Logistics Sector Update : Q2FY26: Mixed bag; all eyes on festive demand, GST stimulus in Q3 by Emkay Global Financial Services Ltd

We expect a mixed quarter for our covered logistics companies, owing to seasonality and a delay in consumption demand due to impending GST cuts. With no change in the reverse charge mechanism (5% slab) and introduction of a higher slab of 18% with ITC (vs 12% earlier) for Goods Transport Agencies (GTAs), organized operators may face higher working capital requirements vs unorganized players. For B2B operators, we expect volume growth of 20%/11%/3% YoY for Delhivery’s PTL/Blue Dart Express/TCI Express, respectively, while volumes are likely to decline 9% for VRL. We model in Delhivery’s organic B2C revenue growth at 16% YoY (32% including Ecom operations), as sector consolidation benefits and early season sale demand kick in (last week of Sep). VRL should see the strongest margin expansion (160bps YoY) among peers owing to price hikes undertaken in Q2FY25.

Delhivery (BUY; TP at Rs450)

We expect 21% YoY revenue growth, with the PTL and B2C express segments growing 20% and 32% YoY, respectively. B2C express growth will be led by early season sale demand (only for a week) and consolidation of Ecom’s operations limiting the impact of Meesho’s insourcing. Margins (excluding integration costs of Ecom Express) are expected to decline by 100bps sequentially due to higher network build-out costs incurred in anticipation of the festive season. Including one-time integration costs, we expect reported EBITDA loss of Rs542mn. We moderate revenue by ~1% each for FY26E/27E, respectively, as a delay in consumption demand owing to impending GST cuts is likely to weigh on FTL and SCS segments, in our view; we expect the segments to recover in Q3. We retain BUY with an unchanged TP of Rs450 (DCF methodology).

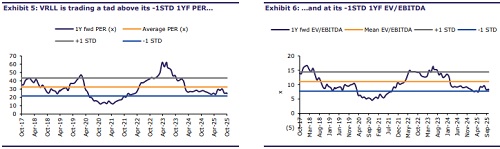

VRL Logistics (ADD; TP cut by 5% to Rs285)

We estimate VRL’s revenue to decline 2% YoY on volume weakness for the third quarter in a row (down 9% YoY), owing to the company’s strategy of relinquishing low-margin volumes in Q4FY25; however, this will be offset by 8% growth in realizations (prices hiked in Q2FY25). Led by higher realizations, we build in gross margin expansion of ~400bps YoY, resulting in 8% YoY EBITDA growth and 25% YoY PAT growth. Commentary on the volume trajectory remains a key monitorable. Margins are likely to face inflationary pressure in the absence of strong volumes. Hence, we lower our EBITDA by ~2% each for FY26E/27E. We retain ADD on the stock, with a revised Jun-26E TP of Rs285.

Blue Dart Express (ADD; TP at Rs6,450)

We expect 11% YoY volume growth for BDE, driven by surface and B2C segments; blended realizations are likely to decline ~1% YoY. EBITDA margin is expected to remain flat YoY as optimal utilization of freighters would be offset by higher contribution from the low-margin surface business. We expect consolidated PAT growth of 10% YoY on finance costs declining 9% YoY. Our estimates largely remain unchanged, with FY26E EBITDA/PAT cut by 2%/3%; we retain ADD and a TP of Rs6,450 (DCF methodology).

TCI Express (REDUCE; TP at Rs700)

We expect growth revival in Q2, after seven consecutive quarters of YoY decline, on a favorable base and encouraging signs of pre-festive demand in key customer segments of TCIE. EBITDA margin is expected to remain flattish YoY on higher contribution from new services and growth in surface offsetting cost pressures seen in Q1. We await sustained improvement in surface’s volume trajectory, to turn constructive on the stock and expect only 5% volume CAGR over FY25-28E. We retain REDUCE with an unchanged Jun-26E TP of Rs700 (DCF methodology).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354