Chemicals Sector Update : Expectations falling like nine pins PL Capital- Prabhudas Lilladher

Expectations falling like nine pins

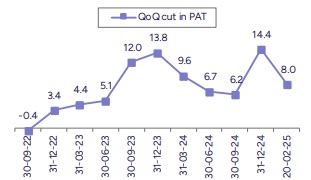

Quick Pointers: ? Consensus estimates for FY25 EPS of our coverage cut down for past 11 quarters

* Consensus estimates for FY26 also cut continuously for the past 7 quarters

* Aggravating demand, inventory stocking, and continued dumping combined with lack of visibility have led to sharp downward revisions in consensus estimates for specialty chemical companies under our coverage. As a result, sliding stock prices, with a few having almost halved in past few quarters, resonate more with EPS cuts rather than downgrades. Some companies like Aarti Industries and Gujarat Fluoro have witnessed as much as 70-75% cut in their FY25 consensus estimates since they began appearing, while most companies like Deepak Nitrite, Navin Fluorine, NOCIL and SRF have witnessed +50% cut. As if it were not enough, FY26 consensus estimates for the pack have been cut by 30% over the past 1.5 years. In contrast, current consensus estimates for Fine Organics for FY25 and FY26 are 3-6% higher than when they started appearing. We continue with our positive stance on Fine Organics, Navin Fluorine and Vinati Organics.

* Ever changing scenarios, mostly downwards: Facing ever challenging macros, our coverage companies have shown marked decline in gross margins since FY20. Aarti Industries saw its gross margin plummeting to 33.2% in Q3FY25 from a peak of 61% in Q3FY22. Deepak Nitrite saw the second worst erosion from 50.7% in Q2FY21 to 26.8% in Q3FY25. Least decline was witnessed in SRF and Navin Fluorine, which saw gross margins declining from high of 54.5%/59.3% in Q2FY21/Q4FY23 to 46.4%/50% in Q2FY25/Q4FY24.

* Lack of clarity continues: Amidst demand recovery challenges and inventory destocking in a few regions, China continues to dump chemical products. CEFIC observes that Chinese production grew by 10.1%, whereas global production grew by only 6.1% in Jan-Jul’24. Continued tariff wars may further slow down the global economy and increase dumping in both domestic as well as non-US export markets. Commentaries from global chemical companies continue to be bearish.

* Positive on Fine Organics, Navin Fluorine and Vinati Organics: Fine Organics has announced a capex of Rs7.5bn, which would be commercialized from FY27, and with 3.5x asset turnover, this capex will help the company to double its revenue by FY29. The stock trades at 23x FY27 and provides an upside of ~35%. Navin’s expansion of R-32 capacity, in line with demand, is on track and is expected to be commissioned this month, while AHF capex shall be commissioned by early FY26. Specialty segment has also started gaining traction with strong order book visibility going ahead. CDMO revenue is targeted to reach USD100mn in FY27, with order received from an EU major and a scale order received from a US major. The stock trades at 47x FY27 and offers ~9% upside. Vinati Organics’ ATBS demand continues to remain robust with the company also expanding its capacity from 40,000mtpa to 60,000mtpa by the end of FY25, while ramp-up in antioxidants is expected to pick up soon along with the commercialization of MEHQ/Guaiacol. The management has guided 20% revenue growth for FY25-27E. The stock trades at 34x FY27 and offers 20% upside.

Above views are of the author and not of the website kindly read disclaimer