Logistics Sector Update : Freight and cargo monthly by Emkay Global Financial Services Ltd

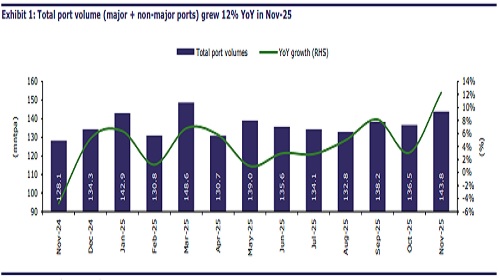

In this monthly edition, we introduce a number of high-frequency data points to assess freight and cargo movements across multiple modes of transportation. For Nov-25, Indian port volumes grew 12% on YoY basis (YTD up 5%) on the back of surge in imports (+11% YoY, +6% YTD). Overall container volume maintained the positive trajectory, growing 10% YoY (YTD up 6%). Adani Ports (BUY) continues to gain market share, with overall/container volume increasing 14/20% YoY in Nov-25. GST e-way bill volume growth moderated to 2% MoM, suggesting that peak festive demand is behind us. Truck freight rates were firm, in line with stable diesel prices. Global container shipping rates have now recovered from the 20-month low seen in Oct-25, up 18% MoM as on 18-Dec-25.

Port volume uptick sustaining; APSEZ continues to gain market share India’s port sector demonstrated robust growth in Nov-25, with overall port volume recording a 12% YoY increase in cargo, reflecting the expanding trade activities and improving infrastructure on the domestic front. Volume at major ports grew 15% YoY in Nov-25, primarily driven by POL (+16% YoY), Iron Ore (+41% YoY), and Fertilizers (+46% YoY), while all ports (except Tuticorin, which declined 5% YoY) such as Paradip (+9% YoY), Kandla (+12% YoY), JNPT (+9% YoY), Vizag (+36% YoY), and Mumbai (+31%) too witnessed robust growth in Nov-25; non-major ports grew 10% YoY over the same period, highlighting the broad-based nature of the recovery across India's maritime ecosystem. Container volume sustained the positive momentum, growing 10% YoY primarily led by 11.4% YoY growth at JNPT (JNPT market share thereby increased from 56.1% in Nov-24 to 56.3% in Nov-25). However, despite such encouraging volume gains, Indian ports continue to face challenges as regards global competitiveness, particularly lagging international counterparts in the port connectivity index, which underscores the need for continued investments in multimodal logistics, digital infrastructure, and process optimization to enhance efficiency and integration with global supply chains.

In Nov-25, APSEZ’s overall volume grew 14% YoY, with containers growing 20% YoY – both outpaced industry growth, leading to gain in market share on YoY basis in Nov-25 (on the overall and container levels).

Continued momentum in GST e-way bill volume GST e-way bill volumes grew in Nov-25 (+28% YoY), though sequential growth moderated to 2%, suggesting normalization from the recent highs, as peak festive season demand is now behind. Intra-state volumes were down 2% MoM (up 13% YoY), while inter-state volumes grew 3% MoM and 22% YoY. Truck freight rates were steady across major trunk routes, as diesel prices were unchanged. Despite higher operating costs (fitness certificate costs increased 10x in Oct-25), freight rates have not increased; this does not bode well for organized players such as VRLL (ADD), which had undertaken significant price hikes last year, citing cost pressures.

Container shipping rates showing signs of recovery Per the Drewry WCI Index, container shipping rates have shown notable resilience, rebounding 18% MoM from the Oct-25 lows and reaching USD2,182 per 40-foot container as on 18-Dec-25. Industry reports suggest shipping rates should firm up driven by carriers pushing for rate increases, with spike in demand due to the Chinese New Year.

Momentum in manufacturing and key commodities remains strong We are adding new high-frequency indicators that would help investors track the cargo momentum for relevant logistics players. Steel production grew 13.5% YoY, while coal production increased to ~93mntpa (+2.1% YoY). The cement sector too demonstrated positive momentum with 5.3% growth, benefiting from post-monsoon construction activity. Manufacturing PMI moderated to 56.6 in Nov-25 (59.2 in Oct-25), indicating slower albeit still-robust momentum. This uptick in commodity production volume points to favorable demand tailwinds for port operators and logistics companies, as higher manufacturing activity typically translates into increased freight and cargo handling opportunities.

Rail freight – Tepid growth continues Rail freight tonnage grew 3.8% YoY in Sep-25 (YTD up 3.2%; FY25 growth was 2.3%). Despite the Eastern Dedicated Freight Corridor (EDFC) becoming operational since Oct-23, coal cargo volumes are yet to meaningfully pick up via rail (61.3k tonnes in Sep-25 vs 65.5k tonnes in Nov-23). Meanwhile, container freight grew a modest 6% YoY, constrained by the incomplete final stretch of the Western Dedicated Freight Corridor (WDFC). This performance aligns with the recent guidance by the management of Container Corporation of India suggesting momentum in containers to remain tepid till completion of WDFC. The softer growth in rail volumes via DFCs suggests that infrastructure investments are yet to fully translate into volume acceleration, which may impact near-term earnings visibility for rail logistics players.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

More News

Auto Sector: Q4FY25 Auto OEM Review ? Growth in 2W/Tractor OEMs By Axis Securities Ltd