Monthly Auto Sales - September 2025 by ARETE Securities Ltd

In September India's auto dispatches register impressive growth, with overall volumes expanding +18% MoM and +9% YoY, propelled by GST 2.0 implementation that clarified pricing and coincided with Navratri to ignite festive fervour across segments. The PV segment recorded its highest fiscal tally at 3.1 lakh units, buoyed by swift inventory clearance and strong consumer traction in SUVs and compacts, as TAMO surged ahead while HMIL benefited from discount strategies, though MSIL faced UV bottlenecks. CVs grew +21% MoM and +13% YoY, with trucks leading the charge through post-reform fleet renewals and macro supports like infrastructure spends and e-commerce surges. Tractors vaulted to record volumes, supported by Kharif positivity, well-distributed rains, and elevated reservoir levels that reinforced rural buoyancy. 2Ws advanced +18% MoM and +9% YoY, as lower GST on entry-level bikes improved accessibility in cost-sensitive hubs, with HERO and BAJAJ driving domestic rebounds amid export steadiness. These aligned patterns reflect the subtle harmony of policy reforms and seasonal-rural dynamics steering the sector's trajectory.

Automobile Sales September - 2025

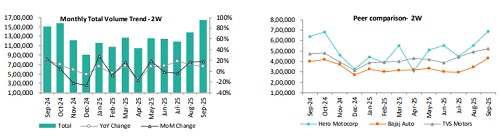

2W Segment

In September, the 2W segment marked its second straight month of expansion, with volumes climbing 18% MoM and 9% YoY. BAJAJ posted the steepest sequential uptick, while TVS delivered the strongest yearly advance in dispatches. Market front-runner HERO registered positive momentum as well, though trailing peers, as TVS's iQube propelled its EV volumes to unprecedented highs thereby elevating TVS's 2W growth above HERO's on a YoY basis. Sequentially, however, HERO led in absolute unit gains. This widespread OEM buoyancy stemmed from the synergistic interplay of GST reforms and the festive season kick-off, with most high-volume 2W models (up to 350cc engines) transitioning to an 18% GST bracket (from prior 28% plus cess), trimming ex-showroom tags by at least 8-10% on entry-level variants and enhancing accessibility in cost-conscious rural and semi-urban hubs, where 2Ws prevail as budget-friendly transport. Segment exports, meanwhile, dipped 2% MoM amid volume contractions at key players like BAJAJ and TVS yet advanced 17% YoY, bolstered by positive contributions across all OEMs. In e2W, TVS/BAJAJ/HERO recorded 22,481/ 19,519/12,736 units, yielding market shares of 22%/19%/12%.

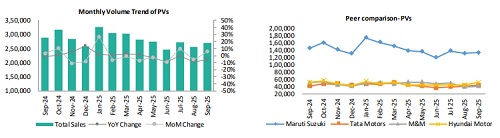

PV Segment

PV segment posted strong sequential growth, marking the highest volume of the fiscal at 3.1 lakh units, supported by recent GST rate reductions that improved affordability in entry and mid-segment models. This pricing clarity converted existing inventory swiftly, driving a broad-based pickup in wholesales. Sentiment was further buoyed by early festive activity, with urban and semi-urban footfalls rising meaningfully, particularly in SUVs and compact cars, as buyers advanced purchases ahead of peak-season rushes. On the first day of GST implementation and Navratri, MSIL, HMIL, and TAMO retailed 30k, 11k, and 10k units respectively, demonstrating strong consumer traction. TAMO led gains with over 40% growth, while M&M benefited from sustained SUV momentum and positive response to Bolero Neo and XUV3XO. HMIL held its second-highest volume rank for the second consecutive period, reflecting strong SUV traction. MSIL underdelivered versus potential due to logistical challenges in UVs, though Compact volumes improved and Mini recovered. Segment exports recorded their highest-ever volumes, rising 12% MoM and 52% YoY

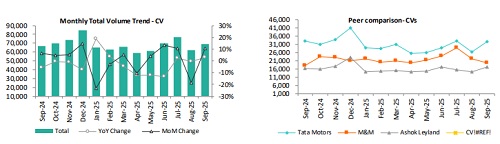

CV Segment

The CV segment reported strong growth, with volumes rising 21% MoM and 13% YoY, led by a sharp rebound in the Truck category, which accounted for 63% of total CV dispatches. Momentum was supported by the implementation of GST 2.0 late in the period, which deferred August fleet upgrades and drove a surge in end-period volumes as revised rates reduced TCO for operators across construction and logistics. This was further underpinned by favourable macro tailwinds, including sustained infrastructure outlays, mining activity, and strong e-commerce-led freight demand, which together enabled healthy fleet renewals and helped clear legacy inventory. M&M captured a meaningful share of the incremental demand in the truck segment. LCVs marked their third consecutive month of growth, up 14% MoM and 10% YoY, largely driven by strong gains at AL, even as M&M saw marginal weakness. Domestic Buses declined 8% MoM and 3% YoY, with the sequential dip led by TAMO, while the annual softness was primarily due to a decline at AL.

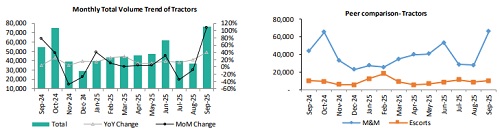

Tractor Segment

September tractor dispatches surged 131% MoM and 49% YoY to record highs, driven primarily by a strong domestic rebound. This growth was led by significant volume gains at M&M, with sales accelerating sharply during the initial nine days of Navratri, supported by an optimistic Kharif harvest outlook, expanded sowing acreage, and above-average monsoon rainfall. ESC reflected similar momentum with comparable domestic volume growth, collectively boosting industry-wide performance and fostering positive sentiment for the coming months. Exports, meanwhile, declined 34% MoM due to seasonal headwinds but maintained a 12% YoY increase, providing some support to overall volumes.

Please refer disclaimer at http://www.aretesecurities.com/

SEBI Regn. No.: INM0000127

More News

Automobiles & Components: Input cost inflation remains a potential margin risk by Kotak Inst...

.jpg)