IT Sector Update : ACN – Q1FY26: Strong quarter; discretionary spend unchanged by Emkay Global Financial Services Ltd

Accenture (ACN) reported Q1 revenue of USD18.7bn, up 6% YoY (5% LC), at the upper end of its LC guidance. New bookings were worth USD20.9bn (up 12% YoY and 10% LC; book-to-bill: 1.1x), including Consulting bookings worth US9.9bn (up 7.2% YoY) and Managed Services bookings worth USD11.1bn (up 16.7% YoY). The management highlighted that overall demand is stable, with clients continuing to prioritize their large-scale transformational programs, which typically convert to revenue more gradually. ACN is seeing early signs of pricing improvements in several parts of their business, with improved contract profitability surfacing in Q1 results. ACN has maintained its FY26 revenue growth guidance of 2-5% in LC, with Q2FY26 revenue expected to grow 1-5% in LC. Demand for AI is both real and maturing rapidly. The mgmt indicated that the pace of overall and discretionary spending is at the same level as seen over last year. ACN continues to deliver revenue growth at the upper end of its guidance on the back of broad-based growth, stability in demand environment, and the management’s conservative approach to guidance amid prevailing uncertainties. Stability in the macro environment and expectations of further interest rate cuts in the US keep hope alive for recovery in spending (particularly discretionary) in CY26; however, clear evidence of it playing out is missing so far. The NIFTY IT Index has outperformed the broader markets by 5%/4% over the last 1M/3M on the back of hope of demand recovery, signs of the earnings downgrade cycle bottoming out, and rupee depreciation. Our pecking order is INFO, LTIM, TCS, HCLT, WPRO, and TECHM in large caps.

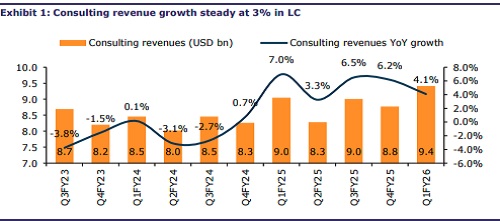

Solid Q1 performance; growth at the upper end of the guided range Consulting revenue grew 4% YoY to USD9.4bn (up 3% LC), while Managed Services revenue rose 8% YoY to USD9.3bn (up 7% LC). ACN posted a ‘very strong’ double-digit growth in Security and a mid-single-digit growth in Song, in Q1. New bookings were worth USD20.9bn (up 12% YoY and 10% LC; book-to-bill: 1.1x), including Consulting bookings worth US9.9bn (up 7.2% YoY; book-to-bill: 1.05x) and Managed Services bookings worth USD11.1bn (up 16.7% YoY; book-to-bill: 1.2x). ACN reported USD2.2bn worth of new bookings in Gen AI (vs USD1.8bn QoQ; USD1.2bn YoY) and recognized ~USD1.1bn in Gen AI revenue in Q1 (vs USD900mn QoQ; USD500mn YoY). GAAP operating margin declined by 140bps YoY to 15.3% in Q1. Adjusted OPM increased by 30bps YoY to 17.0% in Q1. Voluntary attrition (annualized) in Q1 came in at 13%, a decline from 15% QoQ, albeit above the 12% YoY. Total headcount grew by ~4.4k QoQ to 783.7k (up 1% QoQ/down 2% YoY).

Broad-based growth momentum; Banking and Capital Markets lead the path Revenue growth in Q1 was broad-based across industry groups, led by Financial Services (12% LC YoY), CMT (8%), Products (4%), and Resources (2%), except a 1% decline in Health and Public Services. By geography, the Americas grew 4% YoY in LC, driven by Banking and Capital Markets, Industrials, and Software and Platforms, partially offset by a decline in Public Services; within Americas, growth was led by the US. EMEA grew 4%, supported by strength in Banking and Capital Markets, Insurance, and Life Sciences; within EMEA, growth was led by the UK and Italy. Asia Pacific grew 9%, driven by Banking and Capital Markets, Communications and Media, and Public Services; within APAC, growth was led by Japan and Australia.

Retains 2-5% LC revenue growth guidance for FY26 ACN retains 2-5% LC revenue growth guidance for FY26 (including inorganic contribution of ~1.5%). Excluding the estimated 1% impact from the US federal business, growth would be around 3-6%. The guidance assumes an over 2% forex impact on reported USD revenue. ACN guided to a GAAP operating margin of 15.2-15.4% (earlier 15.3-15.5%) for FY26 – an expansion of 50-70bps YoY. Also, it gave guidance for adjusted operating margin of 15.7-15.9%, a 10-30bps expansion. ACN expects Q2FY26 revenue of USD17.35-18.0bn (1-5% LC), assuming +3.5% forex impact. It expects OCF/FCF of USD10.8-11.5bn/USD9.8-10.5bn, in FY26.

A read through for Indian IT peers The management highlighted that the pace of overall spending and discretionary IT-spending levels have remained broadly unchanged vs the past year, with no near-term macroeconomic catalyst expected to materially alter this trend. ACN delivered revenue growth at the upper end of its guidance for another quarter on the back of broad-based growth, stability in the demand environment, and the management’s conservative approach to guidance amid prevailing uncertainties. Clients continue to prioritize large-scale transformational programs, which convert to revenue more gradually, while smaller deals with a shorter duration continue to see a slower pace and level of spending. The company has retained 2-5% revenue growth for FY26, broadly indicating growth to be even across quarters. Stability in the macro environment and expectations of further rate cuts in the US keep hope alive for recovery in spending (particularly discretionary) in CY26; however, clear evidence of it playing out is missing so far. The NIFTY IT Index has outperformed the broader markets by 5%/4% over the last 1M/3M, respectively, on the back of hope of demand recovery, signs of the earnings downgrade cycle bottoming out, and rupee depreciation. Our pecking order is INFO, LTIM, TCS, HCLT, WPRO, and TECHM in large caps.

Earnings Call KTAs

1) The company has not seen any significant change (either positive or negative) in the overall market. The management indicated that clients continue to prioritize large-scale strategic transformation programs that place ACN at the center of their reinvention agendas, even though such programs tend to convert to revenue more gradually. 2) 33 clients with quarterly bookings worth >USD100mn in Q1. 3) Top-10 ecosystem partners (Microsoft, Google, AWS, SAP, Oracle, Salesforce, Workday, IBM, Adobe, Servicenow) contributed over 60% of revenue in Q1, with growth outpacing the company average. 4) Fixed-price work has increased to ~60% of total work (up by 10ppts over 3 years), reflecting increased use of proprietary platforms and client inclination for cost/delivery certainty. 5) ACN is seeing early signs of pricing improvements in several parts of its business, with improved contract profitability showing up in Q1 results. 6) While the company continues to experience demand for Consulting Services, it is seeing a slower pace and level of client spending, particularly for smaller contracts with a shorter duration. 7) In Q1, ACN invested USD374mn in six acquisitions, aimed at scaling AI, cloud, engineering, and learning capabilities across key markets. It plans investing USD3bn on M&As in FY26. It acquired 65% stake in DLB Associates, a leader in AI-led data center consulting and engineering (with an expected market size of USD12bn by CY30). 8) IDC estimates that the advanced AI market will see a CAGR of ~40%, from USD20bn currently to USD70bn by CY29. Advanced AI adoption, while still early, continues to broaden. 9) Over the past nine quarters, roughly 100 new clients per quarter have initiated advanced AI projects; however, only ~1,300 of Accenture’s ~9,000 clients (~14%) have engaged meaningfully to date, underscoring substantial headroom for enterprise-wide scaling and broader adoption. 10) ACN will discontinue reporting discrete advanced AI bookings and revenue metrics, as advanced AI is now embedded across its offerings, making standalone metrics less meaningful. 11) It is nearing its target of 80,000 AI and data professionals globally.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

More News

From The CEO`s Desk : IT sector ? The disruptor will get disrupted by Emkay Global Financial...

.jpg)