Oil and Gas Sector Update : CGD – UFT rezoning announced amid volatile gas costs by Emkay Global Financial Services Ltd

The PNGRB announced implementation of the unified tariff (UFT) rationalization wef 1-Jan-26, wherein Zone 3 and above would be eliminated and CNG and domestic PNG (CGD priority sector) put under Zone 1 UFT, irrespective of the distance from source. The revised rates imply Rs0.4/scm increase in gas cost for Z1 CGD customers like MGL, while gas cost would decrease by Rs0.9- 1.8/scm for Z2 and Z3 customers like IGL. On the gas cost front, prices in India recorded contrasting trends, with most benchmarks including domestic gas and LNG seeing reduction in the last three months, but US Henry Hub (HH) based LNG (sourced by GAIL) saw sharp uptick on the back of cold weather and rising US LNG exports. This was accompanied by sharp rupee depreciation as well. However in the last few days, HH prices crashed to under USD4/mmbtu. Hence, the CGD sector should see some relief and, though UFT rationalization needs to be, most likely, passed on in the near term, it does provide some room to protect margins in the medium term for beneficiaries like IGL. Given the recent weakness in CGD stocks, we find valuations attractive for both MGL (BUY) and IGL (ADD), albeit maintain our neutral stance on Gujarat Gas (GUJGA; REDUCE).

Rationalized UFT to be implemented from Jan-26 The PNGRB has announced implementation of rationalized unified gas pipeline tariff (UFT) from 1-Jan-26. The reform measures replace multiple UFT zones with only two now— Zone 1 being the initial 300km from the source and Zone 2 covering the area beyond 300km. The revised rates are now Rs54.0/mmbtu for Z1 and Rs102.9/mmbtu for Z2 versus the existing Rs42.0 and Rs80.1, respectively, and Rs106.8/mmbtu for Z3. Hence, non-CGD Z2 customers would see a Rs22.8/mmbtu jump in gas cost, while Z1 customers as a whole would see a Rs12.0/mmbtu increase. However, for Z3 and above, gas transport cost would be lower. For the CGD priority sector, Z2 and above entities would benefit from the reduction in gas cost by Rs0.9-1.8+/scm, which implies an equivalent reduction in DPNG prices and a Rs1.25-2.50/kg cut in CNG prices (ex-taxes). Z1 entities, though, would see a Rs0.4/scm negative impact and a Rs0.6/kg CNG equivalent impact respectively. The PNGRB would expect CGD players to pass on the benefit to consumers, as the press release mentions the benefit leading to reduction in the delivered prices.

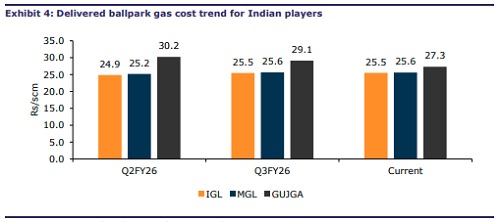

Spike in HH prices impacts CGD gas cost, but prices now lower Natural gas prices in India recorded contrasting trends, with most benchmarks, including both domestic gas and LNG, seeing reduction in the last three months. However, US Henry Hub (HH)-based LNG (sourced by GAIL) played spoilsport, especially for CGDs like IGL and MGL. Prices jumped sharply, with early December HH spot at USD5.2/mmbtu on the back of cold weather and rising US LNG exports. Also, the settlement price for Dec25 was set at USD4.4/mmbtu. The accompanying rupee depreciation was an added impact. However, since their peak, HH prices have corrected sharply, as severe weather expectations reversed and the current rate has fallen below USD4/mmbtu. Spot LNG prices are also down, at ~USD9.5/mmbtu (JKM). If the rupee is stable, gas cost (ex taxes and transport cost impact) is likely to be stable-to-declining for CGD players versus the Q3FY26 average. We expect Rs0.5-0.6 improvement in IGL’s EBITDA/scm QoQ in Q3FY26 due to impact of Gujarat VAT reduction, while MGL and GUJGA could see slight improvement from the CNG and DPNG price-hikes and lower spot LNG prices, respectively. The management’s margin guidance post-Q3FY26 results would be crucial, as the cost environment gains more stability.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354