Aviation Sector Update : Pax growth rises in Oct; momentum strengthens in Nov By Emkay Global Financial Services Ltd

Domestic air traffic regained its momentum through Oct-Nov, supported by strong festive travel, while IndiGo further strengthened its dominant position. With robust international expansion and rising traction, international growth remains a key driver heading into Q3FY26.

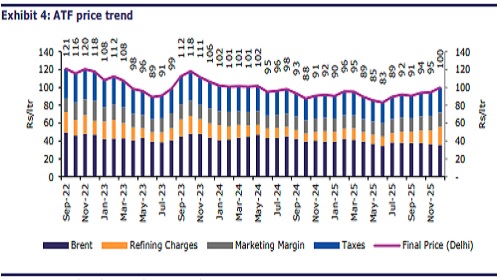

Domestic air traffic rebounds; IndiGo achieves a record market share India’s domestic passenger air traffic returned to growth, increasing 3% YoY to 14mn in Oct-25, bolstered by festive season demand. Daily trends in Nov-25 suggest a further acceleration in traffic growth to ~8% YoY. IndiGo continued to strengthen its dominant position in the domestic space, expanding its market share by 130bps MoM to a record high of 65.6% in Oct-25. SpiceJet’s market share also saw a healthy rebound, increasing by 70bps MoM to 2.6%. However, the Air India Group’s market share declined by 170bps MoM to 25.7%, while Akasa recorded a marginal downtick of 10bps MoM to 5.2%. PLFs plummeted across key airlines in Oct-25, with IndiGo being the only airline to report a MoM uptick, rising by 90bps to 82.4%. PSU OMCs raised domestic ATF prices by 5% MoM to Rs99.7/liter (in Delhi) for Dec-25. The hike, despite a ~2% decline in crude oil prices, was driven by a 33% uptick in jet fuel cracks and a depreciating rupee. However, middle distillate cracks have seen correction in Dec-25.

Domestic outperformance; international expansion drives IndiGo’s growth While domestic pax air traffic declined 2% YoY in Q2FY26, IndiGo reported a 1% YoY pax growth, reinforcing its domestic leadership; meanwhile, international pax growth was healthy at 23%. This drove overall RPK growth of 8% in Q2, with domestic and international RPK rising 1% and 26%, respectively. With IndiGo’s continued push toward international expansion and the introduction of new international routes in Q3, international RPK growth is expected to remain healthy due to longer route lengths, while international passenger growth is expected to be steady. We expect IndiGo to achieve its YoY high-teen ASK growth guidance in Q3, with RPK growth expected to be similar.

No material impact on traffic due to the A320 software directive The EASA issued an Emergency Airworthiness Directive for the Airbus A320 family on 28- Nov, following a JetBlue incident, citing an ELAC software malfunction that required immediate upgrades on newer aircrafts and part replacements on older ones. In India, ~340 aircrafts across IndiGo (~200) and the Air India Group (138) were impacted; however, upgrades were completed in 1-2 days, resulting in no cancellations and only minor delays at the most. Daily passenger traffic from 29-Nov to 1-Dec remained strong and above the Nov-25 average of 0.51mn. However, operations on 2 and 3-Dec-25 were disrupted, with IndiGo seeing OTP drop to 35%, along with 200+ flight cancellations owing to technical snags, congestion at airports, and FDTL norm-related crew challenges, per media reports. We await further clarity, though we do not expect the impact to persist, with IndiGo stating its intent to normalize flight operations within the next 48 hours.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

More News

Media Sector Update : Box Office Returns, Ads don`t By JM Financial Services