Neutral TVS Motor Company Ltd For Target Rs. 2,720 by Motilal Oswal Financial Services Ltd

Accrual of PLI benefit boosts margins

Capex + investments rise to INR39b in FY25

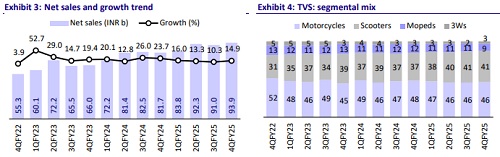

* TVS Motor (TVSL) delivered an in-line operating performance, excluding the PLI benefit. Adjusted PAT grew 42% YoY to INR6.9b, broadly in line with our estimate of INR6.75b. For FY25, the company posted a strong 30% YoY growth in PAT to INR27.1b. While TVSL is expected to continue outperforming in the scooters segment, its underperformance in the motorcycles segment remains a concern. Additionally, 2W industry demand has weakened following the festive season.

* At ~42x/35.8x FY26E/FY27E EPS, we believe most of the positives are already priced in. We maintain our FY25E/26E EPS estimates. Reiterate Neutral with a TP of ~INR2,720 (based on ~32x FY27E EPS and INR212/sh for the NBFC).

TVSL’s Q4 margins (excluding PLI) in line with estimates

* In line with its guidance, TVSL recognized PLI benefits for the entire year in Q4.

* Excluding PLI accruals, TVSL reported revenue of INR93.4b and achieved an EBITDA margin of 12%. This was in line with our estimate, as we had not factored in PLI benefits in our projections due to the lack of clarity.

* For comparison purposes, we have added back the PLI benefit for the quarter—estimated at around INR467m—to the revenue, as it is expected to be recurring in nature. The PLI benefit booked in Q4 for prior periods (estimated at INR1.6b) has been considered an exceptional item in Q4.

* Accordingly, Q4 revenue grew 15% YoY to INR93.9b, largely in line with our estimate of INR92b.

* EBITDA margin expanded 60bp QoQ (+120bp YoY) to 12.5%. The beat was largely driven by the PLI accrual, as indicated above.

* TVSL reported other income of INR145m for Q4. This included dividend income of INR1b from its subsidiary (SACL) and MTM loss of INR890m on the fair valuation of its investments in TVS Supply Chain.

* Adjusted for the prior period PLI benefit, PAT grew 42% YoY to INR6.9b, largely in line with our estimate of INR6.75b.

* For FY25, TVSL posted 14% YoY revenue growth to INR362b, led by 13% growth in volumes.

* EBITDA margin expanded 120bp YoY to 12.3% (50bp boosted by the PLI benefit).

* For FY25, TVSL posted a strong 30% YoY growth in PAT to INR27.1b.

* It invested around INR18b in capex and INR21b in its subsidiaries in FY25. Its FCF stood at INR24.6b for FY25, slightly lower than INR25.6b in FY24.

Key takeaways from the management interaction

* Update on PLI: In Q4, TVSL recognized PLI benefits for the entire year. Adjusted for the PLI benefit, its margin was in line with our estimate of 12%. Including the PLI benefit for Q4, the margin would stand at 12.5%.

* Domestic outlook: Management expects the 2W industry’s growth rate to remain moderate in Q1, given the high base of last year. However, with overall demand drivers remaining positive, management expects 2W growth in FY26 to be similar to that of FY25.

* Exports outlook: Management expects 2W exports to post healthy growth in FY26, led by strong demand from Latin America and a recovery in demand from Sri Lanka and Africa.

* Capex and investments: For FY25, capex stood at INR18b, while investments in subsidiaries amounted to around INR21b. For FY26, investments in subsidiaries are likely to remain at similar levels, primarily directed toward TVS Credit, Norton, and the e-bike subsidiary.

Valuation and view

* The recently launched Jupiter 110 has been well-received by customers and is likely to support TVSL in gaining market share in scooters over the coming quarters. However, in motorcycles, for the first time in many years, TVSL has underperformed the industry in FY25. More importantly, it has underperformed in the 125cc segment, which has been a key growth driver in recent years. Further, the demand outlook in domestic markets has remained weak following the festive season, while the exports outlook also continues to be uncertain.

* Given these factors, we believe TVSL at 42x/35.8x FY26E/FY27E EPS appears fairly valued. Reiterate Neutral with a TP of ~INR2,720 (based on ~32x FY27E EPS and INR212/sh for the NBFC).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412