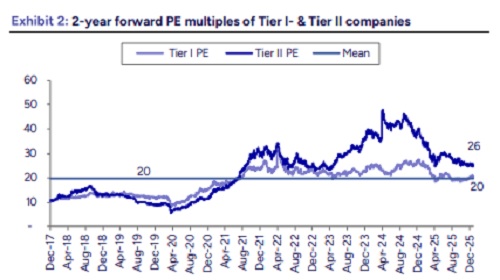

The underlying demand environment remains unchanged; the sectorial growth is driven by two or three verticals instead of a broad-based recovery. The revenue derived through Advanced AI stream is negligible and it is less likely to compensate for the near-term deflationary pressure within traditional service. In our previous note, We highlighted the large Hi-Tech and SaaS companies that are enjoying the benefits of early investments in AI. However, IT services vendors are required to deliver tailored, enterprise-specific offerings rather than plug-and-play solutions, which delays the realization of immediate AI benefits. The incremental optimism is reflected in the IT Index (up 12% over last 3m), the IT stocks have recovered in the past few sessions, although we remain very selective and value buying.

We roll forward our estimates from Sep’27 to Mar’28 and maintain our ratings across our coverage universe, except for TATATECH, where we upgrade the rating from REDUCE to HOLD. Our top picks remain INFO and HCLT among large caps, and PSYS and MPHL within mid-caps, which we expect to outperform their respective peer groups

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271