Buy CreditAccess Grameen Ltd for the Target Rs.1,500 by Motilal Oswal Financial Services Ltd

Profitability set to improve in 2H

Broad-based improvement in new PAR accretion

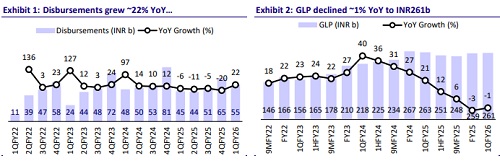

* CreditAccess Grameen’s (CREDAG) 1QFY26 PAT stood at INR602m (vs. est. INR842m). NII declined ~2% YoY to ~INR9b (in line). PPOP fell ~8% YoY to INR6.5b (in line). Cost-income ratio rose ~160bp QoQ to ~33.5% (PY: ~29% and PQ: ~32%).

* Reported yields declined ~10bp QoQ to ~20.3% and CoF was down ~10bp QoQ at 9.7%. Reported NIM rose ~10bp QoQ to ~12.8%. We model NIM (calc.) of 15%/14.7% in FY26/FY27 (vs. ~14.6% in FY25).

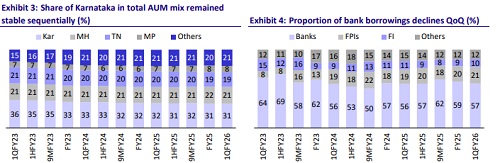

* Disbursements rose ~22% YoY to ~INR55b. AUM was flat QoQ but down ~1% YoY at ~INR261b (PY: ~INR263b). The borrower base declined ~5% QoQ to ~4.56m (PQ: ~4.7m). CREDAG added 51 branches during the quarter to reach 2,114 branches.

* Management indicated a broad-based improvement in PAR accretion across all key geographies, including Karnataka, reflecting enhanced on-ground execution and borrower discipline. The company highlighted that credit costs are expected to remain at similar levels in 2QFY26 due to accelerated write-offs, with a sharp decline anticipated from 3Q onward. It remains focused on balance sheet normalization, with conservative provisioning and continued portfolio clean-up through write-offs.

* The company plans to open 200 new branches in FY26, with a majority of them expected to be operational by 1HFY26. While this front-loaded expansion is expected to temporarily push up the opex ratios, management remains confident that operating leverage and improved productivity from 2HFY26 onward will drive efficiencies. As a result, CREDAG expects to bring down opex/avg. AUM to <5% by end-FY26.

* We cut our FY26E PAT by ~2% to factor in slightly higher credit costs, while we keep our FY27E EPS unchanged. We estimate a CAGR of 19%/79% in AUM/PAT over FY25-27E, leading to RoA/RoE of ~4.9%/19.5% in FY27E.

* We do acknowledge that the residual stress from Karnataka slippages and incremental stress from the implementation of MFIN guardrails 2.0 will have to be provided for, which will keep credit costs elevated in 2QFY26 as well. However, we believe that there is a trend reversal on the horizon in the microfinance sector, which will play itself out over the next one-two quarters and get the sector to near-normalization (operationally) in 2HFY26. That said, we strongly believe that the coming three months present an opportunity to separate high-quality franchises from weaker ones, with performance divergence across the MFI sector expected to be increasingly evident.

* CREDAG trades at 2.1x FY27E P/BV and its premium valuations over its MFI peers should be sustained, given its ability to bounce back to normalcy, much ahead of its peers. Reiterate BUY with an unchanged TP of INR1,500 (based on 2.5x Mar’27E P/BV).

Asset quality broadly stable; credit costs remain elevated

* GNPA declined ~5bp QoQ to 4.7%, while NNPA rose ~5bp QoQ to ~1.8%. Stage 3 PCR declined ~160bp QoQ to ~63.2%. Annualized credit costs declined to ~8.9% (PQ: ~9.3% and PY: ~2.6%).

* Total write-offs in 1Q stood at INR6.9b (including INR6b of accelerated writeoffs). The company highlighted that credit costs arising from new PAR accretion have moderated, while overall credit costs have remained elevated primarily due to accelerated write-offs taken by the company.

* Collection efficiency, including arrears, rose to 93.4% in 1Q (PQ: 92.2%) and to 94.1% in Jun’25. Collection efficiency, excluding arrears, increased to 93.2% (PQ: 91.9%) in 1Q and to ~93.5% in Jun’25.

* CREDAG has guided for credit costs of ~5.5-6.0% in FY26 and expects it to normalize to 3.0-3.5% from FY27 onward. We model credit costs of ~5.8%/3.2% (as % of loan assets) in FY26/FY27.

Highlights from the management commentary

* The company had moderated disbursements in Bihar owing to elevated credit costs, primarily driven by higher employee attrition. With a strengthened people strategy and increased manpower deployment, the company expects an improved growth trajectory in the region going forward.

* Management highlighted that collections in Jul’25 have improved, and the company expects this momentum to sustain through Aug’25 and Sept’25. Notably, collections are also improving in Karnataka.

* The company’s retail finance portfolio is currently skewed toward unsecured loans, which constitute ~70% of the mix, with the balance being secured. Over the medium term, the company aims to achieve a more balanced mix of 50:50 between secured and unsecured loans. Additionally, it plans to increase the contribution of retail finance in the overall GLP to ~12-15% by FY28.

Valuation and view

* CREDAG has successfully navigated a period of industry-wide challenges, demonstrating remarkable resilience and a return to normal operational efficiency. New stress formation (including in Karnataka) has normalized, supported by robust internal processes, including rigorous daily collection monitoring, detailed audit reports, and consistent tracking of center attendance.

* The company will continue to prioritize balance sheet normalization through accelerated write-offs and prudent provisioning. With structural levers such as branch network expansion and strengthening collection efficiency across key geographies (including Karnataka) firmly in motion, it is well-positioned to deliver a strong improvement in loan growth and profitability from 2HFY26 onward.

* CREDAG trades at 2.1x FY27 P/BV. With a strong capital position (Tier-1 of ~25%), it will embark on a strong loan growth trajectory once there are signs of further normalization in the delinquency trends. Reiterate BUY with an unchanged TP of INR1,500 (based on 2.5x Mar’27E P/BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412