Utilities Sector Update : Generation picks up with seasonal demand by Elara Capital

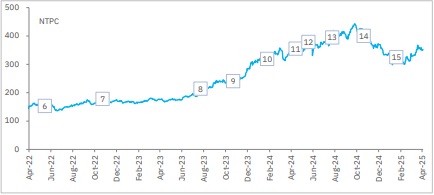

Power companies in our coverage are likely to report strong earnings in Q4. Key drivers include growth in regulated equity from capacity expansion, addition in new transmission lines, pick-up in power demand and sustained volume growth in the short-term market, as also contributions from solar EPC and rooftop installation. We retain our positive outlook on NTPC, driven by increased regulated equity from addition in thermal capacity. We are also positive on CESC and NLC given the strategic shift towards renewable energy for the former and expanding project portfolio for the latter.

Generation revives in Q4, up 5.3% YoY: With the onset of the summer season and a rise in peak power demand, electricity generation revived in Q4FY25. Total generation stood at 453BU, marking a 5.3% YoY increase, after a 6.3% YoY growth in Q4FY24. Monthly trends show that generation has risen by 2.5% YoY in January 2025 to 149BU. It accelerated to 7% YoY in February at 143BU, and maintained strong momentum with a 6.5% YoY increase in March to 161BU.

Peak demand accelerates in Q4FY25: Peak power demand maintained its strong growth momentum in Q4FY25, driven by rising electricity needs with the onset of the summer season. Demand rose 6% YoY to 237GW in January 2025, 7% YoY to 238GW in February, and 6% YoY to 235GW in March.

Renewable generation up 25% YoY in Q4FY25: Coal based generation increased 2% YoY to 341BU in Q4FY25. Hydro generation increased 23% YoY to 25BU. Gas based generation declined 30% YoY to 5BU. Renewable generation increased 25% YoY to 60BU.

Volume momentum continues on the exchanges: For Q4FY25, IEX achieved the highest-ever quarterly electricity volume of 31,747MU, marking an 18%YoY increase. The Market Clearing Price in the Day Ahead Market at INR 4.43 per unit in Q4FY25 declined 9% YoY. The DAM segment registered 16,931MU in Q4FY25, as compared with 14,916MU in Q4FY24, up 14% YoY. The RTM segment registered 9,650MU in Q4FY25, as compared with 7,505MU in Q4FY24, up 29% YoY

Renewed focus on nuclear sector: The government has launched the Nuclear Energy Mission under the Union Budget FY25-26, with an allocation of INRutilt 200bn to boost domestic nuclear capabilities, promote private sector participation, and accelerate the deployment of advanced technologies such as Small Modular Reactors (SMRs).

The initiative aims to develop at least five indigenously designed and operational SMRs by CY33 and supports the development of Bharat Small Reactors (BSRs). Aligned with India’s target of achieving 100GW nuclear capacity by 2047, the mission seeks to scale up nuclear power from 8,180MW to 22,480MW by 2031-32, positioning nuclear energy as a key pillar in India’s clean energy transition.

Coal production and offtake muted in Q4FY25: Coal India’s production and offtake were muted in Q4FY25. While coal production declined 2% YoY to 238MT, coal dispatch remained flat at 201MT for Coal India. Coal India produced 781MT of coal in FY25, ~7% less than the company’s target for the financial year.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

More News

Metals & Mining Sector Update : International thermal coal hits four-year low by Elara Capital