Monthly Auto Sales - January 2025 by ARETE Securities Ltd

In January, the auto sector experienced robust growth across all segments, with the 3W segment notably showing significant annual volume increases, as key players like BAJAJ and M&M reported growth exceeding 10% YoY. The 2W segment also demonstrated remarkable vigour, with a sequential surge of 28%, the highest among all segments. This growth was driven by new product launches from HERO and BAJAJ, complemented by increased export dispatches. However, in the e2W category, BAJAJ lost its market leadership which it had briefly captured in the previous month. In the CV segment, despite a dip in volumes from TAMO, there was sustained positive growth in bus and tractor sales. AL, for the first time this fiscal, reported positive growth across all its segments on a yearly comparison. Turning to the PV segment, there were notable sequential increases in volumes, primarily driven by market leader MSIL and the rapidly expanding M&M. HMIL also marked a return to growth after three months, posting double-digit increases sequentially, followed by TAMO. Overall, this month has set a positive tone for the automotive industry, with all segments showing promising growth trajectories supported by innovative launches, strategic export pushes, and a rebound in domestic demand. This performance suggests a strong market sentiment and potential for continued growth in the coming months, provided external macroeconomic conditions remain favourable.

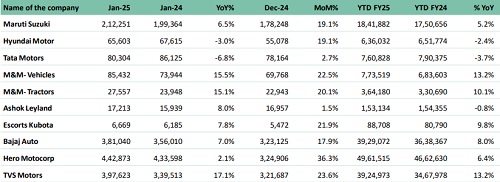

Automobile Sales January - 2025

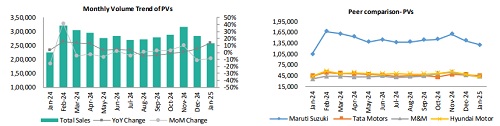

PV Segment

This segment overall showcased a landscape of growth, predominantly driven by MSIL and M&M. MSIL's revival was marked by a surge in demand for its compact cars, signalling a release of long-pent-up consumer desire in this segment. Simultaneously, M&M capitalized on its premium SUV offerings, further strengthening its market position. This dynamic was echoed by HMIL, which saw a sequential sales increase, likely propelled by the well-received launch of the Creta Electric, demonstrating a growing consumer interest in EVs. HMIL's volume grew sequentially but declined annually. TAMO's launch of new entry-level variants drove sequential growth, but it experienced an annual decline and a competitive disadvantage due to its limited SUV offerings. This, coupled with recent price hikes, likely pushed potential customers towards competitors, negatively impacting the company's yearly growth.

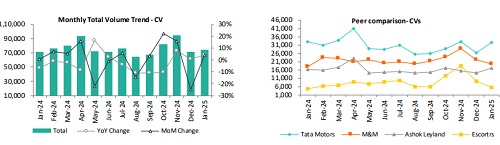

CV Segment

The CV segment showed positive growth across companies except TAMO, which saw declines in all but its bus segment. Industry-wide, bus demand surged by 15%/17% YoY/MoM domestically. M&M's recovery was strong at 23%, led by a 19% rise in its LCV 2T-3.5T category, comprising 80% of CV volumes. AL achieved the highest YoY growth at 8% but only 2% MoM due to modest truck demand recovery. In the tractor segment, Escorts Kubota and M&M reported growth in the domestic and international market of 21%/34% & 20%/36% MoM and 4%/66% & 15%/28% YoY, anticipating further expansion as harvest season nears. Exports for the CV segment are also on an upward trend.

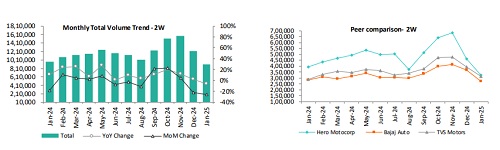

2W Segment

The 2W segment saw a robust 28% growth on a sequential basis, with Hero MotoCorp leading at 36% due to domestic market surge. TVS Motors topped YoY growth at 18%, and Bajaj Auto grew by 7% YoY and 21% MoM. In the e2W segment, market shares were 24% for TVS (23,788 units), 22% for Bajaj (21,294 units), and 2% for Hero (1,615 units). Notably, despite a decrease in export contributions compared to the previous month, the sector still achieved a remarkable 49% YoY and 4% MoM export growth, underscoring the industry's resilience and growth potential

Please refer disclaimer at http://www.aretesecurities.com/

SEBI Regn. No.: INM0000127

More News

Automobiles Sector Update : YoY margin compression for most companies By Elara Capital