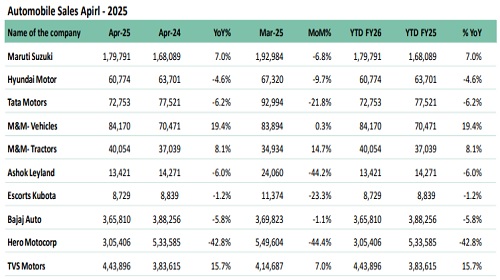

Monthly Auto Sales - April 2025 by ARETE Securities Ltd

In the month of April, India's automotive industry displayed a spectrum of performances across its core segments. The PV market recorded modest growth compared to the previous year, underpinned by MSIL's strategic pricing initiatives and M&M's sustained demand, though entry-level segments faced affordability constraints. The CV segment, encompassing buses, trucks, LCVs, and tractors, experienced a downturn, with AL and TAMO affected by pricing pressures and seasonal declines, while tractors demonstrated notable resilience. The 2W market slumped to its lowest volumes this year, as HERO navigated production-related challenges, contrasted by TVS's gains from robust export markets. These divergent trends highlight the complex dynamics shaping the sector's near-term trajectory.

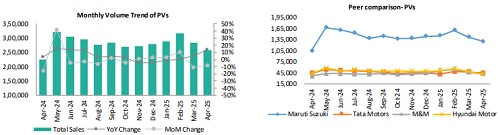

PV Segment

In April, the PV market grew 1% YoY, driven by MSIL's flat sales in domestic market, supported by discounts on key models, and M&M's strong, anticipated gains. However, HMIL lagged behind TAMO and M&M in volumes for the third consecutive month, facing a sharp sequential decline. While SUV demand remains steady, the entry-level segment struggles, likely due to affordability pressures and stricter financing conditions. Looking ahead, a recovery in volumes during H2FY26 could follow only if supportive measures-such as rate cuts or tax relief-were to be introduced by then, potentially aiding weaker segments and lifting overall market momentum.

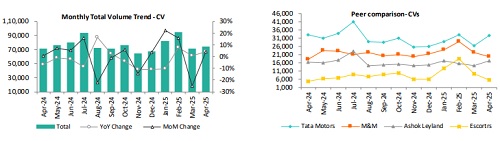

CV Segment

In April, the CV segment recorded a 2% YoY decline and a 28% MoM seasonal drop, partly due to price hikes. Domestic trucks, comprising 20% of volumes, fell 47% MoM and 18% YoY, with AL seeing the steepest sequential decline and M&M most impacted on a yearly basis. Domestic Bus volumes declined 34% MoM and 6% YoY, with AL again posting significant volume losses. LCVs, accounting for 18% of CV volumes, registered a marginal 0.3% YoY decline and a 28% MoM fall, with M&M affected most and AL least. In contrast, tractor sales rose 5% MoM and 6% YoY, supported by strong domestic demand, with expectations of continued momentum driven by a robust Rabi harvest and favourable weather outlook.

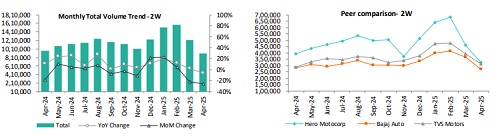

2W Segment

In April, the 2W segment hit its lowest volumes this year, down 16% YoY and 17% MoM. HERO, the market leader, saw a steep decline due to planned production halts for supply chain realignment and process upgrades. Meanwhile, BAJAJ and TVS recorded sequential growth, driven separately by rural demand and the marriage season's uplift. TVS outperformed peers with 15% YoY growth, fuelled by its e2W segment and strong international dispatches, highlighting resilience in a challenging market.

Please refer disclaimer at http://www.aretesecurities.com/

SEBI Regn. No.: INM0000127