Capital Goods Sector Update : Oct-Dec'25 Earnings Preview by Prabhudas Lilladher Ltd

T&D & defense driven healthy execution; prolonged tariffs continue to impact order finalizations

We expect our capital goods coverage universe to report mixed performance in Q3FY26 owing to 1) healthy execution momentum across T&D-led projects and product companies, 2) improved execution of robust backlogs in defense companies along with strong order visibility supported by geopolitical tensions and recent DAC AoN approvals, 3) sluggishness in export-oriented businesses due to likely delays in dispatches and order finalization on account of tariff and geopolitics-related uncertainties, and 4) continued softness in consumables companies. Overall, we expect Q3FY26 revenue/EBITDA growth of ~14.9%/19.5% YoY (~13.1%/16.5% YoY ex-L&T) driven by healthy execution in T&D related and defense companies. Execution pace, order inflows (OIs), expected pickup in private capex led by taxation and labor policy reforms along with the impact of tariffs and geopolitical tensions on exports businesses of our coverage companies, will remain key monitorables. Our top picks are Hindustan Aeronautics, Larsen & Toubro, GE Vernova T&D India and Voltamp Transformers.

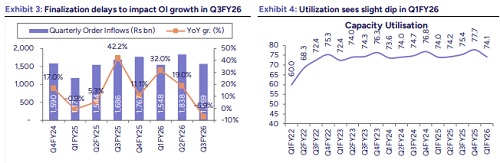

OIs in Q3FY26 are likely to decline YoY due to delays in order finalizations, sluggishness in export markets and front-ended government capex (~59% utilization of FY26BE till Nov’25) preponing some of the orders , partially offset by strong traction in the domestic market for infra verticals such as T&D, B&F and energy transition projects along with defense companies. In Q3FY26, L&T announced OI in the range of Rs145bn-300bn, while EPC companies KEC/Kalpataru have announced OI worth Rs65.4bn/Rs43.4bn till date. BHEL announced an order of Rs66.5bn of EPC packages for thermal power plants, while BEL has announced OI of ~Rs50bn. Order inquiries remain strong driven by traction from power T&D, data centers, railways and defense companies. Meanwhile, key export markets including the Middle East and SAARC are driving export orders for the companies. The recent ~Rs790bn DAC AoN approvals are likely to further support order momentum for defense players over the coming quarters. Despite strong enquiries, we remain watchful of order finalizations for industrial machinery companies amid tariff-related uncertainties.

T&D-related product companies are expected to grow at ~15% YoY driven by ~25%/~47% YoY growth in GVTD/Siemens Energy due to strong domestic T&D demand and execution. Meanwhile, Apar Industries are Voltamp are likely to record muted performance against higher bases. EBITDA margins are likely to remain flattish against slightly higher bases. OI for T&D product companies is expected to be driven by data centers, power T&D, electronics, etc. During the quarter, GVTD received a major HVDC VSC order, strengthening its order book and revenue visibility

Industrial machinery companies’ revenue growth is expected to remain moderate at ~8% YoY, largely impacted by sluggishness in export markets and likely delay in dispatches amid tariff-related uncertainties. EBITDA margins are likely to improve owing to better operating leverage.

Project companies’ revenue is expected to grow ~17% driven by healthy execution of strong order books with strong traction in international markets. EBITDA margins are likely to expand led by better operating leverage and favorable mix. OIs are likely to remain sluggish for Q3FY26 due to finalization delays. We remain watchful of overall execution pace, order momentum, and labor shortages, which have improved, but are yet to reach normalized levels.

Industrial consumables companies’ revenue is likely to grow modestly at ~6% YoY, due to weaker exports amid tariff-related uncertainties and continued threat from Chinese dumping, despite resilient domestic demand. EBITDA margins are likely to remain flattish due to weaker operating leverage being offset by better gross margin.

Defense companies’ revenue is likely to grow at ~12% YoY driven by strong execution of robust order books. EBITDA margins are likely to remain flattish due to lower gross margin and higher other expenses. The recent ~Rs790bn AoN approvals by DAC are expected to translate into incremental OIs, with BEL, HAL, etc., being key beneficiaries. Continued policy thrust on defense indigenization should further support sustained order booking momentum across multiple platforms and programs.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271